AI Tokens Are Dominating Crypto Markets—But Here’s What the Data Is *Really* Showing

AI tokens aren't just trending—they're rewriting the crypto playbook. Forget the hype; the charts tell a different story.

Decoding the AI Token Frenzy

Market caps surge, trading volumes explode, and every other pitch deck suddenly features 'decentralized intelligence.' The narrative sells, but the underlying data often reveals a herd mentality chasing narratives, not fundamentals. It's the classic crypto cycle: find a buzzword, attach a token, watch the speculation begin.

Beyond the Surface Metrics

Look past the green candles. True dominance isn't measured by a single pump. It's about sustained utility, developer activity, and integrations that last longer than a market cycle. Many so-called 'AI' projects are just clever branding on existing infrastructure—a wolf in high-tech clothing.

The Data's Verdict

The numbers show capital flowing in, but also highlight extreme volatility and concentration risk. A handful of tokens capture the majority of gains, while the long tail struggles for relevance. It's a reminder that in crypto, as in traditional finance, the 'smart money' often just follows the dumb money—just faster.

This isn't 2021's DeFi summer or the NFT craze. This is a more sophisticated, yet equally speculative, bet on automation's future. The data suggests a market learning to price protocol utility over pure meme potential. Whether that lesson holds is the trillion-dollar question. After all, on Wall Street or the blockchain, a good story often beats boring math—until the music stops.

As Bitcoin continues to consolidate and major altcoins focus on defending key support levels, traders are watching where attention is shifting next. After weeks of liquidation-driven volatility, market activity has slowed, but interest has not disappeared. Instead, it is rotating. AI-linked crypto tokens are now dominating social engagement, even as prices remain range-bound. This contrast matters.

In past cycles, narratives often regain attention before capital follows. With BTC price stable and broader altcoin momentum muted, tracking where discussion and early participation are building can offer useful clues about potential sector rotation ahead.

What the Charts and On-Chain Data Are Signalling

Price action across AI tokens remains compressed, but on-chain activity adds important context. Wallet activity has stabilised across several large-cap AI projects, with no sharp spikes in exchange inflows. That suggests holders are not rushing to distribute at current levels.

Transaction counts and active addresses have stopped declining, even as price stays range-bound. This often signals participation is holding steady beneath the surface. At the same time, derivatives data show muted open interest growth, confirming that leverage has not yet driven this narrative.

From a trader’s perspective, this combination matters. On-chain data points to engagement without excess, while charts show consolidation rather than expansion. That alignment typically appears before direction resolves, not after it has already played out.

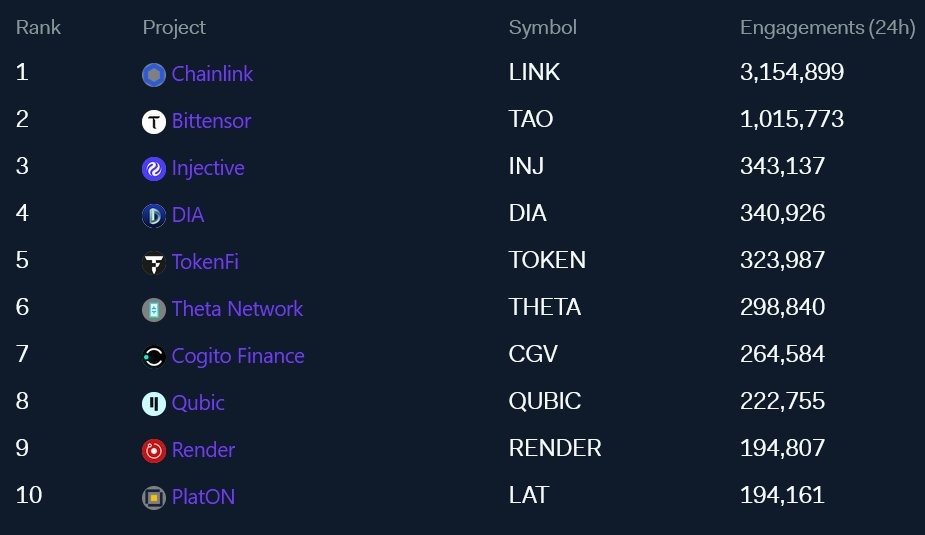

AI Tokens Seeing the Most Trader Attention

The chart highlights where trader attention is concentrating within the AI segment, based on social engagement rather than price performance. Large-cap names dominate the discussion, while mid-cap projects also feature prominently, suggesting interest is spreading beyond a single leader. This kind of engagement clustering often appears when traders are building watchlists, not chasing momentum.

Importantly, attention is rising without a matching surge in volume or volatility. That tells us participation remains selective. Traders are tracking these names for confirmation, waiting for structure breaks or volume expansion before committing capital. In this phase, engagement acts as an early signal of focus, not a trigger for immediate execution.

How Traders Need to Interpret This Phase

This phase tells traders to stay patient, not passive. AI tokens are attracting attention, but price action remains controlled. That usually signals preparation rather than execution. Traders should expect continued consolidation unless volume expands and key resistance levels break. Until then, social engagement should be read as early positioning interest, not confirmation of a trend.

The takeaway is simple. Watch how price reacts when broader altcoin momentum returns. Sectors that hold structure while attention builds often MOVE first once conditions turn supportive. For now, this phase is about observation, refining levels, and waiting for confirmation rather than chasing narratives.