Japan’s Rate Decision Looms: Could Trigger Bitcoin and Altcoin Selloff Within 48 Hours

Tokyo's monetary move threatens crypto's fragile equilibrium.

### The Domino Effect from Tokyo

All eyes shift to the Bank of Japan. A potential rate hike—the first in years—doesn't just rattle yen traders. It sends shockwaves through risk assets globally, and cryptocurrencies sit squarely in the crosshairs. Tighter policy in Japan pulls liquidity, the very lifeblood that's been propping up speculative rallies. When that cheap money tap gets a twist, the high-flyers feel the draft first.

### Why Crypto Cares About a Yen Move

Forget isolation. Crypto markets are now deeply entangled with traditional finance. A BOJ pivot signals a broader shift in global capital costs. Investors who chased yield in volatile altcoins suddenly recalculate. The carry trade unwinds, margin gets more expensive, and the 'risk-on' party faces a sobering bill. It's a classic case of finance ministers in suits dictating terms to digital anarchists—a reality check served with bureaucratic precision.

### The 48-Hour Countdown

The clock is ticking. Market psychology is the real trigger. Traders aren't waiting for the actual hike; they're front-running the fear. Expect leveraged positions to get slashed, stop-losses to cascade, and panic to become a self-fulfilling prophecy. Bitcoin, as the flagship, will take the initial hit. But the altcoins—those with thinner order books and wilder valuations—will get absolutely hammered. It's a liquidity test they might not pass.

### Navigating the Storm

This isn't a call to abandon ship. It's a warning to batten down the hatches. Volatility isn't a bug in crypto; it's a feature. Sharp corrections have always been the entry fee for historic rallies. Savvy players see chaos as a discount window. The ones who get wrecked are those who mistook a bull market for a one-way street—a common delusion in a sector that loves to confuse genius with a rising tide.

The coming days will separate the hodlers from the tourists. While central banks play their old-world interest rate games, crypto's long-term thesis remains untouchable. But in the short term? Prepare for turbulence. Sometimes, the most important move in finance is simply not to be the slowest one out the door when the music stops.

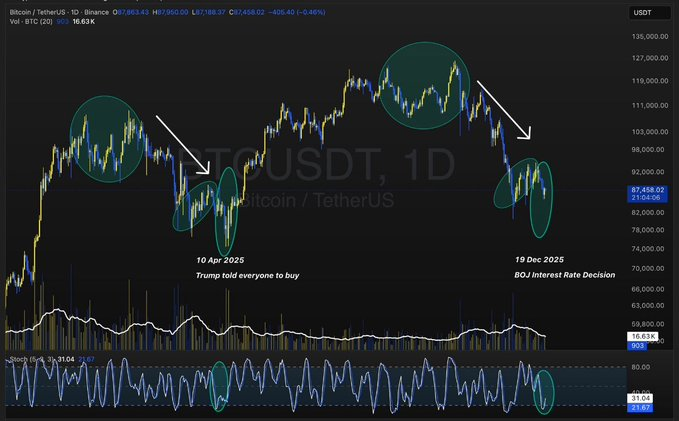

Cryptocurrency markets are facing heightened volatility as the Bank of Japan (BOJ) prepares to raise interest rates, a move that could have Ripple effects on Bitcoin, Ethereum, XRP, and other digital assets globally.

BOJ Prepares Historic Rate Increase

Japan has maintained ultra-low interest rates for decades to stimulate economic growth through cheap borrowing. However, rising inflation and a weakening yen have prompted the BOJ to signal a rate hike. Economists predict a 0.25% increase from the current 0.5%, potentially reaching 0.75%, the highest level in decades.

The rate increase, although seemingly small, represents a major shift in Japan’s monetary policy and is expected to influence both local and global financial markets.

Why Crypto Investors Should Take Notice

Cryptocurrency markets thrive on liquidity, with cheap money fueling investments in high-risk assets. When central banks tighten monetary policy, borrowing costs rise and liquidity dries up. Historically, these conditions trigger sell-offs in speculative markets, including crypto.

Bitcoin often feels the first impact. During the 2022 U.S. Federal Reserve rate hikes, Bitcoin prices plunged from over $60,000 to under $20,000 in a matter of months. Analysts say a similar effect could be seen if the BOJ proceeds with the anticipated hike.

The Role of the Yen and Global Carry Trades

A stronger yen could also impact global carry trades. Investors often borrow yen at low rates to invest in higher-yielding assets such as U.S. stocks or crypto. A rate hike may reverse these trades, creating additional selling pressure in crypto markets.

“This is not isolated to Japan,” said one market analyst. “Japan is the world’s third-largest economy, so their moves create ripples.”

Current Market Trends

As of Dec 17, cryptocurrency markets are showing early signs of stress. Bitcoin is trading around $86,589, down over 1% in the past 24 hours. Ethereum has fallen to $2,834, losing more than 4% of its value. XRP is also under pressure, trading at $1.86 with a decline of nearly 4%. The total market capitalization of cryptocurrencies stands at $2.92 trillion.