Macro Storm Warning: Can Ethena’s Price Setup Survive the Coming Financial Turbulence?

Macroeconomic headwinds are gathering force. For Ethena, the synthetic dollar protocol, the question isn't if they'll hit—it's how hard.

The Fragile Foundation of 'Stable' Growth

Ethena's model, built on delta-neutral derivatives and staked Ethereum yields, thrives in a specific Goldilocks zone. It needs calm markets, predictable monetary policy, and a steady crypto risk appetite. The current macro landscape offers none of that. Rising inflation fears, hawkish central bank pivots, and geopolitical flashpoints create a volatility cocktail that could shatter delicate yield arbitrages. When traditional finance sneezes, crypto still catches a cold—often a much worse one.

Liquidity: The First Domino to Fall

The real danger isn't a slow bleed; it's a liquidity seizure. Macro shocks trigger risk-off cascades. Capital fleets from perceived risk assets. For protocols like Ethena, which depend on deep, liquid markets for its hedging strategy, a sudden dry-up is catastrophic. The 'neutral' in delta-neutral can vanish overnight, exposing the protocol to raw market moves. Remember, in a crisis, correlations between assets tend to converge toward 1.0—everything tanks together, a classic Wall Street 'innovation' in herd behavior.

Navigating the Storm: Adaptation or Obsolescence?

Survival hinges on resilience. Can Ethena's mechanisms dynamically adjust to violent funding rate swings and collateral volatility? Does its design include circuit breakers for extreme macro stress? Protocols that weather this storm will be those built not just for bull market efficiency, but for bear market survival. The coming months will separate robust financial engineering from fair-weather fintech—a necessary purge, if you can stomach the volatility.

The ultimate test for any crypto-native financial system is its performance when the old-world system cracks. Ethena promises a dollar that's 'internet-native.' Now, it must prove it's also 'recession-native.' Otherwise, it's just another high-yield product destined for the graveyard of strategies that worked until they didn't—a finance sector specialty.

The Ethena Price has returned to a critical zone this mid-december that previously marked the start of a powerful rally in 2024. While the current short-term price action can’t be ignored as it remains strongly subdued by macro sentiment. But, a combination of technical positioning and improving on-chain metrics is drawing renewed attention to Ethena crypto amid an uncertain macro backdrop.

Ethena Price Revisits a Historically Reactive Level

In September 2024, ENA/USD traded near the $0.20 level before launching into a strong upside move that carried the token to roughly $1.20 by December, representing a 525% advance. This week, the Ethena price USD is once again hovering near that same demand area.

On the Ethena price chart, the structure appears similar to the setup seen before the previous rally. Although past performance does not guarantee another repetition of rally, but bullish odds can’t be overruled. As markets often respond to levels where liquidity and historical demand are previously aligned. As a result, watching closely for signs of stabilization before any directional MOVE emerges is a wise action here on.

Short-Term Consolidation May Shape Ethena Price Prediction

In the near term, price behavior suggests that a brief consolidation phase could be necessary. As sideways movement around the current support zone WOULD allow sellers to exhaust and buyers to gradually absorb supply. If this process plays out, the Ethena price prediction could shift toward a recovery move targeting the $1.20 region.

Dostlar $ENA söylediğimiz bölgeden %50 yaptı tekrar akümüle seviyesine düştü buralarda yatay bu süreci geçirip yukarı çok sert gideceğine eminim fakat yıldırıyolar, bıktırıyolar elinizdekileri satın market Maker malı kendisi götürsün çabaları görüyorum. pic.twitter.com/8iXmhLUp5V

— Kripto Warrior (@kriptowarrior) December 17, 2025However, this scenario depends heavily on broader market stability. Without supportive conditions across major assets, even technically favorable setups can fail to gain traction. As such, ENA crypto’s short-term outlook remains conditional rather than guaranteed.

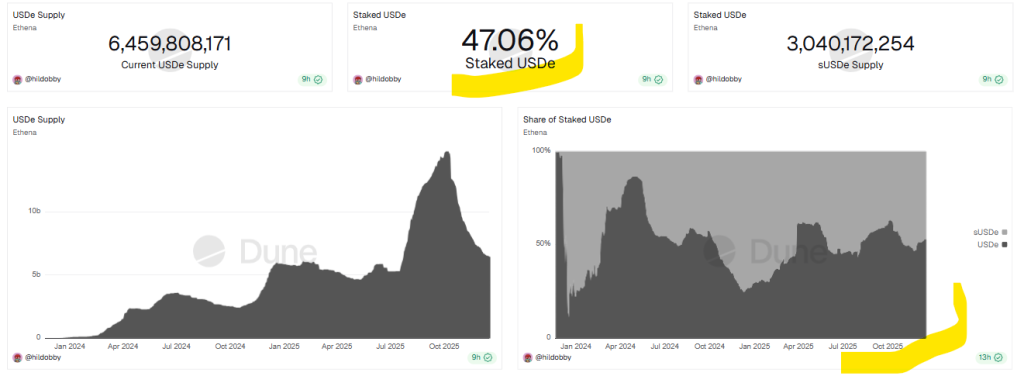

Rising sUSDe Staking Signals Improving Protocol Health

Beyond price action, on-chain metrics present a more constructive picture. The growing share of staked USDe (sUSDe) suggests that a larger portion of the circulating supply is being locked into the Ethena protocol in pursuit of yield. This reflects increasing user trust and confidence in the system’s design.

This generally viewed as a positive indicator for the ecosystem’s fundamentals. While it does not ensure an immediate rebound in Ethena price, it can provide underlying support if market sentiment improves. From a fundamentals perspective, Ethena crypto does not currently show signs of any major weakness.

Macro Conditions Could Override the Ethena Price Forecast

Despite these supportive signals, macroeconomic risk remains elevated. As Bank of Japan’s plays a critical role in global liquidity through the yen carry trade. A potential rate hike on December 19 could force Leveraged positions to unwind, leading to broad-based selling across risk assets.

Historically, Bank of Japan rate hikes in 2024 and 2025 were followed by rapid Bitcoin drawdowns of 20–30%. In such a scenario, ENA/USD would likely struggle to maintain support, regardless of improving fundamentals. Therefore, the Ethena price forecast remains highly sensitive to upcoming shortterm macro developments.

For now, the Ethena price sits at the intersection of constructive on-chain signals and elevated macro risk. If liquidity conditions stabilize and consolidation holds, upside scenarios remain viable. However, a deterioration in global risk sentiment could quickly invalidate bullish setups.