Ripple’s RLUSD Goes Multichain: Why This Move Could Supercharge XRP’s Value

Ripple just pulled the trigger on a major expansion—its stablecoin RLUSD is breaking free from a single chain. This isn't just a technical upgrade; it's a strategic power play that directly impacts every XRP holder's portfolio.

Beyond the Bridge: A Liquidity Onslaught

Multichain deployment means RLUSD liquidity floods new ecosystems overnight. Think DeFi protocols, cross-chain swaps, and trading pairs that never existed before. This creates instant utility and demand hooks for XRP, as the native asset underpinning Ripple's broader financial architecture.

The XRP Symbiosis Play

Ripple isn't building a standalone stablecoin. RLUSD's success is engineered to feed back into the XRP Ledger. Increased settlement activity, enhanced corridor liquidity for ODL (On-Demand Liquidity), and a stronger value proposition for institutional partners—it all points back to XRP's core use case. A rising RLUSD tide lifts all Ripple boats, though skeptics in traditional finance might call it another 'circular ecosystem' waiting for real-world adoption.

Why This Time Is Different

Past announcements promised potential. This move delivers immediate infrastructure. By deploying RLUSD across multiple blockchains, Ripple effectively bypasses the 'walled garden' problem that has plagued other projects. It’s a bid for market share in the stablecoin wars, with XRP positioned as the strategic reserve asset. The cynical take? It's a necessary gambit in a market where stablecoins are becoming the de facto on-ramp—and where being single-chain is a fast track to irrelevance.

For XRP holders, the equation is simple: broader RLUSD adoption translates to heightened network utility and, ultimately, a stronger valuation thesis for XRP itself. The multichain era for Ripple starts now.

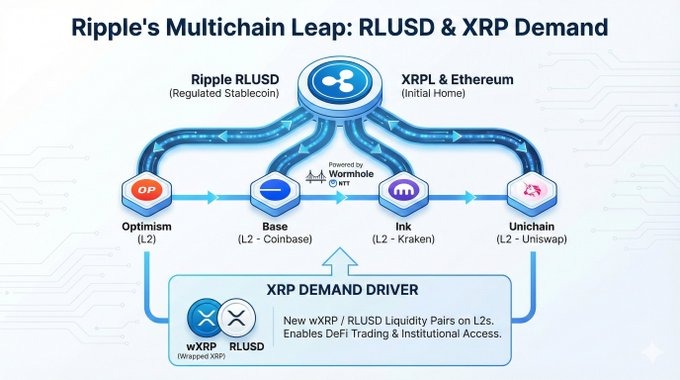

Ripple, a blockchain-based infrastructure for global payments, has taken a major step to expand the use of its US dollar-backed stablecoin, RLUSD. On December 15, the company confirmed it is testing RLUSD on several ethereum layer-2 networks, including Optimism, Base, Ink, and Unichain.

This MOVE builds on its earlier launch and aims to create a more connected system while increasing real-world use for XRP.

Ripple RLUSD Stablecoin Goes Multichain

According to recent updates shared by the Ripple community, Ripple’s RLUSD stablecoin, which already has a market value of about $1.3 billion, has adopted Wormhole’s NTT standard.

This upgrade allows RLUSD to move between blockchains as the original token, not as risky wrapped copies.

RLUSD is expanding to LAYER 2s using @wormhole’s NTT standard for native, secure transfers and will become the first U.S.-based, trust-regulated stablecoin on @Optimism, @Base, @Inkonchain and @Unichain: https://t.co/ju9KyoOIBa

This will enhance utility for XRP and RLUSD by…

By using Wormhole’s Native Token Transfers system, RLUSD can shift smoothly across networks while staying secure and liquid. This setup also lets Ripple keep full control over how RLUSD operates on each supported blockchain.

How XRP Fits Into This Bigger Plan

While RLUSD acts as the “digital cash” in Ripple’s system, XRP plays the role of the liquidity engine. At the same time as RLUSD expands, partners like Hex Trust are rolling out wrapped XRP (wXRP).

This allows XRP to be used on networks like solana and Ethereum, where it can serve as collateral, trading liquidity, or DeFi fuel.

Together, RLUSD handles stable payments, while XRP helps move value between blockchains. For XRP holders, this means XRP is no longer limited to one network and can now play a bigger role across the wider crypto ecosystem.

More Chains Planned in 2025

Ripple is currently testing RLUSD on major Ethereum layer-2 networks like Optimism, Base, Ink, and Unichain. A full launch is planned for next year, once regulators give approval.

Once live, RLUSD will work smoothly across different blockchains while staying fully regulated. With strong regulatory support and growing cross-chain use, Ripple is building RLUSD for the next stage of crypto adoption.

Institutional Adoption Strengthens Ripple Case

Ripple’s progress is backed by strong regulatory approvals in New York and growing use in tokenized funds. BlackRock’s BUIDL platform already uses Wormhole for cross-chain activity, showing rising trust from large institutions.

While prices may not rise quickly in the short term, Ripple’s multichain approach increases XRP’s real use. Over time, this wider use can support long-term value.