Bitcoin Braces for Sub-$70K Plunge as Japan’s Rate Hike Threat Looms

Global markets are holding their breath. Japan's central bank is sharpening its knives, and Bitcoin's record run might be the first casualty.

The Domino Effect from Tokyo

Forget whispers—this is a shout. The Bank of Japan is finally ready to move, signaling a decisive shift from its decades-long ultra-loose policy. That spells trouble for the carry trade, the lifeblood of speculative capital that's been flooding into risk assets like crypto. When the world's last major holdout on negative rates flips the switch, the cheap money fueling rallies dries up fast.

Bitcoin in the Crosshairs

Analysts are scrambling. The correlation between global liquidity and crypto valuations isn't a theory anymore; it's a live wire. A Japanese rate hike doesn't just tighten conditions in Asia—it sends a shockwave through every leveraged position betting on perpetual easy money. The technical charts for Bitcoin are screaming 'overbought,' and a fundamental catalyst like this could be the pin that pops the bubble.

The $70K Line in the Sand

Watch that number. A break below $70,000 isn't just a minor correction; it's a psychological breach that could trigger a cascade of automated sell-offs and margin calls. The entire ecosystem—from overconfident retail traders to institutional whales—has been dancing on a liquidity high. That dance floor is about to get a lot more crowded, and not in a good way.

So, while traditional finance pundits will nod sagely about 'necessary adjustments,' remember: their 'healthy correction' is your portfolio's nightmare. The era of free money is closing its final chapter, and crypto, the ultimate speculative darling, is on the front page. Buckle up.

Bitcoin, which is already struggling to regain its strength around $100K, is facing immense pressure as the Bank of Japan (BOJ) prepares for a key interest rate decision.

In the past, whenever the BOJ hiked its rate, BTC price fell by 25%, and with another hike expected, top crypto experts are warning BTC could fall toward $70,000, a decline of nearly 28%.

Here’s what is coming.

Japan To Hike Interest Rate By 25bps

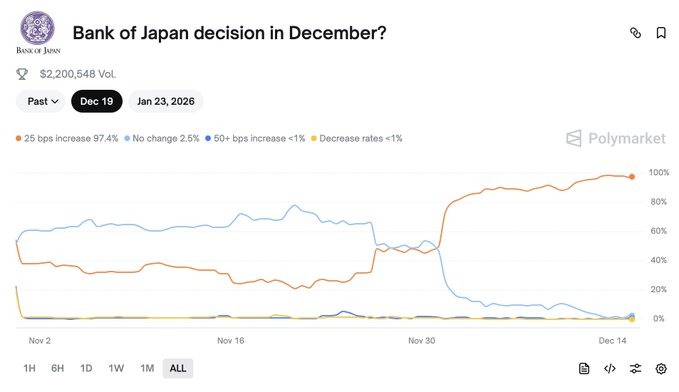

On Dec 19, the Bank of Japan is holding a key policy meeting and is widely expected to raise interest rates by 25 basis points. Even prediction platform Polymarket currently shows a 98% chance of a rate hike on December 19.

Some experts believe the MOVE could be even stronger, with expectations that the BOJ may hike rates by up to 75 basis points.

While it may seem like a local decision, Japan plays a major role in global finance. The country holds over $1.1 trillion in U.S. Treasury bonds, making it the largest foreign holder.

When Japan changes interest rates, it impacts global money flows, bond yields, and risky assets like stocks and cryptocurrencies.

Bitcoin Price To Drop To $70K

History shows a clear pattern. Each time Japan has raised interest rates, Bitcoin has fallen soon after.

- In March 2024, when the rate hike occurred, Bitcoin fell around 23%

- Similarly, in July, when the 2024 rate hike occurred, Bitcoin dropped roughly 26%

- And this year, in January 2025, when the rate hike occurred, Bitcoin slid about 31%

If this trend repeats, Top crypto analysts Merlijn The Trader warn that bitcoin could fall another 20–30%, pushing prices below $70,000 after December 19.

THE BANK OF JAPAN MIGHT BE BITCOIN’S BIGGEST ENEMY

Japan holds the most US debt.

Every time they hike, Bitcoin bleeds:

March 2024: -23%

July 2024: -30%

Jan 2025: -31%

Next hike: Dec 19

Next move: loading…

If the pattern repeats, $70K is in play. pic.twitter.com/R5916R702I

Rising Japan Bond Yields Added Fuel To the Fire

This time, the pressure on the crypto market is not just from a possible rate hike, but from rising Japanese bond yields, which recently hit 2.94%, the highest since 1998.

For years, traders borrowed cheap Japanese yen to invest in higher-return assets like crypto. Now, as Japan’s bond yields rise, this strategy is becoming expensive. Traders are closing positions, which leads to selling, liquidations, and sudden market drops.

As a result, Japanese investors may start moving money back home. Some models suggest up to $500 billion could leave global markets over the next 18 months, pushing U.S. borrowing costs higher even without a Fed rate hike.

Crypto Market Already Struggling

As of now, Bitcoin is currently trading near $90,000, down nearly 30% from its recent peak around $126,000. The overall crypto market is also struggling, with total market value falling from $4.1 trillion to roughly $3.05 trillion.

Major altcoins like XRP, Solana, and Cardano are all down by 40% from their October high. While some memecoin have even seen 60% to 70% drop.