4 Crypto Cards You’ll Actually Use in 2026 – Why Digitap’s ($TAP) Unified Balance Changes Everything

The plastic in your wallet is about to get a serious upgrade. Forget juggling multiple accounts or watching exchange fees eat your lunch—the next generation of crypto cards is moving beyond simple spending tools and becoming full financial hubs.

Unified Assets: One Wallet to Rule Them All

The real friction in crypto spending has never been the technology; it's the fragmentation. Digitap's $TAP protocol tackles this head-on by merging balances across chains and asset types into a single, spendable pool. No more manual swaps before a purchase. It bypasses the traditional multi-step cash-out process, letting you pay for coffee with yield-bearing staked assets as easily as with stablecoins.

Beyond the Cashback Gimmick

While early cards competed on reward percentages, the 2026 landscape rewards utility. The four leading contenders aren't just payment rails—they're integrated gateways. Think automatic tax lot optimization on each transaction, seamless conversion of earned crypto into your local currency, and built-in DeFi strategies that keep idle funds working. It turns your spending card into a stealthy yield engine.

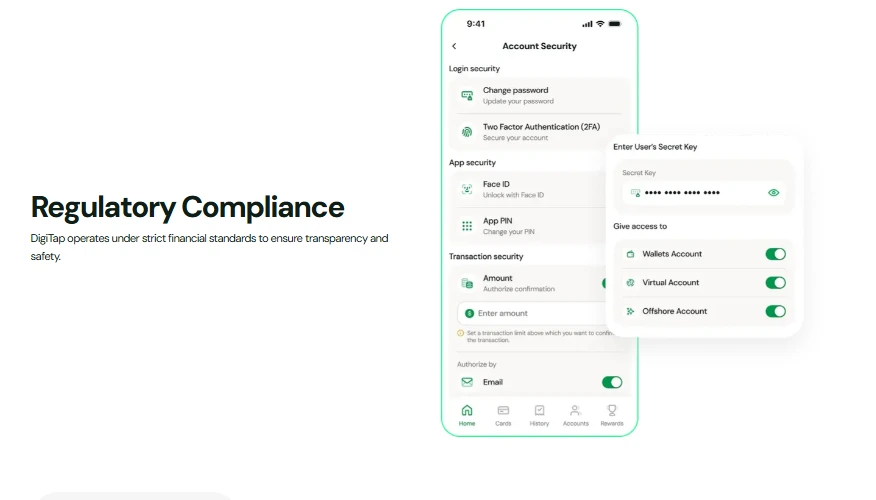

The Regulatory Tightrope

Adoption hinges on more than slick tech. The winners will be those navigating the global patchwork of financial regulations without crumbling under compliance costs—a hurdle that has sunk more fintech dreams than a bear market. Their success makes a cynical point: in finance, the best technology often loses to the one that best handles the paperwork.

The bottom line? The race isn't for the card with the prettiest metal finish. It's for control of the unified financial layer sitting behind it. The platform that makes asset diversity feel invisible to the user will cut through the noise, turning speculative holdings into practical, everyday fuel.

Using cryptocurrency for everyday purchases shouldn’t be complicated. Several industry titans have come close to solving one of crypto’s longest-standing problems. However, while most have come close, only, astartup and creator of the world’s first “omni-bank”, truly solves this problem.

Digitap’s Visa-powered crypto-linked card automatically converts digital assets into fiat at the point of sale. Of course, fiat users aren’t left out as Digitap’s card can also be funded with cash. This unified balance is a game-changer for the industry and makes Digitap a topfor 2026.

Below are the top 4 crypto cards for everyday spending and why Digitap ranks as number one.

Digitap’s Unified Card Appeals As Best Crypto To Buy

Digitap is the fintech company behind the world’s first superbank app that blends fiat and crypto together. Users can send, receive, store, save, invest, and, more importantly, spend, either fiat or crypto, seamlessly, making it awith real utility.

The Digitap card, powered by Visa and available to all Digitap users,, connects to a single account that holds both crypto and fiat. This means users don’t have to manually preload a separate fiat wallet or decide which asset to spend.

Users can hold multiple cryptocurrencies and traditional currencies in one Digitap account, and the AI-powered software will swap the appropriate asset at the time of purchase.

Another advantage is that Digitap doesn’t require staking tokens for better rates or paid memberships for access. Its goal is to function as a crypto-friendly bank account that is open, fair, and accessible to a global population.

How Digitap’s Visa Deal Boosts Confidence In $TAP Presale

Digitap’s successfulof its native $TAP token can in part be attributed to its Visa partnership. This adds a LAYER of credibility to Digitap’s ecosystem, signaling to investors that it is a topas it has passed Visa’s rigorous compliance and integration standards.

It also means users can spend their crypto seamlessly at over 80 million merchants worldwide. This real-world spending capability has set Digitap apart from other presale tokens.

As part of a presale structured in stages, the price of $TAP was first for sale at $0.0125 in the late summer. After each round is complete, the price of $TAP slightly appreciates. Currently for sale at $0.0361, early backers are sitting on a paper profit of nearly 200%.

Digitap’s team recently confirmed its presale will end with $TAP graduating to a live exchange. A date has yet to be confirmed, but the expected listing price of $0.14 implies investors don’t have much time left to buy the token before it is available to the general public.

Why Crypto.com’s Metal Cards Come With Heavy Conditions

One of the most globally recognized crypto cards comes from Crypto.com. It offers a basic free card along with tiered Visa cards with sleek metal card options and rewards like free Netflix and cashback paid in the platform’s native CRO token.

However, the flashy metal card design is purely aesthetic, and the rewards come with strings attached, especially six-month token lockups.

Users can indeed get up to 5% cashback on purchases, although this requires staking $500,000 worth of CRO. The most basic card doesn’t provide any rewards and has to be preloaded with cash.

Why Robinhood’s Card Suits Some, But Requires Membership

Stock and crypto trading platform Robinhood launched an invite-only Gold card in 2025. This is a true credit card (i.e., not a preloaded debit card) that is available to Robinhood’s Gold subscription members.

The card’s headline feature is a flat 3% cashback on all purchases with no categories or foreign transaction fees. This is an industry-leading rate for an uncapped, all-category card. Rewards can be redeemed into a Robinhood brokerage account, making it a convenient option to invest rewards.

However, access is limited, and users must be on a Robinhood Gold subscription, although it isn’t as prohibitive as rivals at around $5 per month. But, as a conventional credit card, it requires a credit check and approval based on creditworthiness.

An Elite Coinbase Amex Card With Access Limited to a Few

Coinbase, one of the largest crypto exchanges, launched the Coinbase One Card that operates on the American Express network. A sleek-looking metal card offers users up to 4% cashback in Bitcoin on every purchase.

There is no annual fee for Coinbase One members, and benefits include American Express’ standard protections like warranty on purchases and travel insurance. While certainly a premier, if not elite, card, it ranks lower on the list because it is subject to approval based on credit score.

Coinbase does offer the opportunity for users to check eligibility with no hard credit impact, which is a nice touch. It is also, for the time being, limited to U.S.-based users. Still, it provides a convenient way for existing and eligible Coinbase users to earn bitcoin rewards.

Why Digitap’s No-Strings Card Already Stands Out From Rivals

Crypto.com, Robinhood, and Coinbase all offer useful and appealing cards to certain demographic groups. They come with conditions, such as staking tokens, paying for memberships, or navigating credit checks. While there is certainly a market for this, Digitap stands out with its more unifying approach.

Digitap, despite still being aproject, removes the hurdles and allows anyone to spend crypto hassle-free. This means fewer steps and no surprises. A user’s money in any FORM should be available to tap-and-pay anywhere, anytime, with no conditions.

As crypto cards continue to gain momentum, 2026 could be the year they go mainstream. Solutions like Digitap’s card, which blur the line between traditional and digital finance, are likely to lead the evolution. Buying a coffee with leftover USDC or BTC with a bank card is a narrative that could gain traction and make $TAP a leadingnext year.

Discover the future of crypto cards with Digitap by checking out their live Visa card project here:

- Presale https://presale.digitap.app

- Website: https://digitap.app

- Social: https://linktr.ee/digitap.app

- Win $250K: https://gleam.io/bfpzx/digitap-250000-giveaway