Gemini Gets Green Light: CFTC Clears Path for U.S. Prediction Markets Launch

Gemini just scored a major regulatory win. The crypto exchange secured clearance from the Commodity Futures Trading Commission to launch prediction markets for U.S. customers—a move that could reshape speculative trading.

The Regulatory Hurdle Cleared

Navigating U.S. financial regulation often feels like running an obstacle course blindfolded. Gemini's approval cuts through a significant layer of that complexity, granting it a rare license to operate what are essentially event-based futures contracts. This isn't just another product listing; it's a sanctioned entry into betting on real-world outcomes.

A New Arena for Crypto Capital

This opens a direct channel for crypto liquidity to flow into non-financial speculation. Think elections, weather patterns, or box office numbers—all becoming valid trading instruments. It bypasses traditional sportsbooks and creates a decentralized, transparent market structure, potentially attracting a wave of capital currently sitting on the sidelines.

The Fine Print and The Future

The CFTC's blessing comes with strings, naturally. Expect strict know-your-customer protocols, position limits, and oversight that would make a traditional compliance officer blush. But for Gemini, it's a strategic masterstroke, positioning it ahead of rivals still tangled in regulatory red tape. It turns the exchange into a one-stop shop for both digital asset trading and speculative hedging.

Let's be real—Wall Street has been making markets on uncertainty for centuries, just with fancier suits and higher fees. Gemini's move simply digitizes the casino and lets the public pull the lever. The house always wins, but now the game has a new, crypto-native dealer.

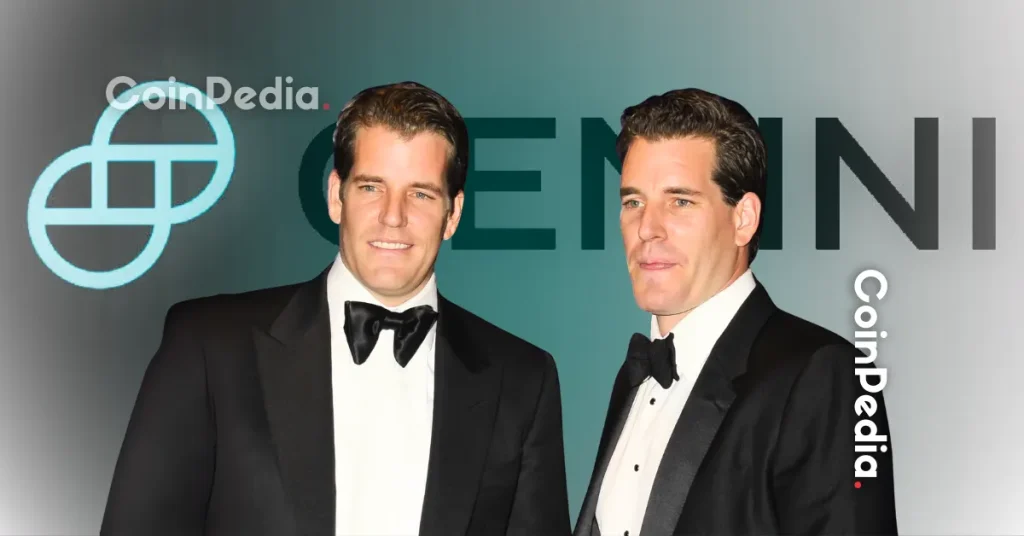

Gemini Titan, the Winklevoss twins’ affiliate, secured CFTC Designated Contract Market approval on December 10, 2025, five years after applying in March 2020. U.S. users can soon trade binary yes/no contracts on Gemini’s site, like “Will Bitcoin top $200K?”, with mobile rollout next and crypto futures, options, perpetuals planned. CEO Tyler Winklevoss thanked President Trump for crypto relief as Kalshi and Polymarket smashed volume records post-election.