How High Can XRP Price Go After Tomorrow’s FOMC Meeting?

All eyes turn to the Fed as XRP traders brace for volatility.

The Federal Open Market Committee's decision tomorrow isn't just about interest rates—it's a potential catalyst for the entire crypto market. XRP, sitting at a critical technical juncture, could see its next major move dictated by a room full of economists in Washington.

The Macro Trigger

Forget the daily chart noise. The real driver this week is monetary policy. A hawkish hold from Jerome Powell could slam risk assets, sending traders fleeing from altcoins like XRP. A dovish tilt, or even a hint of future cuts, might be the rocket fuel digital assets are waiting for. Liquidity is the only fundamental that matters in the short term, and the Fed controls the taps.

XRP's Make-or-Break Zone

Technical analysis points to a tight consolidation pattern. The token has been grinding sideways, building energy for a breakout. Key resistance levels loom overhead, but a decisive close above them—powered by a favorable macro shift—could open the path to significantly higher ground. Support, however, is thin. A break below current levels on a risk-off Fed statement would be ugly.

The Trader's Dilemma

This is the classic crypto gamble: betting on a digital, decentralized asset whose immediate fate is tied to the most centralized financial decision-making body on the planet. It's a reminder that for all the talk of 'debanking,' everyone's still watching the old bankers.

Tomorrow's verdict will set the tone. Will XRP ride a wave of renewed liquidity hopes, or get crushed in a traditional market rout? The charts are set. The Fed holds the match.

![XRP News [LIVE] Update](https://image.coinpedia.org/wp-content/uploads/2025/12/01124853/How-High-or-Low-Can-XRP-Price-Go-After-Fifth-ETF-Launch-Today-1024x536.webp)

The Federal Reserve meets tomorrow, and prediction markets show a 95% chance of a 25 bps rate cut. The Fed has also signaled that Quantitative Tightening may be close to ending, which points to a softer policy stance.

A rate cut still depends on the latest inflation numbers, labour data, and the broader economy. Since September 2024, each rate cut has caused a quick spike in the US dollar, while crypto markets have seen short but sharp swings.

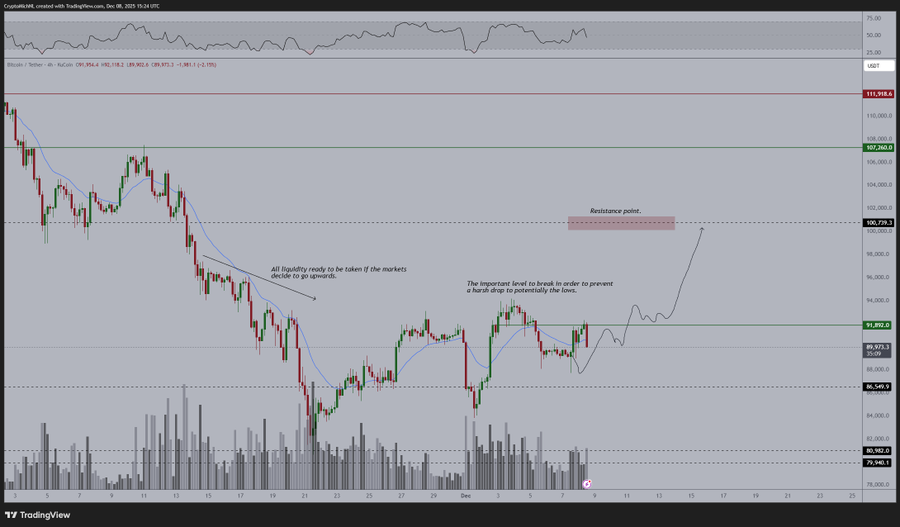

Bitcoin’s Range Keeps Altcoins Limited

Bitcoin is trading around $90,000 and has not been able to break above the $93,000 to $94,000 resistance zone. ETF inflows have slowed, which is one reason for the stalled momentum.

Analyst Michael van de Poppe says traders often reduce risk during FOMC week. He expects Bitcoin to either form a higher low or drop toward support levels at $86,000 and $80,000 if pressure increases.

XRP usually reacts to Bitcoin’s direction, so this backdrop limits strong moves ahead of the announcement.

XRP Stays Quiet in a Tight Consolidation

XRP continues to trade calmly as the meeting approaches. The market shows low leverage, light spot selling, and declining volume. This matches its current consolidation structure.

On the chart, XRP still has an unfilled price gap around $1.96 to $1.98, which often gets tested before a bigger move. Traders appear to be waiting for the Fed’s decision before committing to new positions.

How High XRP Can Go After the Fed Decision

If the Fed delivers the expected rate cut and the market shifts into risk-on mode, XRP could bounce from the $2.00 area. In that case, the price may push toward short-term resistance levels NEAR $2.10 and $2.20.

A stronger move would depend heavily on bitcoin reacting positively to the decision and reclaiming higher levels.

The top of XRP’s consolidation sits around $2.30. Breaking above $2.30 WOULD require a clear improvement in sentiment and heavier trading volume across the crypto market.

What Comes Next for XRP

XRP may first revisit the $1.96 to $1.98 zone before finding support. If the market responds well to the FOMC decision, the price could MOVE back toward $2.10 to $2.20.

A sustained rally above $2.30 is possible, but it depends on both the tone of the Fed’s message and Bitcoin’s reaction to the rate cut.