Institutions Gobble Up $28 Million in Ethereum in Mere Hours - What’s Driving the Frenzy?

Big money just made a massive move on Ethereum, and the market's taking notice. In a stunningly short window, institutional players deployed a staggering $28 million into the second-largest cryptocurrency. This isn't retail FOMO—this is capital with a plan.

The Whales Are Feeding

Forget the day traders. This scale of accumulation screams institutional strategy. When that volume hits the tape in hours, not days, it signals a coordinated shift in sentiment among the suits who usually move at a glacial pace. They're not buying the dip; they're building a position.

Decoding the Signal

So, what do they see? It could be positioning ahead of anticipated protocol upgrades, a hedge against traditional market volatility, or a simple bet that smart contract platforms are the backbone of the next financial system. Or maybe they just finally read the whitepaper after a decade. Either way, their wallets are talking louder than any analyst report.

The Ripple Effect

This kind of buying pressure does more than just lift the price. It validates the asset class for other large, cautious funds still sitting on the sidelines. It drains exchange liquidity, setting the stage for sharper moves. It's a classic power play—deploy capital, create a narrative, and watch the herd follow. After all, what's a few million to them? Probably less than their annual consultant budget for telling them to 'consider blockchain.'

The move is a stark reminder: while Main Street argues over memecoins, Wall Street is quietly loading up on the infrastructure. The smart money isn't always right, but it's always worth watching when it places a $28 million bet in the time it takes you to finish a coffee.

Ethereum, the second-largest cryptocurrency in the world, is entering one of its most interesting phases in months. In just a few hours, big institutions moved 9,000 ETH off exchanges, major whales opened large long positions, and exchange supply dropped to new lows.

Many now wonder, is ethereum preparing for its next big rally?

Institutions Pull 9,000 ETH in Few Hours

According to Arkham Intelligence, institutions removed a significant amount of Ethereum from exchanges. Two major players, Amber Group and Metalapha, withdrew 9,000 ETH worth over $28 million from the Binance exchange in the past few hours.

This isn’t a one-day event. Over the last five months, institutions have accumulated nearly 4 million ETH, a level of inflow that usually appears before major market shifts

![]() INSTITUTIONS ARE ACCUMULATING $ETH ~ QUIETLY.

INSTITUTIONS ARE ACCUMULATING $ETH ~ QUIETLY.

In the last few hours:

• Amber Group withdrew 6,000 ETH ($18.8M) from Binance

• Metalapha withdrew 3,000 ETH ($9.4M)

That’s 9,000 ETH pulled off exchanges in a single morning.

This is the same pattern we’ve seen for weeks:… pic.twitter.com/MBgyXoPfJz

Meanwhile, these are not short-term trades. These are the kind of withdrawals institutions make when preparing for custody, long-term positioning, or deploying capital for the next big cycle.

Ethereum Sees Silent Whale Accumulation

Along with institutional withdrawals, several big wallets opened large long positions on Ethereum. Wallets like 1011short and Anti-CZ together added around $426M in Leveraged ETH longs.

Ethereum Exchange Balances Hit Low

On-chain data shows Ethereum’s available supply is shrinking fast. Only 8.7% of ETH now sits on exchanges, while more than 28 million ETH is locked in staking, custody, and long-term storage. Daily staking inflows stay strong, with over 40,000 ETH added each day.

This steady supply drop lowers selling pressure and helps create a stronger base for Ethereum’s next major move, even as the price trades around $3,040.

Ethereum Price Outlook: Key Levels to Watch

Following this accumulation, Ethereum has posted a 3% gain over the last 24 hours and is now holding the $3,100 support level strongly.

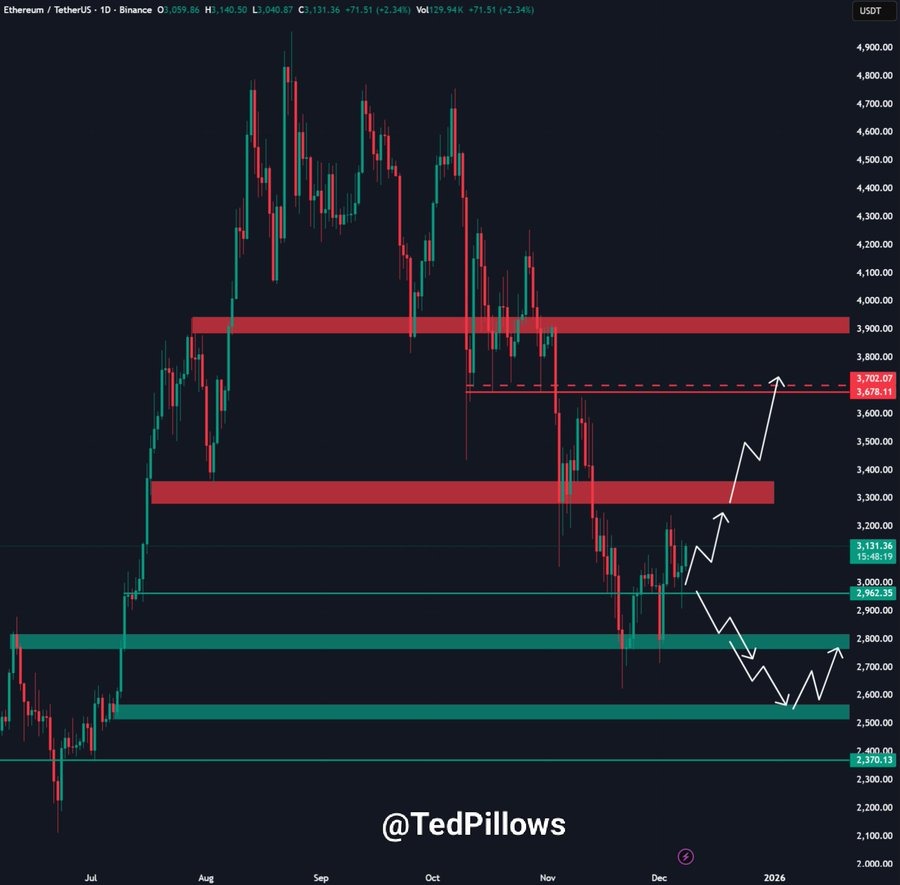

According to analyst Ted Pillows’ chart, ETH is trading inside a tight range between $3,050 and $3,200, awaiting confirmation.

If ETH breaks above the crucial $3,300–$3,400 resistance, it could rally toward the $3,700 to $3,800 zone.

However, rejection from this band may push ETH back toward $3,000, where buyers could attempt another recovery.