Pi Network’s Pi Coin Faces Delisting Risk After China Flags It as High-Risk Token

Regulatory storm clouds gather over another digital asset.

The Warning Shot

Chinese authorities just fired a shot across the bow, slapping the 'high-risk' label on Pi Coin. It's a move that doesn't just raise eyebrows—it sends exchanges scrambling to reassess their listings. When a market that size speaks, the global crypto ecosystem tends to listen, or at least check its legal exposure.

Delisting Dominoes

That 'high-risk' classification isn't a suggestion; it's a trigger. Compliance teams worldwide are now running the numbers, weighing the growing regulatory heat against any trading volume Pi Coin brings in. For platforms eyeing broader legitimacy, hanging onto a flagged asset becomes a precarious game—one where the house often changes the rules mid-play.

The Survival Calculus

This is where crypto's decentralized ethos meets centralized reality. A project's community momentum crashes against the wall of geopolitical risk. The path forward isn't about code or consensus mechanisms; it's about navigating a patchwork of national stances that can shift faster than a memecoin's chart. Some see it as an overreach, others as a necessary market sanitization—either way, it's a costly hurdle.

It’s the classic finance tango: huge potential rewards dancing with even huger, government-shaped risks. One regulator's warning can accomplish what a thousand bear markets couldn't—turning digital gold into a compliance headache.

Pi Network’s native token Pi coin is under new pressure after China’s top financial groups warned against illegal crypto activities and directly named Pi Coin as a risky asset. This has also increased fears that exchanges may delist Pi and that a future Binance listing is unlikely.

Meanwhile, Pi Price dropped another 7% this week to around $0.22, now down 92% from its all-time high.

Pi Network: China Labels Pi Coin a High-Risk Asset

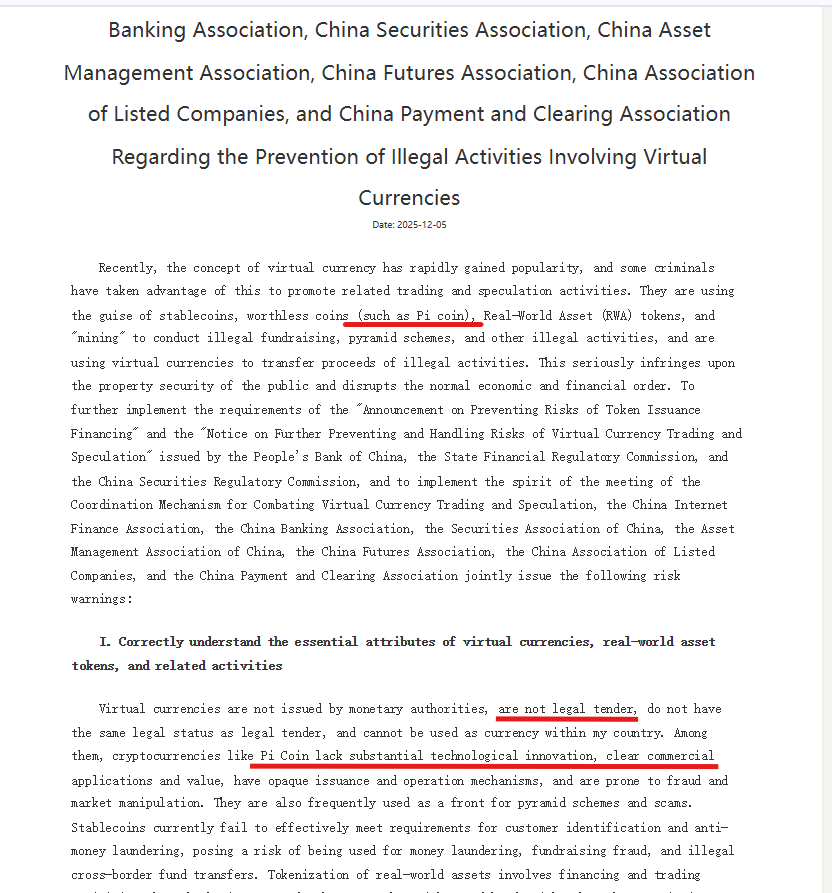

According to a joint notice issued by seven national associations, including the China Internet Finance Association, regulators warned the public about projects that promote VIRTUAL currencies without real value or technology.

The statement clearly mentioned Pi Coin, calling it an “air coin,” a term China uses for tokens that lack transparency, utility, or proven backing.

According to the regulatory notice, projects like PI Network have been associated with frequent scam activities, raising concerns about investor protection and financial stability.

However, authorities also reminded everyone that virtual currencies do not have legal tender status in China, as they cannot be used inside the country, and are not allowed for payments or investments.

Binance Listing Fades, Even Pi Could Delist From Listed Exchange

The new warning from China is already causing problems for Pi Coin on exchanges. Some platforms that allow people to trade Pi are now thinking about removing it, because they don’t want to get into trouble with regulators.

Market experts say a strong regulatory backlash in China makes it impossible for major exchanges like Binance, one of the world’s largest exchanges, to consider listing Pi Coin.

Some exchanges that have already listed $Pi may delist $Pi spot trading soon. Followers, please be aware of the risks! Please see my latest tweets for details.![]()

![]() #PiNetwork #Pi

#PiNetwork #Pi

某些已经上架 $Pi 的交易所近期可能会下架 $Pi 现货粉丝们注意风险!具体原因请看我最新的几条推文注意规避 pic.twitter.com/f1e06owl4D

Right now, Pi is listed on places like Gate.io, OKX, Bitget, CoinUp.io, and a few smaller exchanges. But after the new warning, these listings may also be at risk.

Pi Coin Price Drops Again, More Downside Ahead?

In the past week, Pi coin price dropped 7% and is currently trading around $0.22, continuing its month-long decline. The token is also down 92% from its all-time high, as confidence continues to weaken due to repeated delays and new regulatory warnings.

Recently, a Coinpedia analyst reported that Pi is showing early warning signs as it falls below an $0.29 important trading range after getting several.

If Pi fails to hold its rising trendline around $0.223–$0.225, the drop may speed up because liquidity is weak below this zone. In that case, Pi could slide toward $0.20 next, and even a fall to $0.18 is possible.

Unless Pi Network delivers clear communication on the open mainnet, the token may continue facing downward pressure.