Crypto Market Tumbles: Live Analysis & Key Drivers Behind Today’s Decline | Dec 1, 2025

Crypto markets are bleeding red. Major assets across the board are seeing significant pullbacks, shaking out late entrants and testing the conviction of long-term holders. The sell-off isn't isolated—it's a broad-based retreat.

The Liquidity Squeeze Is On

Market depth has evaporated on several major exchanges. Large sell orders are slicing through thin order books, creating exaggerated downward moves. It's a classic cascade where automated systems and margin calls fuel the fire.

Regulatory Headwinds Return

Fresh commentary from global watchdogs is spooking institutional money. Vague statements about "upcoming frameworks" and "investor protection reviews" are enough to trigger risk-off flows. Traders are pricing in uncertainty—the market's ultimate nemesis.

Technical Breakdowns Accelerate Selling

Key support levels didn't hold. When major psychological price points shattered, it triggered a wave of stop-loss orders. The technical damage now needs time to repair, regardless of the fundamental story.

Where's The Safe Haven?

Even the usual suspects aren't immune. The correlation between major assets has spiked—everything's moving down together. It suggests this is a macro-driven capital flight, not a project-specific issue. The old Wall Street adage applies: when the tide goes out, you see who's swimming naked. In crypto, it seems a lot of portfolios forgot their trunks.

This is volatility, not a verdict. Markets overshoot in both directions. Today's panic creates tomorrow's opportunity—just ask any traditional finance desk currently pretending they never wanted exposure anyway.

December 1, 2025 05:25:09 UTC

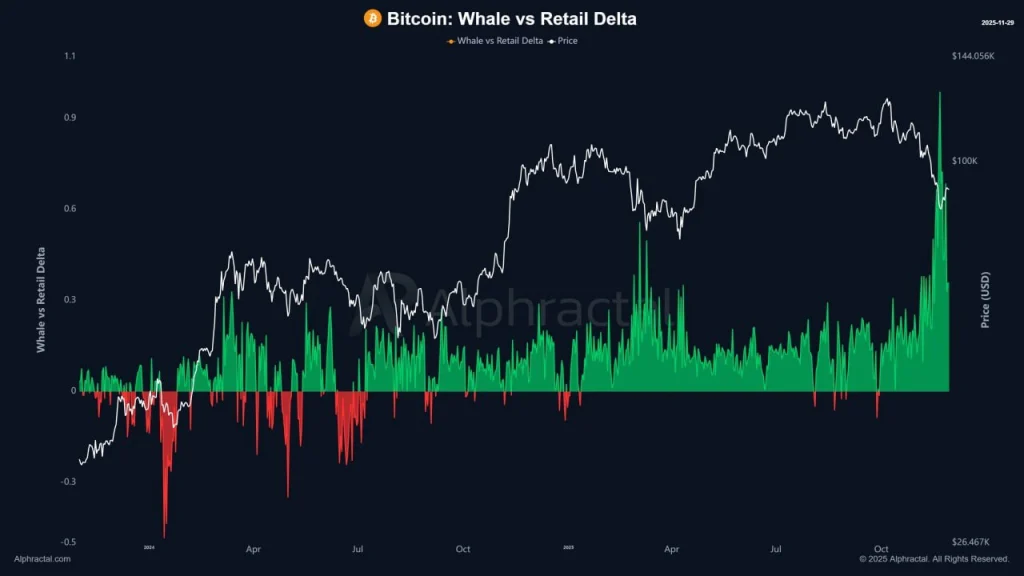

Whales Turn Cautious as Retail Traders Fuel Bitcoin FOMO

Whales appear to be reducing their long Bitcoin positions or quietly adding to shorts, even as retail traders jump in out of FOMO. This kind of setup often leads to sideways movement, as happened in March and April. Some bearish traders are also watching the $80,000 zone again, possibly preparing to accumulate if the price dips back into that range.