Bitcoin’s Crash Wasn’t About Selling—It Was About Buyers Vanishing. Can the BTC Price Stage a Recovery?

Bitcoin's latest plunge tells a familiar, brutal story in finance: panic isn't always about a stampede for the exits. Sometimes, it's about the doors to the entrance slamming shut.

The Vanishing Bid

Forget the narrative of massive sell orders flooding the market. The real driver was a sudden, chilling evaporation of buy-side interest. The order books didn't just thin—they hollowed out, leaving support levels looking more like suggestions than concrete floors. Liquidity, that magical grease for the financial engine, dried up faster than a puddle in the desert.

A Market Built on Momentum

Crypto markets, Bitcoin included, thrive on narrative and momentum. When the flow of new capital slows to a trickle, the entire price discovery mechanism grinds into something less rational. It's less about fundamental value and more about a collective game of musical chairs where the music has stopped. The so-called 'number go up' technology faces its hardest test when the number starts going down and nobody steps in to catch it.

The Path to Recovery

So, can it bounce back? History says yes—volatility is a feature, not a bug. Recovery hinges on one thing: the return of the buyer. That requires a shift in sentiment, a new catalyst, or the old-fashioned exhaustion of sellers. It might be institutional accumulation in the shadows or retail FOMO rekindled by a green weekly candle. The market has an amnesia problem, which is often its greatest strength.

In the end, Bitcoin's fate rests not with the holders sweating over their wallets, but with the next person willing to hit the 'buy' button. Until then, the market is just a price in search of a believer—a fitting metaphor for modern finance itself.

Bitcoin remained within a range-bound consolidation and closed the monthly trade above $90,000, raising hopes for a bullish yearly close. Yet, the BTC price crashed hard below $86,000 and created a ripple effect within the markets. The global crypto market cap slumped below $3 trillion, wiping out nearly $140 billion, while the ETF accumulation also remains nominal despite the discounted price.

The major reason behind the current collapse is said to be liquidations and high volatility, but deep down inside, it was due to a liquidity vacuum created by the buyers. This raises serious alarms about whether the buyers are not confident in the BTC price recovery, as a normal decline turned into a sharp downward cascade.

Liquidity Vanishes Before the Bitcoin Price Crash

Heading into the early Monday session, order-book depth on several top exchanges had already thinned significantly. Market makers typically reduce inventory over weekends, but this time the pullback was deeper. Bid-side liquidity—the volume of buy orders within 2% of the current price—dropped by an estimated 30–50% for Bitcoin and Ethereum, creating the perfect conditions for volatility.

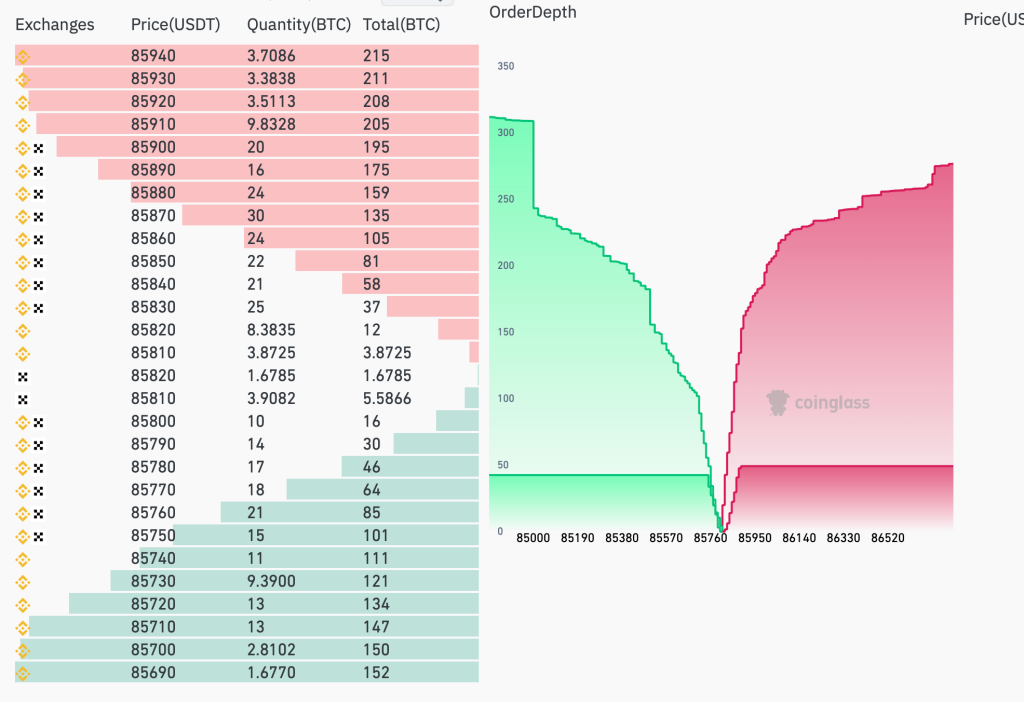

The order book data—taken just as BTC slid below the $86,000–$85,700 zone—shows a steep imbalance:

- Sell orders stacked deeply up the book

- Buy orders nearly flatlined near the bottom

- Total bid liquidity near the key $85,760 level almost evaporated

In the depth chart, the green side (buyers) plunges sharply before flattening out—a visual confirmation that the market simply ran out of demand. Meanwhile, the red side (sellers) thickened around the $85,900–$86,500 range, overwhelming the thin bid side.

This is the exact structural pattern that turns a routine pullback into a rapid cascade.

Spot CVD Confirms Buyers Stepping Back, Not Sellers Attacking

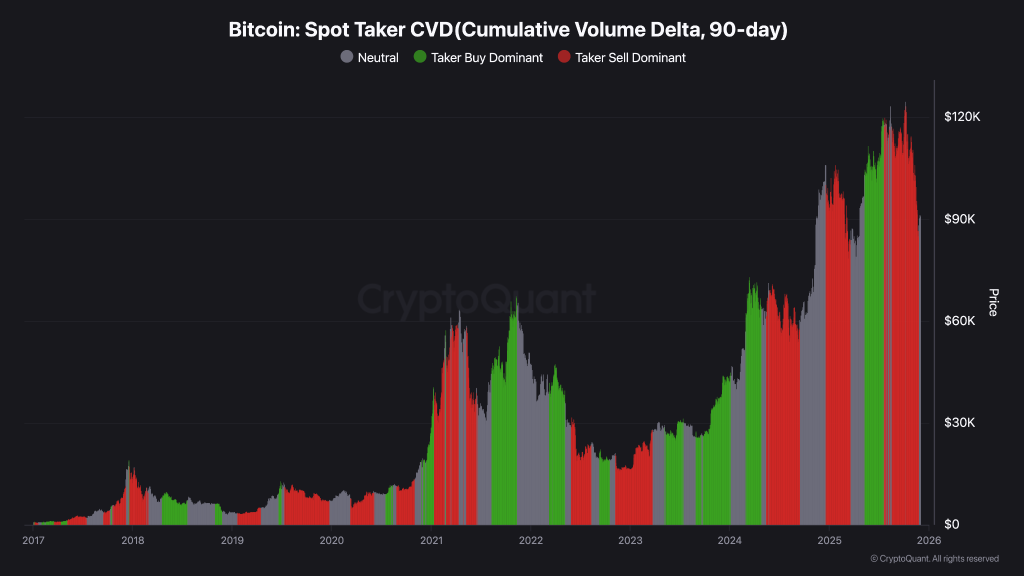

To validate whether selling pressure was truly overwhelming, we examine the Spot Taker Cumulative Volume Delta (CVD)—a reliable tool that tracks whether buyers or sellers are in control. This indicator measures the cumulative difference between market buy and market sell volumes over a period.

The chart clearly shows a sharp reversal in buy-side aggressiveness, with taker-buy volume drying up right around the time of the drop. Importantly, there is no spike in taker-sell dominance, reinforcing the argument that Bitcoin’s decline was caused by a sudden lack of buyers rather than panic selling.

This aligns perfectly with what order books are signalling: price didn’t fall because traders dumped—it fell because no one stepped up to buy.

Is Recovery Possible From Here?

Today’s crash wasn’t a typical risk-off event or liquidation cascade. Historically, similar liquidity-driven drops tend to recover quickly once market makers restore depth and spot buyers step back in. The key levels to watch are

- $85,800 – immediate resistance

- $86,500–87,000 – short-term recovery zone

- $83,500 – the next major demand zone if liquidity remains thin

If fresh bids return to the book and CVD turns positive again, a swift rebound is likely. But if buy-side liquidity remains weak, the bitcoin (BTC) price may continue to drift lower until stronger demand emerges.