Quant Surges to $79 - $86 Next Stop in Crypto Rally?

Quant rockets past resistance as bullish momentum builds

The Rebound Engine

Quant's price action just flipped from bearish to bullish in spectacular fashion, climbing back to $79 with undeniable force. This isn't just a minor correction—it's a full-scale reversal that's got traders scrambling to reposition.

Target Locked: $86

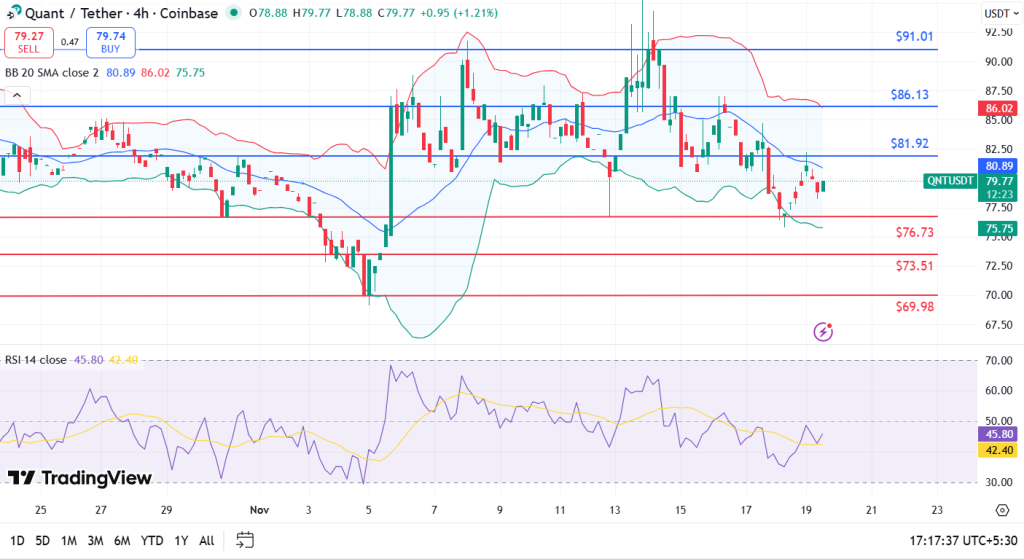

All technical indicators now point toward $86 as the next major resistance level. The charts show clean breakout patterns, with volume confirming the move's legitimacy. If Quant maintains this trajectory, we could see another 8-9% gain in the coming sessions.

Meanwhile, traditional finance keeps pretending they don't see what's happening—their loss, our gain.

Quant’s price journey has sparked fresh excitement, especially after this week’s visible rebound. The QNT token managed to climb 2.57% to $79.59 in the last 24 hours, drawing eyes to the utility surge and technical bounce. What set this rally apart was a combination of strong token news, a resilient technical setup, and a sector-wide shift favouring real-world blockchain solutions.

With traders jumping in, driven by Quant Network’s new QuantNet and Fusion launches, it looked like the market found a new rhythm. Let’s dig into what’s actually fueling the move and where the QNT price might head next.

Will Bulls Break $82, or Are Bears Coming?

QNT’s rally started after touching an ascending trendline that has supported its price for almost a year. When prices bounced from $77.70 up to $82.10, the move signalled renewed confidence. Holding above the 50-day EMA at $81.92 offered dip-buyers a green light to step in. The price zig-zagged NEAR crucial resistance levels, with targets at $81.92 and $86.13.

If Quant Price can clear $82, bulls could aim for $86 or even $91 within the next 5–10 days, depending on how quickly volume picks up and sentiment stays strong. If prices drop below $76.73, sentiment could turn bearish fast, with downside risk down to $73.51 and possibly $69.98.

For now, I see a tug-of-war. Bulls lean on momentum from QuantNet and Fusion’s launch, while the bears point to low volume as a warning. As long as the price holds above the key support trendline, any bearish slide likely remains short-lived.

Conclusion

Looking ahead, I expect the QNT price to test the $81.92 resistance, but it needs higher volume to break above and push toward $86 or $91. If enthusiasm from the QuantNet launch remains, a 5–10 day timeline could see these targets hit.

That being said, the bears only get loud if the price falls under $76.73, as momentum could fade and trigger a short drop closer to $73.51. For now, the overall tone feels cautiously bullish.

FAQs

What is Quant’s price today?Quant trades at $79.59, up 2.57% in 24 hours, but down 4.88% for the week, showing mixed momentum.

What are Quant’s next price targets?Short-term targets for Quant are $81.92 and $86, with $91 possible if volume and sentiment improve within 5–10 days.

Should I buy Quant now?Quant is cautiously bullish right now, as price holds key support and benefits from positive network news. Hence, you can pick a trade.