Bitcoin at Critical Juncture: Bulls Battle for $92K Support—$130K Breakout or $80K Collapse Ahead?

Bitcoin's make-or-break moment arrives as it retests the $92K bull market support level—a zone that could determine the next major move. Analysts are split: some see a springboard to $130K, others warn of a plunge toward $80K if the floor cracks.

The $92K Litmus Test

This isn't just another pullback. The $92K level has historically acted as a launchpad for Bitcoin's parabolic rallies. Hold here, and the path to six figures clears. Fail, and the 'bull market' narrative starts smelling like last cycle's hopium.

Wall Street's Schrödinger's Bitcoin

Institutional analysts—always hedging—are calling it both ways. 'Technical strength suggests $130K is inevitable,' claims one desk, while another whispers about leveraged longs getting liquidated if $80K hits. Meanwhile, crypto Twitter oscillates between diamond hands and panic sells faster than a meme coin rug pull.

The Bottom Line

Market mechanics favor volatility either way. With futures open interest at record highs and spot ETFs hungry for dips, Bitcoin's next 20% move will likely happen before traditional finance finishes their third coffee. Buckle up—this is where traders separate from HODLers, and where 'long-term investors' suddenly remember they have stop-losses.

Bitcoin (BTC) price has retested a crucial multi-year support trendline. The flagship coin dropped over 2% on Monday, to reach a range low of about $91,214 during the mid-North American session.

Bitcoin Price at a Crucial Crossroads

Bitcoin price has dropped around 20% in the past four weeks to retest its multi-month rising logarithmic trend. As CoinPedia recently reported, the BTC/USD pair was well-positioned to retest the support level around $92k to fill its multi-month unfilled CME gap.

Source: TradingView

In the weekly timeframe, Bitcoin’s Moving Average Convergence Divergence (MACD) has flashed a bear market. Notably, the weekly MACD has been registering rising bearish histograms as the MACD line teases crossing below the Zero line.

What’s Next for BTC Price Amid Extreme Fear of Capitulation?

Potential rubber-spring rebound fueled by a short-squeeze and renewed whale demand

From a technical analysis standpoint, the Bitcoin price is well-positioned to rebound quickly in the coming weeks. After closing last week in a bearish candlestick, BTC has suffered more selling pressure fueled by leveraged traders.

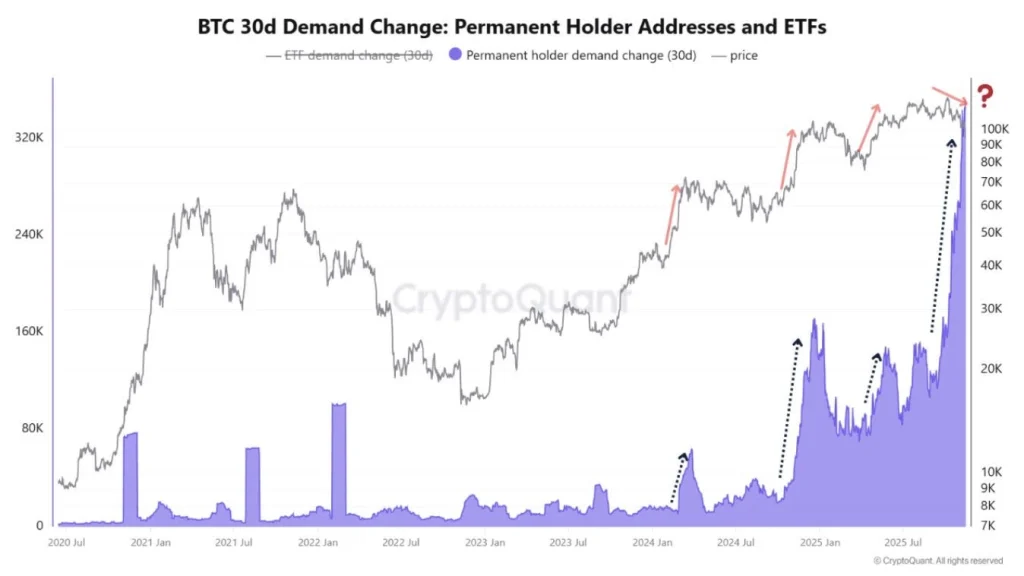

A potential short-squeeze is likely to trigger a rubber-spring rebound fueled by high demand from whale investors. According to on-chain data analysis from CryptoQuant, long-term capital, led by Strategy that acquired nearly 9k BTC, has been aggressively accumulating amid the ongoing selloff.

Source: CryptoQuant

The long-term whales are potentially betting on expected capital rotation from gold to Bitcoin in the coming weeks. Moreover, the upcoming Fed’s Quantitative Easing (QE) in December is a bullish trigger for the wider crypto market.

A possible beginning of a multi-month bear market

On the other hand, BTC price is likely to continue in bearish sentiment if whales fail to absorb selling sprees by short-term traders. If bitcoin price consistently closes below $91k in the coming days, the onset of its multi-month bear market will be inevitable.

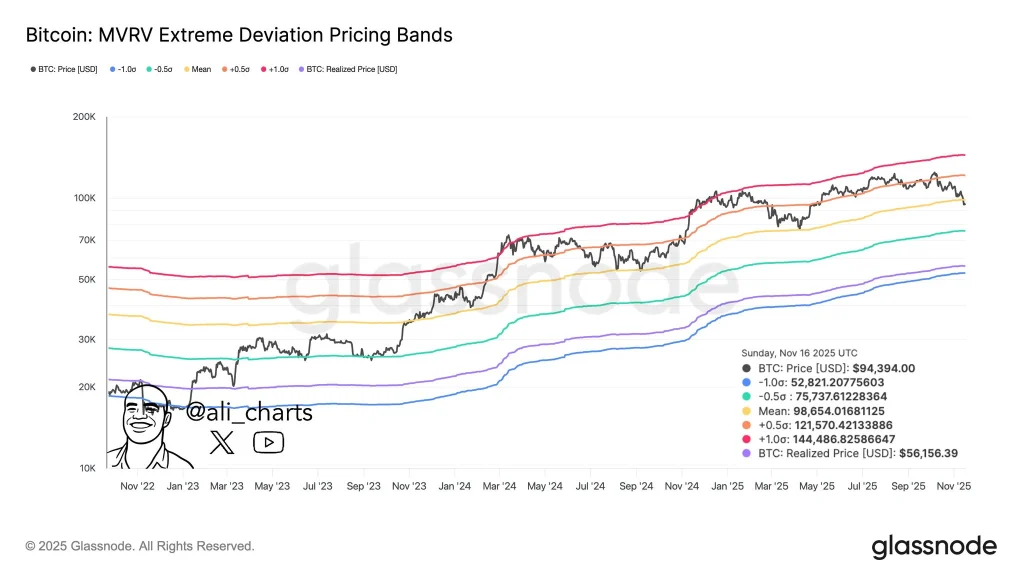

Source: X

According to market data analysis from Glassnode, the bitcoin price will likely fall below $80k if the bullish thesis fails to materialize in the coming days.