Bitcoin Price: Stuck in a Macro Bear Market or Primed for a Breakout? Analysts Weigh In

Bitcoin's price action has traders divided—is this a prolonged bear market or the calm before the storm?

Bearish signals flash red as BTC struggles to reclaim key levels. Yet some analysts spot hidden bullish divergences.

Meanwhile, traditional finance pundits scoff—'just another crypto winter'—while quietly increasing their ETF exposure.

The truth? Macro trends cut both ways. When the Fed pivots, crypto bypasses Wall Street's speed bumps. Watch the charts, ignore the noise.

Bitcoin (BTC) price has dropped below a crucial psychological support level of about $100k. The flagship coin slipped over 2% on Thursday to reach a range low of around $98.2k before rebounding to trade about $98.4k during the mid-North American trading session.

Why is Bitcoin Price Down Today?

Continued selloff by whale investors amid gold and stock market rebound

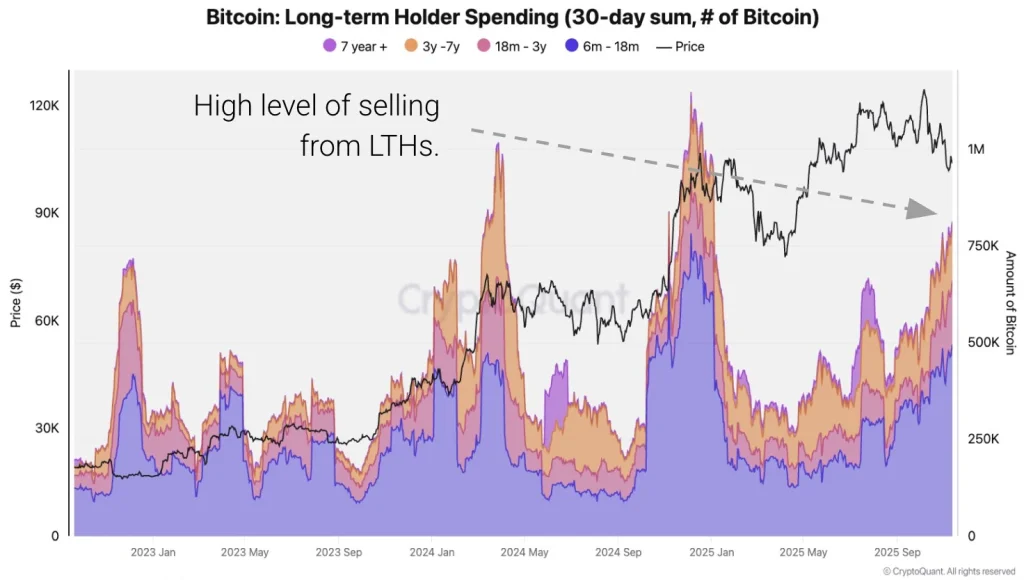

The notable Bitcoin selloff today was largely influenced by the low demand from whale investors. According to market data analysis from CryptoQuant, Bitcoin’s long-term holders have been offloading aggressively akin to the fourth quarter of 2024.

Source: CryptoQuant

Precisely, long-term holders sold 815k BTCs during the past 30 days. On-chain data analysis from Arkham revealed that a single whale sold Bitcoins valued at $290 million on Thursday through Kraken.

Amid the ongoing Bitcoin-led crypto selloff, the Gold price has been on the rise. Despite the reopening of the U.S. government, capital flow to the crypto market has not yet reached the capacity to absorb the high selling pressure.

Heavy liquidation of long traders amid heightened fear of further capitulation

Following the sudden Bitcoin-led crypto selloff, more than $647 million was liquidated from Leveraged crypto markets. According to market data analysis from CoinGlass, more than $519 million involved long traders, with Bitcoin accounting for over $234 million.

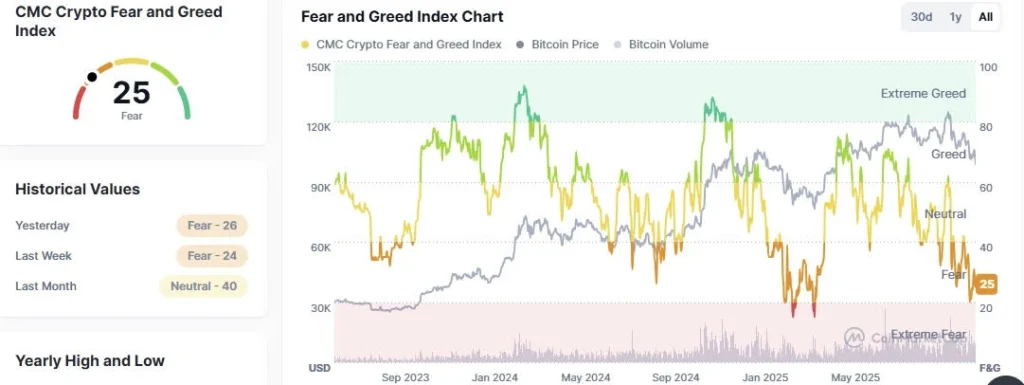

The heavy liquidation of long traders triggered the impact of a long squeeze amid heightened fear of further capitulation. Notably, the crypto fear and greed index has dropped to a multi-month low of about 25, signaling extreme fear of further capitulation.

Source: CoinMarketCap

Technical breakdown: BTC price has dropped below its bull market supports

After BTC price failed to reclaim $107k as a support level in the last few days, its market reversal was confirmed. As such, the flagship coin is well-positioned to retest its multi-year rising logarithmic support trendline.

The pain has just begun this was only a small drop.

The real pain comes once we break this pattern around 94K–90K.

Hope you’ve got a plan.$BTC pic.twitter.com/rlx1XZRo4e

From a technical analysis standpoint, BTC price may drop as much as $92k, where a CME gap remains unfilled.

What’s Next for the Bull Market?

All attention has now shifted to the Federal Reserve ahead of December’s anticipated Quantitative Easing (QE). With investors expected to rotate Gold profits to Bitcoin, a potential rebound is likely in the coming weeks, with most Wall Street experts predicting a parabolic rally soon.