Bitcoin Price Alert: 3 Compelling Signals Pointing to a $92K Drop Ahead

Bitcoin's bull run hits turbulence as market dynamics suggest an imminent correction. Here's why traders are bracing for a dip to $92,000—and what it means for your portfolio.

Liquidity crunch meets miner capitulation

Exchange reserves are swelling while hash rate derivatives flash red. When weak hands and overleveraged miners collide, even Wall Street's 'digital gold' narrative can't stop the bleed.

Derivatives time bomb ticks louder

Perpetual swap funding rates hit year-to-date highs last week. Now open interest is concentrating at $92K strike puts—smart money's hedging against the very rally they engineered.

Macro headwinds return with a vengeance

The Fed's reverse repo facility just saw its biggest quarterly drain since 2023. As yield-starved institutions rotate back into Treasuries, crypto's 'risk-on' facade crumbles faster than a meme coin's tokenomics.

Will this be a healthy pullback or the start of something uglier? Either way—the market's about to separate the HODLers from the bagholders. (And no, your 'buy the dip' tweet doesn't count as a strategy.)

Bitcoin (BTC) has signaled further midterm weakness. The flagship coin has been retesting a crucial psychological support level around $100,000 and has weakened it every time.

Why Is Bitcoin Price Likely to Retest $92k Soon?

Failed ‘Uptober’ bullish narrative amid crypto liquidity crunch

After Bitcoin price recorded its first red October in six years, it has been trapped in a mid-term falling trend. The flagship coin has dropped 20% since hitting its new all-time high (ATH) around $126k during the first week of October.

The BTC/USD pair has retested a crucial support level of around $100k and dropped to $99k twice this week. As such, the bitcoin price is likely to drop further in the midterm fueled by the ongoing liquidity crunch.

Earlier this week, Wintermute noted that the crypto market has not experienced a new wave of cash inflow but a rotation of existing capital.

Re-awakening of old whales increases traders’ fear of further correction

According to on-chain data from CryptoQuant, old whales, led by Michael Saylor’s MicroStrategy, have been moving their Bitcoins in the recent past.

![]() JUST NOW: Just after I hit send… 26,025 $BTC (~$2.5B) from 3y – 5y old moved

JUST NOW: Just after I hit send… 26,025 $BTC (~$2.5B) from 3y – 5y old moved![]()

Earlier today, the large movement came from @saylor’s @MicroStrategy.

Now I need to check if this massive transfer belongs to them too. https://t.co/pPSQVoN8DK pic.twitter.com/5NFJ1c32dy

The notable surge in the re-awakening of old coins has coincided with the extreme fear of further crypto capitulation. At press time, CoinMarketCap’s Fear & Greed index hovered around 21/100, representing extreme fear.

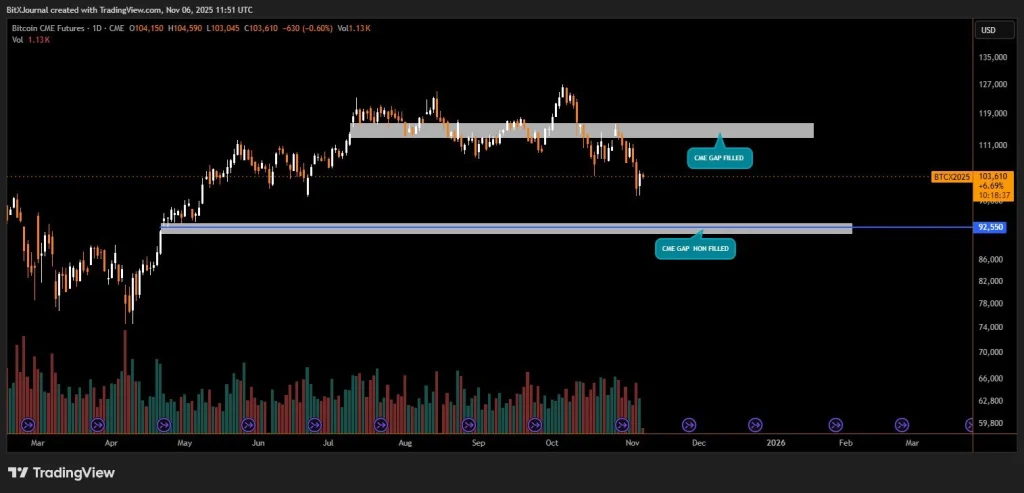

Technical headwinds amid unfilled CME gap around $92k

Bitcoin price has fallen below its 50-weekly Simple Moving Average, and dipped below its two crucial support levels around $107k and $103.7k. Meanwhile, the BTC/USD pair is likely to drop towards its bull market support around $92k, which also coincides with an unfilled CME gap.

Source: X

Bigger Picture

Despite the mid-term bearish sentiment, BTC price is likely to regain a bullish outlook before the end of this year. Earlier this week, JPMorgan Strategist Nikolaos Panigirtzoglou noted that the Bitcoin price is undervalued relative to gold and may rally to $170k to match its performance.

The macro bullish outlook for bitcoin is bolstered by the upcoming Fed’s Quantitative Easing (QE) on December 1, 2025.