$312M Crypto Unlock Tsunami Hits Markets - Is This The Beginning of the Great Crypto Crash?

Massive token unlocks trigger market tremors as $312 million floods the ecosystem this week alone.

The Unlock Avalanche

Projects across multiple chains are releasing previously locked tokens into circulation - creating immediate selling pressure that's rattling investor confidence. The timing couldn't be worse for markets already showing signs of fatigue.

Market Mechanics Exposed

Early investors and team members finally get their hands on long-restricted holdings. Many immediately cash out - because who wouldn't take profits after years of waiting? It's the classic crypto cycle playing out in real-time.

Domino Effect Fears

As one major unlock triggers sell-offs, others follow suit. The psychological impact often outweighs the actual supply increase. Suddenly everyone's checking their calendar for the next unlock date.

Traditional finance would call this 'planned dilution' - in crypto, we call it Tuesday. Another day, another opportunity for early backers to exit while retail investors hold the bag.

Will markets absorb this $312 million hit and bounce back stronger? Or are we witnessing the first cracks in the crypto foundation? One thing's certain - when this much supply hits at once, someone's always left buying the dip that keeps dipping.

After a volatile start to November, the crypto market continues to struggle for stability. Bitcoin has been consolidating near $107,000, showing limited signs of recovery after last week’s sharp correction. Ethereum has also failed to reclaim the $3,900 mark, while top altcoins like Solana, Avalanche, and Dogecoin are facing consistent selling pressure. The broader sentiment remains cautious, with traders watching whether the market’s bullish momentum from October can be sustained amid growing macro and liquidity headwinds.

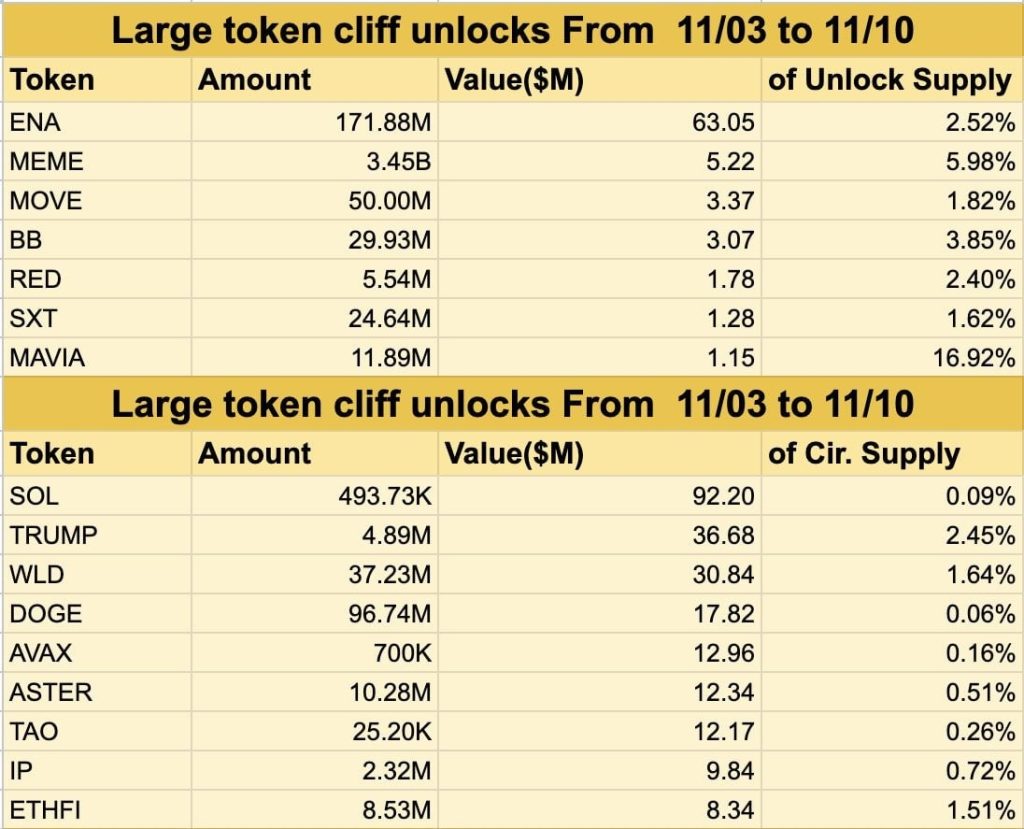

Amid this uncertainty, the market faces another challenge—a massive wave of token unlocks worth over $312 million scheduled for this week. These unlocks, which release previously locked tokens into circulation, could introduce additional supply and potentially intensify the current pullback.

Major one-time unlocks include Ethena ($ENA), Memecoin ($MEME), Movement ($MOVE), Big Time ($BB), and Red ($RED). Simultaneously, daily emissions from large-cap tokens like Solana ($SOL), Dogecoin ($DOGE), Worldcoin ($WLD), and Avalanche ($AVAX) continue to add steady pressure.

Data from on-chain trackers shows Ethena leading this week’s schedule with nearly $97 million in tokens set to unlock, followed by Memecoin and Movement, each contributing sizable liquidity inflows. These unlocks come at a delicate moment when the market’s recovery is losing steam, increasing the likelihood of heightened volatility. Historically, large unlocks during weak market phases tend to accelerate corrections as newly available tokens hit exchanges.

With Bitcoin and ethereum struggling to attract new inflows and global risk appetite shrinking post-FOMC, traders are likely to remain defensive. The key question now is whether the market can absorb the $312M inflow without triggering another wave of sell-offs—or if this unlock cycle becomes the tipping point for a deeper correction.