Chainlink (LINK) Plunges Below $17 - Will Bulls Stage a Comeback on October 31, 2025?

LINK bulls get a Halloween scare as price action turns spooky.

The Breakdown

Chainlink's valuation takes a hit, dropping below the $17 threshold that traders had been watching closely. Market sentiment shifts from optimistic to cautious as the oracle network faces selling pressure across major exchanges.

Technical Outlook

Support levels are being tested while resistance builds overhead. Trading volume suggests both panic selling and strategic accumulation are occurring simultaneously - creating the kind of volatility that separates professional traders from the 'buy high, sell low' crowd.

Market Psychology

Fear and greed are doing their usual dance. Some see this as a buying opportunity while others are cutting positions. The classic crypto dilemma: is this a temporary dip or the start of something more concerning?

Final Take

Whether this proves to be a healthy correction or something more significant depends on whether LINK can reclaim key levels. Remember - in crypto, sometimes the scariest drops create the most profitable bounces. Just don't tell that to the leverage traders currently sweating over their positions.

As of October 31, 2025, Chainlink (LINK) is trading near $17.05, down around 2.8% in the last 24 hours. The decline comes as broader crypto market momentum cools, with Bitcoin struggling to hold above $110,000.

Despite this pullback, LINK remains one of the top-performing altcoins over the past quarter, posting a 30% gain in Q3 2025 due to steady growth in Chainlink’s oracle adoption and integrations across DeFi protocols.

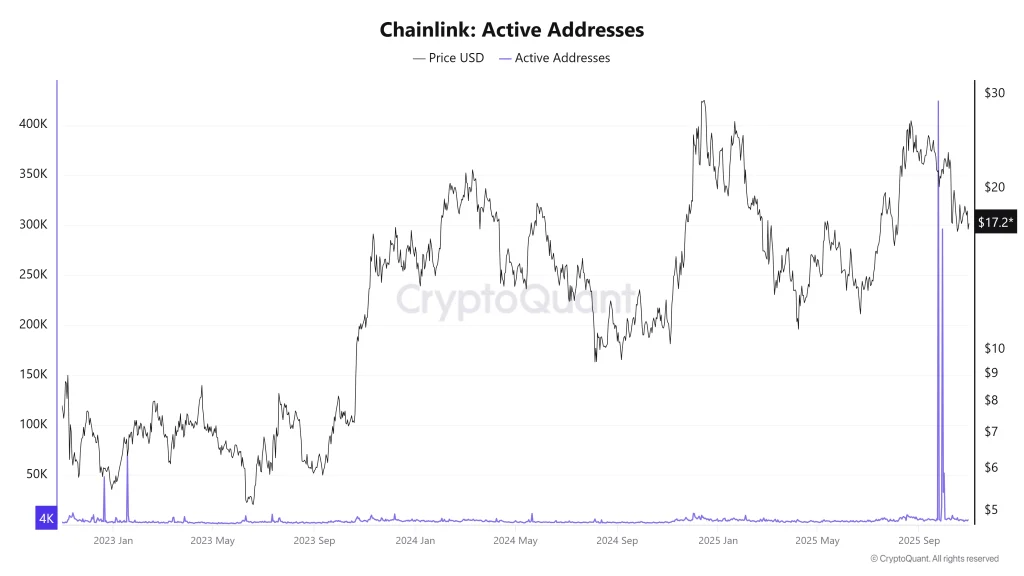

Chainlink Active Addresses

As per CryptoQuant, Recent on-chain data shows that whale transactions have slowed compared to last week, signaling reduced accumulation. However, the total number of active addresses remains stable, reflecting consistent user engagement within the chainlink ecosystem.

Additionally, traders are closely watching Bitcoin’s next move, as LINK tends to mirror BTC’s short-term price action. A BTC rebound above $112,000 could help stabilize LINK above $17 once again

LINK Price Analysis

On the, LINK has broken below itsnear, turning it into immediate resistance. Thelies around, followed by $15.8.

- Resistance Levels: $17.50 and $18.20

- Support Levels: $16.50 and $15.80

- RSI (14): 43 — indicating mild bearish pressure

- MACD: Showing a weak bearish crossover

Chainlink (LINK) Outlook for November

Looking ahead, thewill likely determine LINK’s next direction. A successful defense could attract new buyers and push the price back above $18, while failure to hold may lead to a test of $15.5.

With Chainlink’s continued partnerships in real-world data tokenization and oracle expansion, long-term sentiment remains, even if the short-term trend appears slightly.

FAQs

What caused Chainlink’s recent price drop?Chainlink price fell due to heavy institutional selling, loss of key technical support, and overall risk-off sentiment driven by Bitcoin’s correction.

Where is the next key support and resistance for LINK?Current support levels are at $16.50 and $15.33, while resistance stands at $17.20.

Does higher active addresses mean a reversal is likely?Spikes in active addresses signal rising on-chain activity and volatility, which could precede either a rebound or deeper decline, depending on how traders react to new momentum.