Chainlink Primed for Bullish Reversal as Fed Conference & On-Chain Data Reveal Major Accumulation Wave

Chainlink's price trajectory shows classic reversal patterns as institutional money starts flowing back into the oracle sector.

Fed Signals Fuel Crypto Optimism

Powell's latest conference comments sent shockwaves through traditional markets—and smart money immediately started rotating into crypto infrastructure plays. Chainlink's oracle network stands to benefit directly from renewed institutional interest in blockchain interoperability.

On-Chain Metrics Don't Lie

Wallet accumulation patterns reveal whales are positioning aggressively at current levels. The data shows consistent buying pressure despite broader market uncertainty—a classic indicator that informed players see value others are missing.

Because nothing says 'sound investment' like betting on digital assets that fluctuate based on central banker soundbites and whale wallet movements.

The chainlink price appears to be regaining strength after weeks of sluggish performance, as multiple on-chain metrics reveal signs of accumulation among investors.

Data from Glassnode’s cost basis distribution heatmap shows that $16 has become a crucial accumulation point, where roughly 54.47 million LINK tokens have been added. This zone now serves as a strong support base, providing a potential foundation for an upward MOVE in the coming sessions.

At the time of writing, Chainlink price today continues to hover around this accumulation zone at $17.92, maintaining stability while broader market sentiment improves following the recent market-wide liquidation event.

Glassnode and Santiment Data Highlight a Potential Turning Point

Recent data insights from Santiment suggest that when LINK’s 30-day average returns dip below 5%, it is seen as a good signal for an attractive buying opportunity.

Since the wallet performance over the past month implies that current sentiment is reflecting “crowd pain”. This is often seen as a condition that precedes a rebound. The last instance of such conditions aligned with strong recovery rallies, adding weight to the ongoing bullish accumulation narrative.

Similarly, other on-chain observers have also noted increased wallet activity and token inflows to accumulation addresses. This clearly indicates that market participants are quietly building positions during this consolidation phase.

Fed’s Crypto Payments Innovation Conference Boosts Industry Confidence

Adding to the growing optimism, the U.S. Federal Reserve is hosting its crypto Payments Innovation Conference today.

This conference will feature participation from major industry names. This conference features Chainlink, as well as other notable companies, including Coinbase, Circle, and Paxos. This event marks a significant milestone, which suggests higher odds that the Fed has been focused on blockchain rather than any resistance to it.

Such institutional recognition clearly strengthens the chainlink price forecast 2025 and beyond, as it validates the project’s role in decentralized finance (DeFi) and real-world blockchain applications.

![]() BREAKING:

BREAKING:

THE FED WILL HOST A CRYPTO PAYMENTS CONFERENCE TODAY.

SUPER BULLISH! pic.twitter.com/zWCxNTrFu1

The market is anticipating potential announcements that could further accelerate the adoption of LINK crypto solutions in mainstream financial infrastructure.

Technical Outlook and Long-Term Chainlink Price Forecast

Technically, the Chainlink price chart reflects a descending triangle pattern that has persisted since 2022. Analysts suggest that a breakout above the $25 resistance could trigger an explosive rally toward $30 by year-end, with projections reaching as high as $100 by next year if momentum continues.

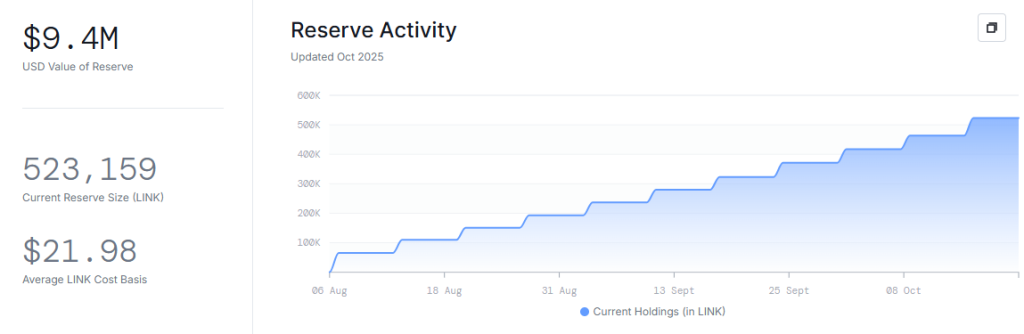

Supporting this bullish case is the Chainlink Reserve, which has been increasing since August. Also, recently it received an additional inflow of nearly 59,968 LINK tokens, pushing its total to 523,159. These in total are valued at approximately $9.4 million, with an average cost basis of $21.98. This strategic reserve demonstrates continued ecosystem growth and confidence in future performance.

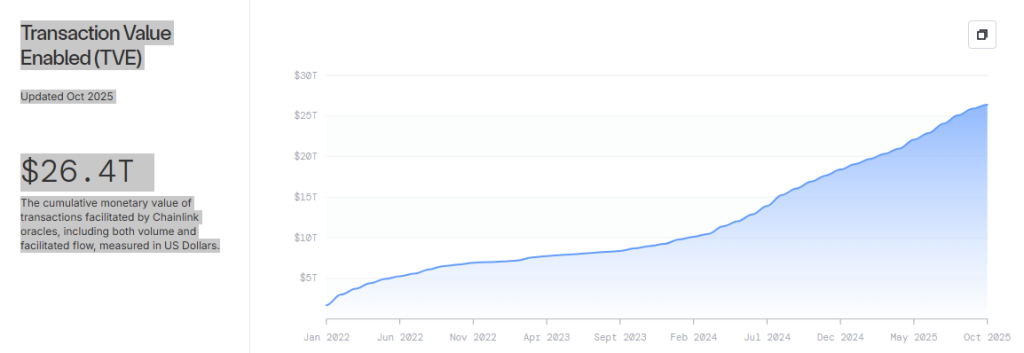

Meanwhile, adoption metrics continue to rise to record levels, showing jaw-dropping numbers.

The platform’s Transaction Value Enabled (TVE) has reached an all-time high of $26.4 trillion. This number is insanely massive, which clearly displays that its adoption level is huge. This data further reinforces Chainlink’s dominance in oracle-based infrastructure and its growing role in securing blockchain data flows.

At last, if accumulation continues and the $16 support zone holds. Then the Chainlink price USD could see renewed strength heading into the final quarter of the year.