Solana Price Weakens—Is This the Start of a 15% Correction or a Buy-the-Dip Opportunity?

Solana's momentum stalls as technical indicators flash warning signs—traders brace for potential turbulence ahead.

Technical Breakdown: Reading the Charts

SOL faces critical resistance levels after failing to maintain its recent bullish trajectory. The 15% correction scenario isn't just trader speculation—it's backed by clear technical patterns emerging across multiple timeframes. Key support levels are being tested while trading volume suggests institutional hesitation.

Market Psychology: Fear or Greed?

Retail investors are piling into leveraged long positions just as smart money appears to be taking profits. The classic battle between panic selling and strategic accumulation is playing out in real-time. Meanwhile, crypto influencers can't decide whether this is the dip they've been praying for or the beginning of a broader market rotation.

Institutional Perspective: Big Money Moves

Hedge funds that rode Solana's recent rally are now quietly trimming positions. Their risk models apparently can't ignore the technical deterioration—though they're keeping enough exposure to benefit if this proves to be another fakeout. Because nothing says sophisticated investing like hedging your hedges.

The Verdict: Correction or Opportunity?

Traders face a classic crypto crossroads: cut losses before the potential 15% drop materializes, or double down believing in Solana's fundamental strength. The network's underlying metrics remain strong, but market sentiment has clearly shifted. Sometimes the market's way of telling you it needs a break is by breaking your portfolio.

Solana (SOL) price is witnessing renewed selling pressure as technical indicators hint at a potential 15% price correction. After weeks of strong gains, the momentum appears to be fading, with traders closely watching key support zones to determine the next move. On-chain data shows declining network activity and reduced whale accumulation, fueling short-term bearish sentiment. As the broader market consolidates, investors are now asking—will solana rebound from this dip or extend its downward trajectory in the coming days?

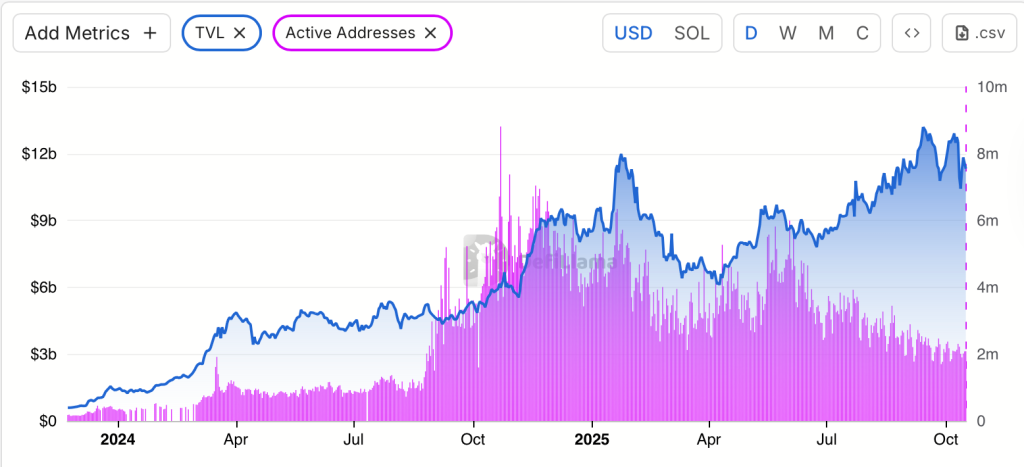

Massive Divergence Between SOL TVL & Active Address

Solana has been one of the most popular altcoins after Ethereum in the recent past, after a historic recovery from a single-digit figure. Moreover, the rally, which triggered the price from a consolidated zone in Q4 2024, attracted massive attention from the traders. Unfortunately, this attention has dropped heavily, which could drag the rally towards the recently tested lows. The chart below from DefiLama shows a significant divergence between the TVL and Active addresses, which is not conducive to a healthy SOL price rally.

On-chain data reveals a clear divergence in Solana’s network activity. While the Total Value Locked (TVL) has surged from around $6 billion to over $12 billion since early 2025, active addresses have dropped sharply from nearly 9 million to around 2–3 million. This indicates that network participation is narrowing, with capital becoming concentrated among larger players and DeFi protocols rather than retail users. Such divergence often precedes short-term weakness, suggesting that Solana could face a 10–15% correction if user engagement fails to recover despite rising on-chain value.

SOL Price Analysis: Will it Drop to $150 or Rise to $220?

The Solana price has been maintaining a strong ascending trend for over the past few months, holding the rising ascending support. Unfortunately, the latest pullback broke the support and marked an intraday low below $170. Although the bulls initiated a recovery, the fear of a pullback continues to hover over the SOL price rally. Therefore, the token is believed to plunge back to the recent lows in the next few days.

Solana (SOL) is trading NEAR $192 after breaking below its ascending trendline, indicating fading bullish momentum. The 20-day EMA ($186.8) now acts as immediate support, while the 50-day EMA ($199.4) and 200-day EMA ($208.7) serve as strong resistance zones. The Chaikin Money Flow (CMF) at 0.11 signals mild buying pressure but not enough to confirm a reversal. The formation of a rising wedge breakdown suggests a potential decline toward $172–$165, unless SOL reclaims $200, which could invalidate the bearish setup.