Red September: Bitcoin and Ethereum ETFs Bleed $244 Million - What’s Next for Crypto Markets?

Crypto ETFs hemorrhage $244 million as September's red ink flows through digital asset markets.

The Great Unwinding

Bitcoin and Ethereum exchange-traded funds just posted their worst performance since the 2022 bear market. Institutional money flees at the first sign of trouble—some things never change on Wall Street.

Market Mechanics Exposed

ETF outflows reveal the fragile foundation beneath crypto's institutional adoption narrative. When traditional finance meets digital assets, the marriage gets messy fast.

Looking Beyond the Bloodbath

Smart money knows these pullbacks create buying opportunities. The same institutions pulling funds today will be chasing prices tomorrow—the eternal dance of fear and greed continues.

Wall Street's seasonal 'risk-off' approach proves yet again that old finance habits die hard—even when dealing with revolutionary technology.

On September 23, both spot Bitcoin and ethereum ETFs recorded a second straight day of net outflows. Data from SoSoValue shows Bitcoin ETFs lost $103.61 million, while Ethereum ETFs saw outflows of $140.75 million.

Bitcoin ETF Breakdown

Bitcoin ETFs posted a total outflow of $103.61 million. Fidelity’s FBTC led withdrawals at $75.56 million. Ark & 21Shares’ ARKB followed with $27.85 million, and Bitwise’s BITB shed $12.76 million.

Only two products managed to attract inflows. Invesco’s BTCO added $10.02 million, while BlackRock’s IBIT brought in $2.54 million.

Trading activity in Bitcoin ETFs reached $3.16 billion, with total net assets of $147.17 billion, representing about 6.6% of Bitcoin’s market cap. This reflected a decline from the prior day.

Ethereum ETF Breakdown

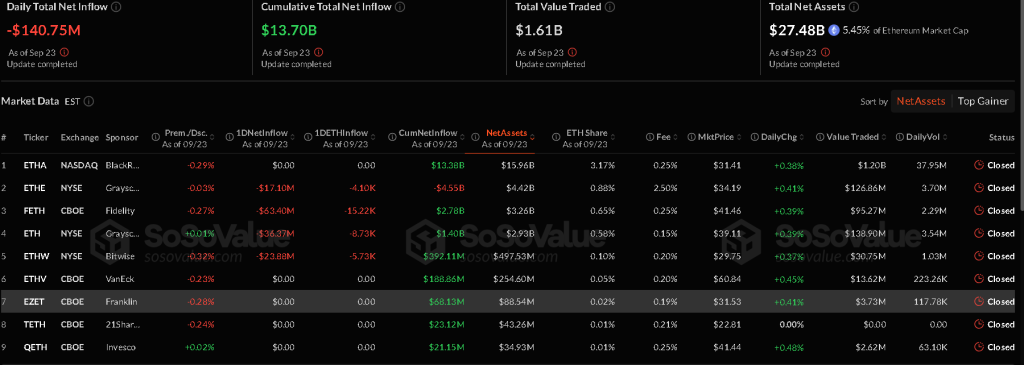

Ethereum ETFs recorded heavier outflows at $140.75 million. Fidelity’s FETH led selling pressure with $63.40 million. Grayscale’s ETH fund withdrew $36.37 million, followed by Bitwise’s ETHW at $23.88 million and Grayscale’s ETHE at $17.10 million.

None of the nine Ethereum ETFs reported inflows. Total trading volume dropped to $1.61 billion, while net assets fell to $27.48 billion, equal to 5.45% of Ethereum’s market cap.

Source: SoSoValue

Market Context

Bitcoin is trading at around $112,348, signalling a 3.4% drop compared to a week ago. Its market cap is also experiencing a dip, and fell to $2.238 trillion today, along with its daily trading volume, which descended to $48.874 billion.

Ethereum is priced at around $4,155.29, with a market cap of $502.099 billion. Its trading volume marked a sharp decrease of $38.585 billion, reflecting a slow market sentiment.

Despite dominating the crypto market, both bitcoin and Ethereum are showing negative momentum in ETF flows and trading activity. Analysts expect Ethereum to face short-term bearish pressure through late September, while Bitcoin is forecast to stabilize in the $112,000–$119,000 range.

This downturn has led market watchers to label the current pullback “Red September 2025.”