0G Explodes 75% on Supply Squeeze - Is ATH Next?

Supply walls crumble as 0G rockets past resistance levels.

Scarcity Engine Ignites

Traders scramble for position as circulating supply constraints trigger classic supply-demand imbalance. The 75% surge signals institutional accumulation patterns emerging beneath retail frenzy.

Technical Breakout Territory

Chart formations suggest momentum traders are overriding resistance levels that capped previous rallies. Volume profiles indicate sustained buying pressure rather than pump-and-dump volatility.

Market Psychology Shift

The move challenges bearish narratives that dominated recent quarters. Short positions evaporate as FOMO dynamics override traditional technical indicators.

Just wait for Wall Street to 'discover' this innovation right after their fifth coffee meeting about blockchain.

This isn't just a pump—it's a fundamental recalibration of tokenomics meeting market timing. The question isn't if new highs come, but how fast they arrive.

0G, the native token of AI-focused LAYER 1 blockchain 0G, has seen a meteoric rise in recent days. Built by 0G Labs, the project aims to bring decentralized AI on-chain through its modular setup that includes DeAIOS, the 0G Chain, and 0G Storage. With a total supply of 1 billion tokens, the token was recently launched on major exchanges and participated in the BingX Listing Carnival, offering rewards worth up to $110,000.

Why is 0G Price Up Today?

Three factors explain this explosive move:

Binance’s September 21 listing created turbulence, but with only 2 million tokens (0.2% of supply) distributed to BNB holders and withdrawals disabled, circulating liquidity was heavily restricted. This limited supply fueled a 20% rebound within minutes of the listing, aided by Trading Bots and short squeezes. The next test lies in withdrawal activations—once liquidity increases, the $5.60 support could come under pressure.

Institutional interest added fuel to the rally. FLGC’s $3.66 billion ZeroStack initiative involved purchasing 0G tokens at $3 each, 48% below current levels, anchoring a strong valuation base. In parallel, a collaboration with China Mobile to develop AI training nodes strengthens 0G’s utility narrative and reduces near-term selling pressure, as institutional allocations remain locked.

Bitget’s September 22 Launchpool allows staking BGB and USDT to farm 0G, while HAiO’s upcoming iNFT music platform (launching September 26) could expand real-world adoption. While staking helps support demand, the 13% community reward allocation (130M tokens) raises dilution concerns. Still, long-term ecosystem expansion may offset short-term volatility.

0G Price Analysis

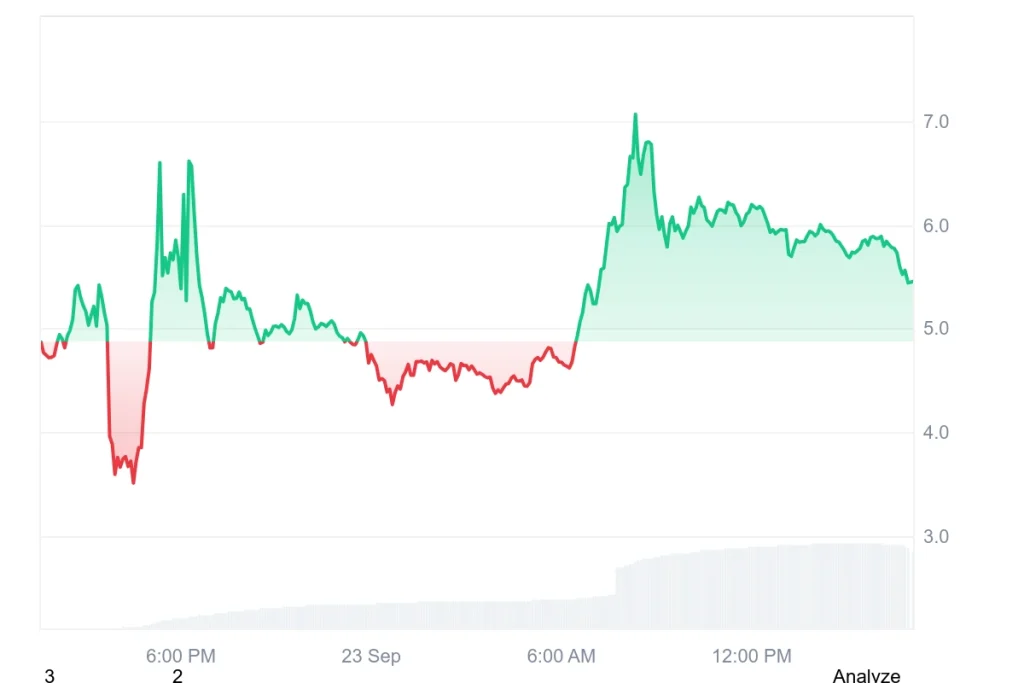

In the last 24 hours, 0G set both its all-time high of $7.31 and all-time low of $3.33, underscoring its extreme volatility. The surge has drawn massive attention, with 0G now trading at $5.87, marking a 75% daily gain and nearly 20% weekly growth.

Its market cap sits at $1.25 billion, while trading volume skyrocketed over 4000% to $3.33 billion in just 24 hours. The price is now consolidating NEAR $5.87, with key support at $5.60 and resistance at $6.10.

Conclusion:

0G’s rally reflects a perfect storm of exchange tactics, strategic partnerships, and ecosystem growth. However, with institutions buying in at much lower prices and community token unlocks ahead, volatility remains high. The key question now: will HAiO’s September 26 launch spark sustained developer activity, or will profit-taking from airdrop unlocks weigh down momentum?

FAQs

Why did 0G’s price surge so quickly?The surge was driven by Binance’s restricted listing, institutional purchases, and strong AI-focused partnerships.

What are 0G’s key support and resistance levels?Support sits near $5.60, while resistance is seen at $6.10.

What should investors watch next?The HAiO iNFT launch on September 26 and token unlocks from community rewards could shape short-term price action.