HB1812 Crypto Bill Shocker: Waxman’s Move to Ban Officials from Profiting Sparks Debate

Lawmakers target government insiders with new crypto trading restrictions—just as digital assets hit mainstream adoption.

The Accountability Push

Representative Waxman's HB1812 legislation aims to slam the door on officials using non-public information for crypto gains. No more trading ahead of policy announcements or regulatory decisions. The bill mandates full disclosure of digital asset holdings and imposes cooling-off periods before officials can trade after leaving government service.

Market Implications

This crackdown comes as institutional crypto investment surges—because nothing says 'legitimate asset class' like needing laws to prevent insiders from front-running the entire market. The proposal would apply to all elected officials, appointed regulators, and senior agency staff with access to sensitive financial policy information.

Enforcement Mechanisms

The bill empowers watchdog agencies to monitor compliance through blockchain analytics tools. Violators face severe penalties including disgorgement of profits, fines up to triple the gains, and potential imprisonment—finally treating insider trading with the seriousness it deserves, whether it happens on Wall Street or in the DeFi space.

Washington's trying to clean up crypto trading—just as everyone realizes the real insider advantage was always in traditional finance anyway.

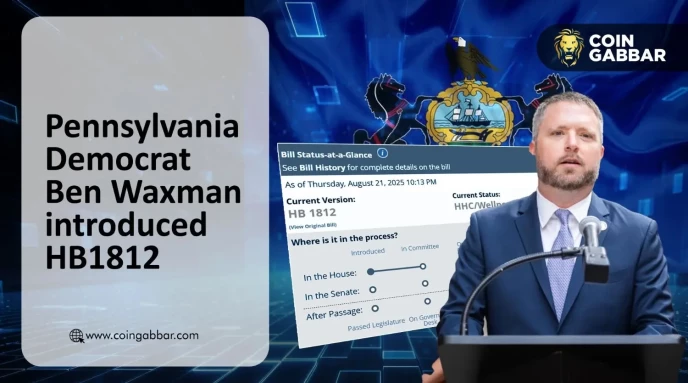

Pennsylvania Representative Ben Waxman, Democrat from district 182 has introduced a new bill which is aimed at stopping elected officials from making money through cryptocurrency while in office. Read More

Pennsylvania Representative Ben Waxman, Democrat from district 182 has introduced a new bill which is aimed at stopping elected officials from making money through cryptocurrency while in office. Read More