Ethereum 2026 Price Prediction: Key Catalysts That Could Define Its Trajectory

Ethereum's 2026 valuation hinges on a handful of critical, high-stakes developments. Forget the vague hype—specific technical and adoption milestones will either propel it to new heights or expose its limitations.

The Merge's Long Shadow

Proof-of-stake was just the opening act. The real test is whether the significantly reduced energy footprint and tentative issuance cuts translate into sustained institutional inflows. Are ESG funds buying the narrative, or is it still crypto-native capital chasing the same loops?

Layer 2 Scaling Showdown

Ethereum doesn't just need scaling—it needs scaling that doesn't fragment liquidity or compromise security. The battle between Rollups and Validiums isn't academic; it's a fight for the chain's very utility. Can it handle mainstream application throughput without becoming a costly settlement layer for other networks?

Regulatory Sword of Damocles

Smart contract platforms are in the crosshairs. A hostile regulatory clampdown on staking or dApp operation in major economies could freeze development overnight. Conversely, clear frameworks might unlock the trillion-dollar traditional finance pipelines—every Wall Street desk is running the numbers, just in case.

The Application That Breaks the Internet

NFTs and DeFi were the first waves. The 2026 question is: what's the third? A killer app for decentralized social media, gaming, or enterprise DAOs that actually works at scale could drive demand for block space—and ETH—into uncharted territory. No app, no problem—just ask the 'stablecoin settlement layer' advocates, a narrative about as exciting as watching legacy banking infrastructure.

Macro Tides and Crypto Winters

Never forget the Fed. Interest rates and global liquidity conditions remain the invisible hand guiding all risk assets, crypto included. Another macro downturn could stifle momentum, no matter how perfect the tech roadmap. Bull markets make geniuses out of everyone—until the tide goes out and we see who's been swimming naked with over-leveraged positions.

The path to 2026 isn't about moon math or blind faith. It's a gauntlet of execution, adoption, and survival. Ethereum either navigates it and solidifies its position as digital infrastructure, or stumbles and gets overtaken by nimbler, hungrier protocols. The code, as they say, doesn't lie—but the market often does, especially to portfolio managers collecting fees on both the hype and the crash.

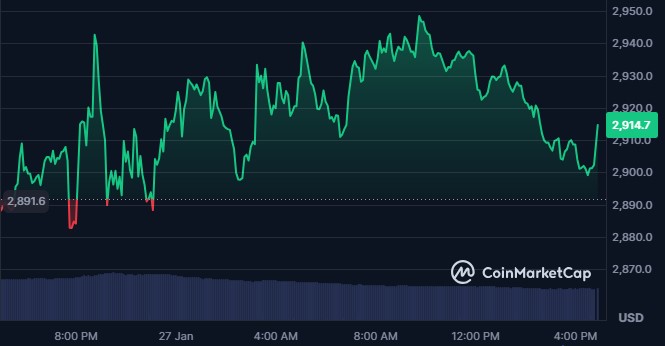

Prices are moving, big players are active, and upgrades are coming, but still the digital asset is struggling to gain momentum above the $3,000 mark.

Entering the 2026 after the October crash, Ethereum has been hovering just below this level, teasing a breakout but never fully committing. Traders, however, are still watching $3,000 as a key level as it often decides the token's next big move, but is it really worth watching in the recent price scenarios?

Why is the $3,000 Mark Considered Important?

Ethereum’s past explains why this level feels so significant.

May 2021: ETH broke above $3,000 for the first time and later surged to nearly $4,878, its all-time high.

Mid-2025: ETH again crossed $3,000 after months of consolidation between $2,400–$2,800.

Looking at this suggests how $3K level often pushes traders confidence back in the asset.

But the recent trends have changed. During the Fusaka upgrade HYPE in December 2025, ETH briefly moved above $3,100 but failed to hold. Since then, ETH has crossed $3,000 multiple times, only to fall back quickly. Each failure has led to noticeable pullbacks, making traders extra cautious. This has turned $3,000 into a battle zone, not a celebration point.

Main Reasons Behind: Broader Crypto Shocks or Bitcoin Influence

After the October 2025 crypto market crash, the series of continuous ups and downs are following the crypto market and its major assets, including Bitcoin, BNB, Solana.

Adding on, back-to-back shocks from geopolitical tensions like war situations, sanctions, tariffs put heavy pressure on the market and the traders, surpassing the positive impact that comes from the new crypto regulations from many regions.

Many market watchers are attributing Ethereum’s struggle to Bitcoin’s performance also. bitcoin is seen as a major indicator for the market’s mood. Altcoins often surge as Bitcoin rises; however, for now, the golden asset itself is struggling to hold above $1,00,000, after 2025 ATH and the following downtrend.

The ETH/BTC ratio is near multi-year lows, suggesting ETH is waiting for Bitcoin to either break out or calm down. In simple terms, if Bitcoin breathes easy, Ether gets room to run.

Can It Come Back, or How Long Will It Take?

Ethereum can still make a comeback, but not overnight. For a strong recovery, the digital asset needs:

A clean break and hold above $3,000–$3,100

Support from ETF inflows instead of outflows, as it recently recorded $611 million in weekly outflows.

Large institutions are also helping in its long-term breakout as they quietly build confidence.

One major signal came when BitMine staked over 209,000 ETH worth $610 million, locking those coins instead of selling them. On top of that, whale wallets have been accumulating more coins, tightening the available supply in the market.

Ethereum is also proving its real-world usefulness. A gold ETF from Hang Seng was tokenized on ether, highlighting its role as a settlement layer, not just a trading asset. This kind of adoption keeps long-term believers interested, even during slow price periods.

If these align, history suggests the token could see 15%–20% upside after confirmation. Without them, ETH may stay stuck between $2,600 and $3,000 for weeks or even months.

So…Is Ethereum Still Worth It?

Ethereum in 2026 is not in trouble, but it’s not in a hurry either. Macro pressure, ETF outflows, and Bitcoin’s dominance are keeping ETH stuck in a tight range for now but the token has proved itself in a long run where it started with around $0.42.

Strong fundamentals, upcoming upgrades, and heavy staking are still paving the way for growth but it needs a long-term belief.

This content is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile, and readers should conduct their own research before making any investment decisions.