Tether Dominates 2025: The Unstoppable Revenue Juggernaut of Crypto

Forget the flashy altcoins—the real money machine in crypto just posted another record year. Tether, the controversial stablecoin giant, has cemented its position as the undisputed heavyweight champion of blockchain revenue generation for 2025.

The Engine Room of Crypto

While traders chase the next 100x moonshot, Tether's USDT quietly powers the entire ecosystem. Its revenue doesn't come from speculative token pumps, but from the bedrock of digital finance: liquidity. Every transaction, every trade, every cross-border settlement that uses USDT adds another brick to its financial fortress. It's the toll booth on the highway of decentralized finance, and traffic has never been heavier.

A Masterclass in Market Positioning

Tether's strategy is brutally simple—be everywhere. It dominates trading pairs on centralized and decentralized exchanges alike, serving as the primary on-ramp and off-ramp for billions in capital. This ubiquity creates a powerful network effect that competitors struggle to crack. Why switch stablecoins when everyone else is already using USDT? It's the VHS of digital dollars.

The Cynical Take

Let's be real—traditional finance executives are probably staring at these numbers with a mixture of horror and envy. While they navigate regulatory mazes and quarterly earnings calls, a company built on a digital dollar they once dismissed as a fad is printing money with the efficiency of a central bank. The irony is almost too rich.

Love it or hate it, Tether's financial dominance forces a reckoning. It proves that in the new financial landscape, the biggest profits might not come from the most innovative technology, but from providing the most essential utility. The market has voted with its wallets—and for now, it's all in on green.

This highlights how stablecoins, especially USDT, continue to generate strong income during both bull and uncertain market phases.

Crypto Revenue Share Shows Stablecoins Winning

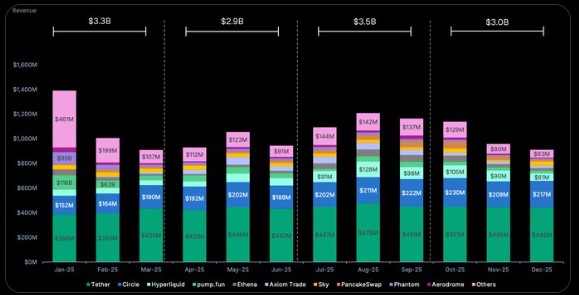

In 2025, stablecoin issuers Tether-Circle together earned over $7 billion, while DeFi innovators such as Hyperliquid ($1.4B) and Ethena ($1.2B) ranked lower in the cryptocurrency revenue ranking. Trading platforms like Pumpfun ($1.2B) and PancakeSwap ($910M) also performed well but were far behind USDT-issuer in total earnings share.

This represents how liquidity tools are now more profitable than many DeFi and trading narratives.

How Tether Crypto Revenue Is Generated

Unlike many crypto projects that depend on token speculation, Tether's digital asset revenue comes from scale and real-world financial mechanics. When users hold and transfer USDT, Tether invest the backing reserves into safe, yield-generating assets like U.S. Treasuries and cash equivalents.

The profits from these yields are excess income, not customer funds. In 2025, this structure allowed the USDT operator to build a strong buffer while providing liquidity across digital asset markets.

Gold Strengthened Tethers' Crypto Revenue

A major factor behind the strength of the stablecoin leader crypto revenue in 2025 was its growing exposure to gold. In Q4 2025, the network added 27 metric tons of the precious metal, lifting total holdings to roughly $4.4 billion. This followed another 26-ton purchase in Q3, placing the USDT-operator among the world’s largest non-government gold buyers.

Gold represents roughly 7% of Tether’s consolidated reserves, while the rest is largely held in the U.S. Treasuries (70–80%), plus smaller amounts in bitcoin and cash equivalents. About 12 tons are allocated to XAUT, its tokenized gold-product, while the remainder strengthens the company’s overall reserve base.

How Gold Strengthens The Portfolio

Gold’s role in the portfolio is twofold. First, it acts as a hedge against inflation, currency devaluation, and geopolitical uncertainty, providing a SAFE store of value.

Second, with gold prices reaching record highs above $5,000 per ounce in 2025, the value of Tether’s holdings increased significantly, boosting both reserve strength and market confidence in USDT.

This combination of digital scale through USDT and physical asset backing through the precious metal makes it unique. It stabilizes the peg of USDT, enhances investor trust, and helps the stablecoin giant maintain its market-leading position even in turbulent market conditions.

This article is for informational purposes only and does not constitute financial, investment, or legal advice. Readers should conduct their own research and consult qualified professionals before making investment decisions.