Pi App Studio Payments Launch Enters Critical Test Phase - Major Utility Boost for Pi Network Ecosystem

Pi Network just flipped the switch on real-world payments. The Pi App Studio payments launch hits its test phase—and the entire ecosystem holds its breath.

From Digital Promise to Tangible Function

This isn't another speculative token feature. It's the core utility engine roaring to life. Developers inside the Pi App Studio can now integrate payment rails, turning theoretical Pi coin balances into transactional fuel. Every test transaction moves Pi one step further from being 'just another altcoin' to becoming a functioning digital economy.

The Infrastructure Play Everyone Missed

While traders obsess over price charts, the real story is infrastructure. A successful test phase doesn't just validate a feature—it validates the entire Pi Network development stack. It proves the blockchain can handle settlement, the wallets can secure transfers, and the community can actually use what it's been mining. This is the boring, essential plumbing that makes or breaks a cryptocurrency's long-term survival.

Why This Test Phase Matters More Than Any ATH

Forget short-term pumps. A functional payment system creates inherent, non-speculative demand. It turns Pi from an asset you hope to sell into a tool you can use. This builds utility-driven value that's far more resilient than hype-driven volatility. It's the difference between building a casino and building a marketplace.

The Cynic's Corner: A Necessary Jab

Let's be real—the crypto space is littered with 'game-changing' test phases that vanished into the void. Success here requires more than just technical execution; it needs merchant adoption, user education, and a frictionless experience that rivals, you know, actual money. Otherwise, it's just a very complicated way to buy digital stickers.

The Bottom Line

This test phase is Pi Network's proving ground. If it works, it unlocks a new utility layer that could finally justify its massive user base. If it stumbles, it becomes another cautionary tale in the long crypto saga of promise versus delivery. The network's future utility—and perhaps its credibility—is now on the line with every test transaction.

Source: X (formerly Twitter)

Why this In-App Payment Integration Matter?

It will directly strengthen Network's utility. Until now, it had very limited real usage cases.

This makes this integration much more powerful. Apps can now include:

Digital purchases

Game items

Services

Subscriptions

Pi in-app payments change the platform from a passive asset into an active payment tool. As more apps adopt payment integration, real demand for it can start to grow.

Developer Support Expands in 2026

Earlier updates already showed Pi Network direction. On January 10, it released a library that lets developers integrate payments in under ten minutes. On January 22, they announced a creator event where 1,000 users WOULD receive 5 credits for building in App Studio.

build → test → integrate payments → deploy.

This is how ecosystems grow. Developers create value, users spend this token, and demand becomes organic.

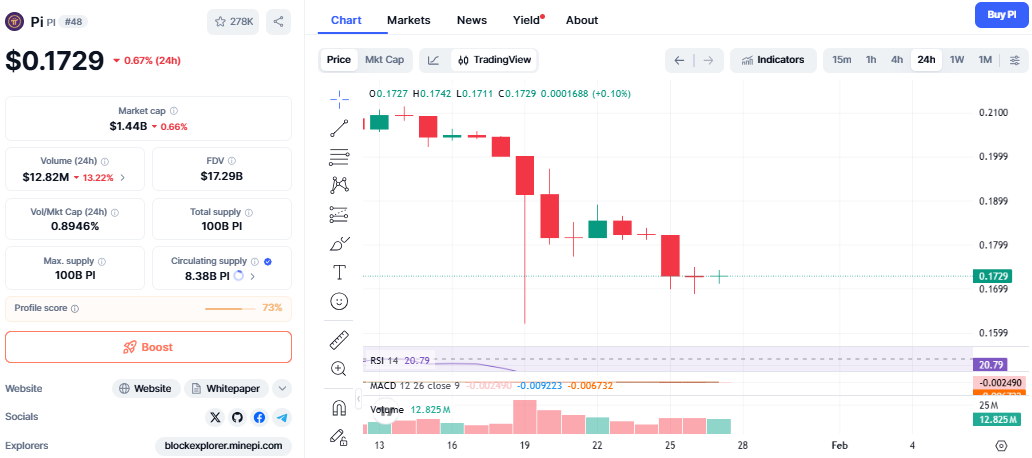

Pi Coin Price Today Shows Heavy Pressure

It is around $0.1729. The chart shows strong bearish pressure. Market cap stands NEAR $1.44B, and daily volume is falling as per the CoinMarketCap.

Source: CoinMarketCap

RSI around 20.79, which signals oversold conditions

MACD remains negative, showing bearish momentum

This means it is deeply oversold, but a trend reversal is not confirmed yet. Buyers remain cautious because of upcoming token unlocks.

Token Unlocks Remain a Major Risk

Nearly 150 million tokens will unlock in the next 30 days. That is around 5 million tokens per day. On February 7, the unlock peak reached about 6.1 million PI.

This creates constant selling pressure. Without strong demand from App Studio Payments or real utility growth, price recovery becomes difficult. This is why its price prediction remains cautious in the short term.

Can Utility Balance Supply Pressure?

Pi App Studio Payments may become the answer. If developers start using in-app payments widely, demand can slowly absorb unlocked supply.

Utility is the only long-term solution. Speculation alone cannot support price. The App Studio makes network utility real, measurable, and scalable.

What If Binance Listing Comes in 2026?

Right now, it mainly trades on: OKX, Bitget, Gate, MEXC, BitMart, and XT.com

There is no official Pi Binance listing yet. But many believe that once it launches the Open Network and proves real utility through this update, a Binance listing in 2026 becomes possible.

Increase liquidity

Add global exposure

Improve trust

But without an open mainnet and working payments, such a listing remains unlikely.

What’s Next For the Price?

Pi Coin Price Prediction

It is in a strong oversold zone with RSI near 20, showing selling pressure may be slowing, but MACD is still bearish. In the short term, price is likely to MOVE sideways between $0.16 and $0.18.

If support at $0.165 breaks, it could drop toward $0.15. For any recovery, the price must break and hold above $0.185. A strong move above $0.20 would signal a trend change.