Interlink Labs: Mainnet & Mini-App Launch in Q1, Exchange Listing Targeted for Q2

Interlink Labs is gearing up for a pivotal first half of 2026, with a dual-phase rollout that could shake up the modular blockchain space. The project's roadmap puts key infrastructure live in the coming months, setting the stage for a major liquidity event.

Phase One: Core Infrastructure Goes Live

First on the docket is the Mainnet launch, scheduled for Q1. This isn't just another chain going live—it's the foundational layer for Interlink's entire ecosystem. Launching in the same quarter is the project's Mini-App, a user-facing portal designed to demonstrate practical utility and onboard early adopters directly onto the new network. The back-to-back releases suggest a coordinated strategy: build the highway, then immediately put cars on it.

Phase Two: The Market Makes Its Call

The big question for traders and speculators—when does it hit the exchanges? The target is Q2. This timeline gives the project roughly a quarter to prove its Mainnet's stability and the Mini-App's traction before facing the ultimate stress test: the open market. It's a calculated move, betting that demonstrable usage will be a stronger price catalyst than pure hype. After all, nothing makes a tokenomics model look better than actual users—or so the theory goes.

If the team executes, Q2 could transition Interlink Labs from a promising protocol to a traded asset. Of course, in crypto, a 'target date' is often just a sophisticated guess before the inevitable 'strategic reassessment.' Get the infrastructure right first; the trading frenzy—and the subsequent VC unlock dump—will follow soon enough.

Why Q1 2026 Is the Foundation for the Interlink Labs Listing Date

Q1 2026 is centered on the private mainnet. This is not a test chain. It is a payment-ready Layer-1 designed for speed and high transaction throughput, with a first goal of 10,000 payment points. That means the chain is being prepared for real usage, not just experiments, the team shared the details over X (formerly Twitter).

At the same time, the mini app expands the free-mining model into a full super app. Users earn value by being verified humans, not by buying hardware or staking capital. Facial scanning and liveness checks protect the system from bots and fake accounts. This makes the Interlink Network launch date more important than a normal blockchain release. It introduces proof of personhood as the Core of the economy.

Private launch plus human verification equals real token demand. Without these, the Interlink Labs listing date WOULD remain speculative.

Tokenomics Strength That Supports a Post Listing

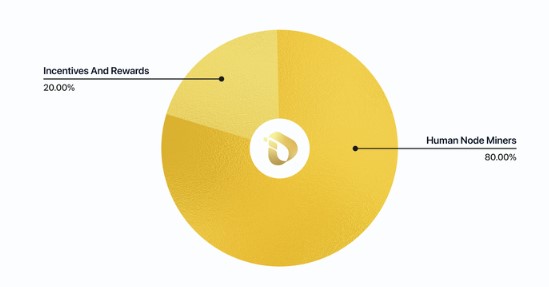

Interlink Network tokenomics are built around activity, not speculation. The total supply of ITLG is capped at 100 billion tokens. Eighty percent is reserved for human node miners, meaning verified users who stay active. Only twenty percent goes to ecosystem growth, development, and partnerships.

There is no venture capital dominance and no early insider unlock pressure. Emissions expand and contract based on real human participation. Inactive and unverified balances can be burned or redistributed, which adds a natural deflation effect.

The dual-token system adds depth. ITLG is the participation token. ITL is the reserve token with a total supply of 10 billion. Half of ITL is earned through staking verified ITLG. Treasury companies buy ITL through OTC markets, not from the CORE team. That creates external demand without inflating supply.

Mini App, Mainnet, Then Exchanges: The Q2 2026 Window

The Interlink Network mainnet launch date in Q1 sets the stage for exchange exposure in Q2 2026. The token listing on major exchanges is expected around May-June 2026. However, the team hasn’t made any confirmation on this yet.

Mini apps bring real user activity. The private mainnet proves payment throughput. Human verification proves uniqueness. Once these systems are stable, major exchanges have a stronger reason to list the token.

The roadmap also points toward U.S. market ambitions, including future NYSE-related expansion. That is why analysts expect the Interlink Labs launch date for trading markets to follow, not precede, the mainnet.

Conclusion

The Interlink Labs listing date depends on execution, not hype. With the mini app and private mainnet launching in Quarter 1 2026, the project builds real demand before opening public markets. A Q2 2026 exchange listing appears logical, structured, and aligned with sustainable token growth and verified human participation.

This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile. It is always essential to do your own research before making any investment.