Circle’s Solana Gateway Ignites USDC Cross-Chain Liquidity Revolution

Circle just flipped the switch on its Solana Gateway—and the entire cross-chain liquidity landscape just got a whole lot simpler. No more fragmented pools or clunky bridges slowing down the world's second-largest stablecoin.

The Seamless Swap

This isn't just another bridge. It's a direct liquidity pipeline. USDC moves between chains now with institutional-grade speed and security, cutting out the middleman and the associated risks. Developers can finally build cross-chain applications without the usual friction—think instant settlements and unified liquidity pools that actually work.

Why Solana? Speed Meets Scale

Solana's throughput is the perfect engine for this. The Gateway leverages its high-speed, low-cost infrastructure to make cross-chain transfers feel native. It's a strategic power move, positioning USDC at the heart of the fastest-growing ecosystems and giving Ethereum a run for its money—literally.

A New Era for Digital Dollars

This launch signals a major shift. Liquidity is no longer siloed. For traders, it means better prices and faster arbitrage. For institutions, it's a compliant on-ramp into decentralized finance. And for the crypto space? It's a giant leap towards the interoperable future we've been promised, while quietly showing the traditional finance world how slow their legacy systems really are.

The bottom line: Cross-chain is now the default. The walls between blockchains are crumbling, and the flood of liquidity is just beginning. Watch where it flows next.

The market is already voting "yes" on this move. Following the news, Solana’s price staged a sharp recovery to $131, a signal that could launch SOL toward the $150–$185 range.

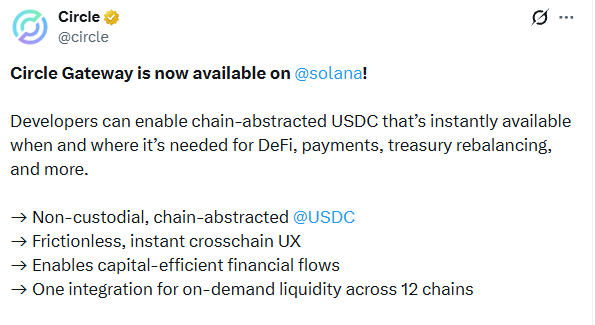

What Actually is Circle Gateway Solana?

Think of it as a "Universal Wallet." Usually, if you have USDC on Ethereum, it’s stuck there. To use it on the network, you’d have to bridge it.

With the Circle Gateway solana launch, you now have a unified USDC balance. You deposit your USDC into a non-custodial contract, and it becomes "chain-abstracted." This means you can spend that USDC on any of the 12 supported chains (like Arbitrum, Base, or Avalanche) instantly. No waiting for confirmations, no third-party bridge risks, and most importantly no more headaches.

The Company has made this entirely non-custodial. You are still the only one who holds the keys. If you want your money back, you sign a "burn intent," and the system mints your asset exactly where you need it. It’s fast, it’s secure, and it’s how crypto was always supposed to work.

Why Solana is the New "Wall Street" of Crypto

The timing of this launch is perfect. Solana is already a beast when it comes to stablecoins, having processed over $1 trillion in USDC transactions last year alone. But the network is evolving.

Alongside the Circle news, Ondo Finance has just expanded its tokenized stock platform on the network. We aren’t just talking about a few niche assets; they’ve activated over 200 tokenized stocks and ETFs. You can now trade real-world equities with the same speed you’d trade a memecoin. According to TokenTerminal, the network is already hosting over $1.5 billion in tokenized assets, proving that big institutions are finally moving their capital onto the chain.

The Technical Play: Is the SOL Rally Just Starting?

For the traders out there, the charts are looking interesting. After dipping to $124, SOL has bounced back to $131.

If the momentum from the Circle Gateway launch continues, analysts expect a retest of the $150 resistance level. A clean break above that could trigger a run to $185, which lines up with the 50% Fibonacci retracement.