Gold Price Soars as Trump Tariff Shock Sparks Market Chaos - What It Means for Your Portfolio

Gold just caught a massive bid. Market uncertainty? Check. Political shockwaves? Double-check. Investors are scrambling for cover as traditional assets wobble—and the yellow metal's traditional 'safe haven' narrative gets another moment in the sun.

The Flight-to-Safety Playbook, Rewritten

Every time headlines scream volatility, the old guard reaches for the same script. Gold surges, analysts nod sagely about 'store of value,' and capital floods into a physical asset that, let's be honest, mostly just sits there. It's a predictable dance of fear and shiny objects.

Beyond the Glitter: A Digital Perspective

While gold gets its traditional bounce, a parallel narrative is unfolding. These moments of institutional doubt don't just highlight gold's appeal—they underscore the very vulnerabilities decentralized assets were built to bypass. Think about it: geopolitical risk, monetary policy shocks, and centralized control are the exact friction points crypto aims to eliminate.

The Real Signal in the Noise

The spike isn't really about gold. It's a flashing indicator of systemic anxiety. When trust in political and monetary stability erodes, the search for true, uncorrelated value intensifies. That search is increasingly leading investors to look beyond vaults and toward verifiable, programmable scarcity on a blockchain.

So, gold shines today. But the smart money is watching where the fear flows next—and it's not all heading to Fort Knox. After all, in modern finance, sometimes the safest haven is the one that doesn't ask for permission. (And doesn't charge you storage fees.)

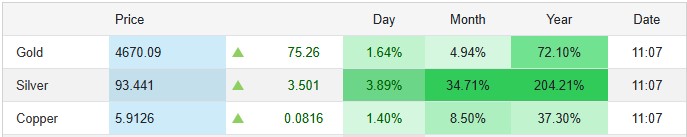

Silver followed gold’s lead, surging above $94 per ounce and posting a 31% gain so far in 2026. Strong demand for silver in solar panels and electronics, combined with a global supply deficit, has added fuel to the rally. Copper, Steel, and Platinum also hold strong.

While precious metals are showing continuous strength, risk assets like stock market and crypto are resting differently, showing comparatively low potential.

So, how this volatility in the market will impact in a longer term. Is it the start of a major rally which generally follows the downturn in the initial phase or hinting towards another crash after the recent one of 2025?

Tariffs War: What’s Causing Fear and Rally at the Same Time

The sharp rise in the gold price followed President Donald Trump’s announcement of new tariffs on European imports. The plan includes a 10% tariff starting February 1 on goods from countries such as Germany, France, the UK, and the Netherlands, rising to 25% by June 1.

The MOVE is linked to Trump’s demand that the U.S. secure purchase rights over Greenland, a move that has alarmed European leaders.

In response, European officials are reportedly preparing an emergency summit and considering up to €93 billion in retaliation. This sudden escalation in trade tensions pushed investors toward safe-haven assets, lifting the gold price sharply while pressuring risk assets.

Traditional And Crypto Markets: Both Are Suffering

Digital Asset and Stock, both markets are heavily dependent on the traders sentiments and geopolitical conditions. New tariffs raise costs for businesses, threaten profits, and increase the risk of a broader trade war, which hurts growth expectations and increases sanctions’ fear.

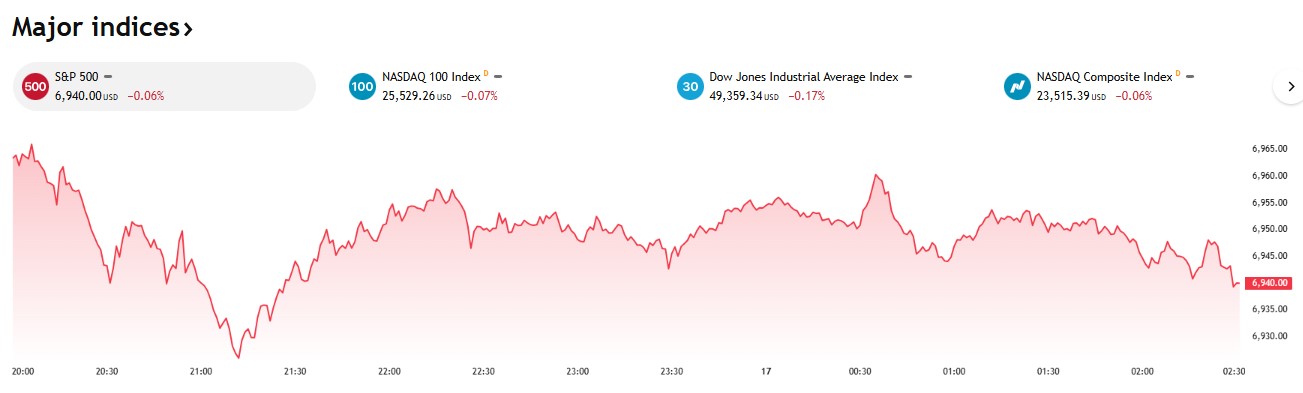

Reacting to this, the U.S. stock futures declined. The S&P 500 dropped 0.7% while Nasdaq 100 fell by 1.1%. Dow Jones also got influenced by the news and traded 0.6% down on the day. All major indicators moved lower on tariff concerns.

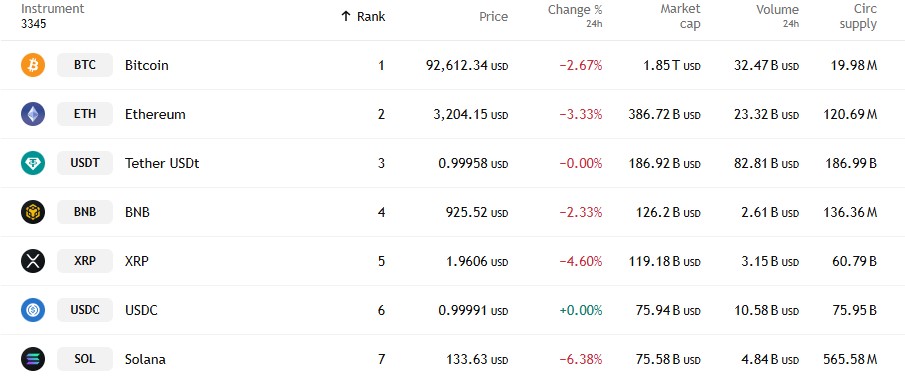

Talking about the cryptocurrency market, it also dropped 2.66% to $3.14 trillion. Bitcoin, which recently started to gain above $96,000, fell to $92,711 (-2.45%). Other major assets like ethereum (-2.96%), BNB (-2.25%), XRP (-4.49%), and Solana (-6.35%), are also triggered sharply.

Over $500 million in Leveraged crypto long positions were liquidated within an hour, as traders reacted to falling equities, low weekend liquidity, and rising geopolitical risks.

On the other, institutional interest in digital assets with ETF inflows remains strong. On-chain data shows large holders continuing to accumulate, suggesting confidence in a rebound.

What’s For Next?

Analysts remain bullish on precious metals, with UBS projecting the gold price could reach $5,000 per ounce if inflation risks persist.

With the fear of tariff war, the weakening of traditional currencies including U.S. dollar, also gathers more uncertainty. In this scenario, possibilities of risky assets to fall further and increasing demand and price in physical metals looks genuine.

However, whatever comes next will be directly bound to sentiments, and market behaviours also changed over the time, so predicting accurate things from here looks difficult, but possible in a NEAR time.