ASTER Token in Freefall: Will the Buyback Program Stop the Bleeding or Is This Another Crypto Mirage?

Another day, another altcoin nosedive. The ASTER token is getting hammered, and the project's response—a buyback program—has the crypto community asking the tough questions.

The Buyback Gambit: Desperate Move or Strategic Masterstroke?

When a token chart looks like a cliff, management's favorite playbook page is the buyback. It's the crypto equivalent of shouting 'I'm fine!' while your portfolio burns. The theory is simple: use treasury funds to scoop up tokens on the open market, reducing supply and—hopefully—propping up the price. In traditional finance, it sometimes works. In crypto? It's often a band-aid on a bullet wound, a temporary confidence trick for bagholders.

Market Mechanics vs. Narrative Warfare

A buyback fights a purely mechanical battle against sell pressure. But crypto runs on vibes. Can a scheduled treasury spend really compete with the gnawing fear of a dead project? It creates a fragile floor, not a foundation. True revival needs more—a killer product update, a major partnership, something that screams 'future' instead of just managing a messy present. Otherwise, it's just rearranging deck chairs.

The Verdict: Watch the Wallet, Not the Words

Forget the press releases. The only due diligence that matters here is on-chain sleuthing. Track the buyback wallet. Is it actually buying, or just sitting there as a PR prop? Is the volume meaningful, or a drop in the ocean of selling? In a sector where 'fundamentals' can mean a viral meme, a buyback is a test of conviction. It either shows a team putting skin in the game to rebuild, or it's another cynical ploy to buy time before the next rug pull. Your call, degens.

Why Did the Aster Price Crash Happen?

The biggest trigger behind the price fall is concern over the sustainability of its buyback model.

The team recently announced that it will now use 20% to 40% of daily platform fees to buy back ASTER tokens. While this sounds positive on paper, many traders fear that the system depends too heavily on trading volume.

If platform activity drops, the buyback strength weakens. On-chain data already shows that fees have fallen sharply in recent weeks. This has made investors nervous about whether it can maintain such an aggressive token burn strategy.

Strategic Buyback Program: Support or Pressure?

The project confirmed that it has started automatic repurchases from its reserve wallet. The goal is to reduce circulating supply and support long-term token value. However, the price fall shows that the market is not fully convinced.

Source: X (formerly Twitter)

Many investors are worried that pushing 40% of fees into buybacks may stress the ecosystem if revenue drops further. Instead of creating confidence, the MOVE has created uncertainty about future liquidity and platform stability.

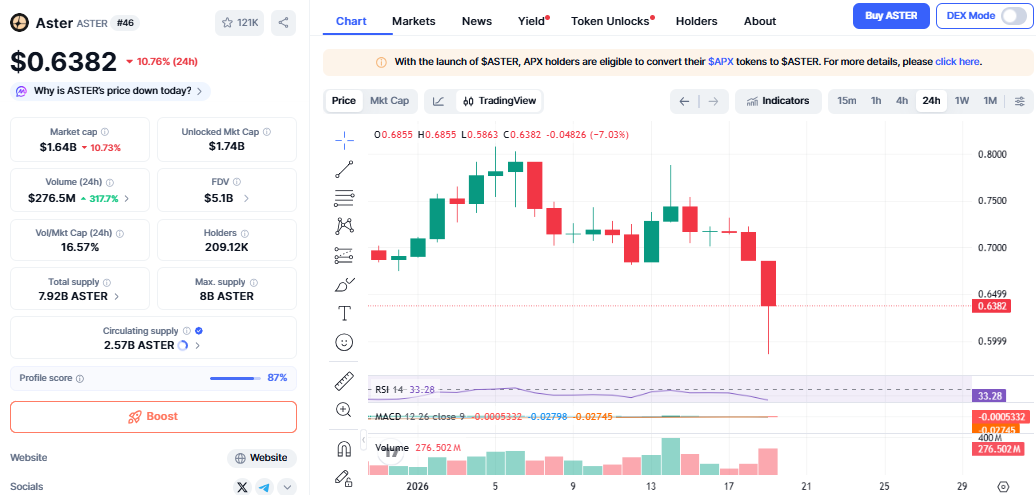

Technical Breakdown Adds to Selling Pressure

The Aster price fall became worse after the coin broke the strong support at $0.72. This level was important. Once it failed, stop-loss orders were triggered rapidly.

The RSI is now near 33, which signals oversold conditions. But oversold does not always mean a bounce is guaranteed. The next important support zone is around $0.66. If this level breaks, it could test deeper levels near $0.60 again.

Source: CoinMarketCap

The price drop is also linked to overall market weakness. bitcoin is facing selling pressure, and altcoins are suffering even more. The Altcoin Season Index has dropped sharply, showing that capital is leaving smaller assets.

Liquidations across the derivatives market have increased, especially in altcoins. When fear rises, traders prefer stable assets or cash. That hurts tokens like this even if they have long-term plans.

Aster Price Today and Price Prediction

It is hovering near $0.63 after touching new lows. The volume spike shows both panic selling and early accumulation attempts.

If it reclaims $0.68, a short relief rally toward $0.72 is possible.

If $0.60 fails, the price drop could extend toward $0.55.

Will the Buyback Program Help Recovery?

The buyback program can help only if trading activity remains strong. Without high volume, the burn mechanism becomes weak. That is why the investors are cautious despite the announcement.

Stable platform revenue

Increasing user engagement with Aster DEX

Broader market strength

A Successful Defense of the $0.60 Price Point

Until then, the price drop continues as a warning sign rather than as a buying signal.

Final Thoughts

While Aster’s buyback programme shows commitment to long-term tokenomics, its heavy reliance on revenue makes investors uneasy.

In weak market conditions, even strong plans fail to support prices immediately. For the coin to recover, confidence must return both to the project and to the crypto market as a whole.

This article is for informational purposes only and not a financial advice, kindly do your own research before making any investment decisions.