Bank of America Warns Stablecoins Could Drain $6 Trillion in Deposits

Stablecoins aren't just a crypto curiosity—they're a direct threat to the traditional banking system's lifeblood.

The Looming Drain

Bank of America's latest analysis paints a stark picture. The report suggests that the quiet, steady growth of dollar-pegged stablecoins could siphon a staggering $6 trillion away from conventional bank deposits. That's not a slow leak; it's a potential structural shift in where capital lives.

Why Banks Should Sweat

It's about utility and yield. Stablecoins operate 24/7, settle in seconds, and are programmable. They bypass the legacy plumbing of ACH transfers and wire fees. For corporations and institutional players moving large sums, the efficiency argument is becoming undeniable. Meanwhile, traditional deposits often sit idle—earning fractions of a percent while banks lend them out for multiples more. A classic case of the middleman getting complacent.

The Real Risk Isn't Collapse—It's Relevance

The warning isn't that stablecoins will implode and take the economy with them. The deeper fear for institutions like Bank of America is obsolescence. If high-quality, regulated stablecoins become the preferred settlement layer for global commerce, banks risk being relegated to costly utilities—overseeing the on-and-off ramps while the real action happens elsewhere on the blockchain. Another finance jab? It's almost poetic watching banks fret about liquidity after decades of optimizing their own balance sheets at everyone else's expense.

The $6 trillion figure isn't a prediction—it's a wake-up call. The race isn't just about digital assets anymore; it's a battle for the foundation of modern finance itself.

Moynihan also said that if deposits start to move into stablecoins, then banks WOULD have to resort to more expensive funding. Though he added that Bank of America would adjust, crypto enthusiasts view the warning as confirmation that stable coins are gaining traction for their higher yields compared to traditional saving accounts’ near-zero interests.

How Yield-Bearing Stablecoins Pose Challenges for Traditional Banks

The fixed value pegged virtual coins work similar as money market funds, maintaining deposits in secure assets in-place of fueling loans. This reduces the banking system’s lending capacity and could affect smaller organizations unequally.

The concern is shared by banking groups lobbying Congress to regulate stablecoin yields under frameworks like the GENIUS Act and proposed CLARITY Act, which restricts direct interest but allows transaction or staking rewards.

Debate Over Yield-Bearing Stablecoins Heating: Industry Vs. Banks

The statement directly ties with the debate over the Digital Asset Market CLARITY Act, which seeks to restrict yields or “rewards” on stablecoin to prevent them from competing with bank deposits. Banks are strongly pushing for these restrictions, however, private players showing great discontent.

Coinbase head Brian Armstrong publicly pulled back its support for the act a few days ago, calling it harmful for stablecoin rewards, DeFi privacy infrastructure, and innovative space. The withdrawal of the nation’s largest crypto trading platform leads to the Senate Banking Committee to delay markup, stalling pro-crypto reforms.

Market experts said that the MOVE favors traditional monetary systems, but strong opposition keeps delays and puts regulations in limbo.

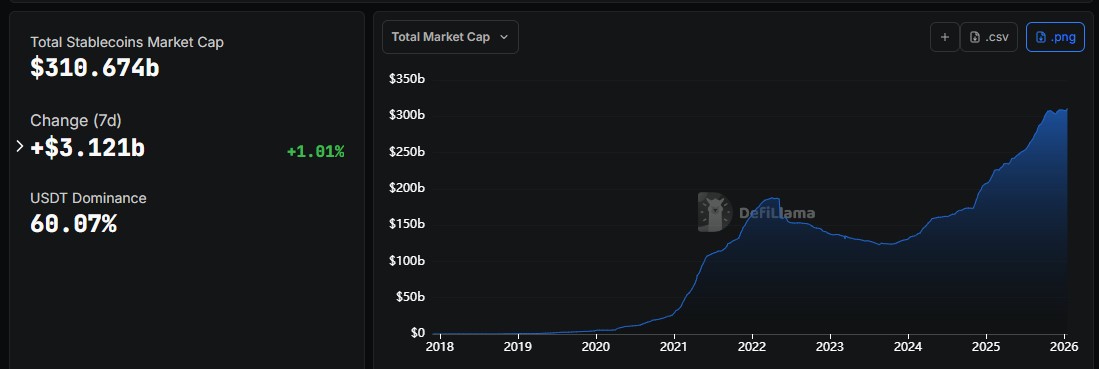

How Important Stablecoin Is? Current Status

Despite being involved in regulatory issues, the crypto market exhibits momentum. The stablecoin facilitate payments as well as cards above $1.5 billion on a monthly basis, and Interactive Brokers provides USDC, RLUSD, and PYUSD as funding options for accounts. The market capitalization of stablecoin is above 310 billion, with 222 million users worldwide.

In the Last

The tug-of-war between banks and crypto innovators also underlines a critical juncture in which stablecoins are revealed to be a true competitor to traditional finance. Yields in their regulation might well end up determining in which capacity these stablecoins are developed.

As for now, this January 2026 provides evidence about rising tensions in the American financial sector, with banks securing their funds, and the value of cryptos being confirmed in the mainstream finance system.

This article is for informational purposes only. It doesn’t consist of any financial advice. Crypto investment carries risk.