Ripple’s Luxembourg EMI License Breakthrough: Unlocking Regulated EU Payments

Ripple just bulldozed another regulatory wall. The Luxembourg EMI license isn't just another piece of paper—it's a skeleton key for the entire EU's payment corridors.

The Single Gateway Play

Forget nation-by-nation approvals. This license operates on passporting rights. Secure it in Luxembourg, and you're cleared for takeoff across 27 member states. RippleNet's infrastructure—the one already moving billions—just got a regulated superhighway. It turns cross-border settlements from a multi-day bureaucratic slog into a near-instantaneous click.

XRP's Institutional Green Light

This is about more than payments. It's about legitimacy. Banks and financial institutions that have been lurking on the sidelines, wary of regulatory gray areas, now have a glaring green light. The license effectively wraps Ripple's digital asset, XRP, in a compliance-approved package for institutional use. Liquidity pools are about to get deeper.

The Old Guard's New Headache

Watch the legacy cross-border systems sweat. SWIFT's multi-day settlement narratives look increasingly archaic. Ripple's move proves a digital asset-native framework can not only match but surpass traditional rails on speed and cost, all while playing by the regulators' rules. It's a masterclass in disruption through compliance.

The Bottom Line

Luxembourg's stamp of approval isn't an endpoint; it's a launchpad. It validates a model where digital assets power real-world finance at scale. For the EU, it signals a competitive, unified digital payments frontier. For the skeptics? It's another case of the future arriving—not with a bang, but with a bureaucrat's stamp. Sometimes, the most revolutionary tool in finance is a pre-approved form.

What the EMI License Means for the Organisation?

The firm gets the legal ability to control and offer electronic money as well as payment services as a regulated business. This means that the firm is able to hold and transfer money for its clients while using blockchain technology in the background.

The firm is now able to:

Provide fully compliant digital payments

Strengthen stablecoins and virtual currencies

Provide service to banks and financial institutions

Europe Is Becoming Ripple’s Key Market

Ripple Secures EMI License approval in Luxembourg just days after getting EMI and crypto registration approval from the UK Financial Conduct Authority (FCA). This shows a clear plan, the organisation is building strong regulatory access in Europe’s most important financial regions.

Source: X (formerly Twitter)

Firm’s UK CEO,Cassie Craddock, said it has been a massive week for Ripple in Europe. She explained that Luxembourg’s progressive regulatory system makes it a great place to grow digital payment infrastructure across the EU.

Ripple’s Growing Global Strength

The Preliminary Electronic Money Institution License approval as part of a much larger picture. The company now holds more than 75 licenses and registrations worldwide. It has already processed over $95 billion in payment volume and reaches about 90% of daily foreign exchange markets.

These numbers show they are not testing ideas. It is building real financial infrastructure that moves real money at scale. Few blockchain companies have reached this level of regulatory compliance.

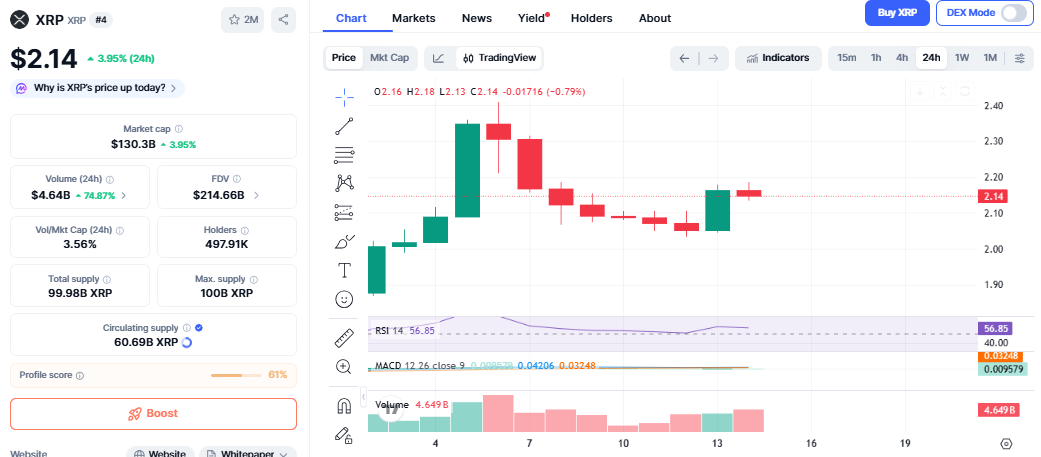

Impact on XRP Price

XRP price today reacted positively after the Ripple news. XRP rose about 3.8% in the last 24 hours, performing better than both bitcoin and Ethereum. Trading volume also increased strongly, showing rising interest.

Source: CoinMarketCap

This MOVE was supported by:

EMI License news

A wider crypto market rally

Cooler US inflation data

Growing belief in institutional crypto adoption

XRP Price Prediction

Electronic Money Institution License approval while XRP is showing strong momentum on charts.

If XRP stays above $2.15, the next target could be NEAR $2.26. Strong volume and positive indicators support this direction.

If the market weakens, XRP may move back toward $2.05 before trying to rise again.

Short-term price movement may change, but Ripple’s regulatory progress supports long-term confidence.

Why Does This Matter?

The organisation secures EMI License approval quietly, but its impact is huge. This is how crypto becomes part of real finance. Not through hype, but through compliance, regulation, and trust.

The firm is now building:

Regulated payment services

Institutional-grade infrastructure

Strong global licensing

A bridge between traditional finance and digital assets

This is why many see XRP as a future bridge asset for global on-chain payments. Ripple is no longer just a blockchain company. It is becoming part of the financial system itself.