Polygon’s Strategic Acquisition Spree Paves Way for Regulated US Payments Dominance

Polygon isn't just building—it's buying its way to the top of the regulated payments food chain.

The blockchain scaling powerhouse has gone on a calculated acquisition binge, snapping up key crypto infrastructure firms to assemble the pieces of a fully compliant US payments platform. This isn't a side project; it's a direct assault on the traditional financial rails.

From Scaling Solution to Financial Contender

Forget just processing cheap transactions. Polygon's endgame is now crystal clear: become the backbone for real-world, dollar-denominated payments. By acquiring firms with existing regulatory licenses and compliance frameworks, Polygon bypasses the innovation-killing slog of starting from scratch. It's a move that cuts years off the timeline and positions them directly against legacy payment processors who are still trying to figure out what a blockchain even is.

The Compliance Moat

The strategy is brutally efficient. Instead of navigating the regulatory labyrinth alone, Polygon is acquiring the map and the keys. Each targeted firm brings a critical piece—a state money transmitter license, expertise in anti-money laundering protocols, or established banking partnerships. Together, they form a regulatory moat that pure-DeFi protocols can't easily cross. It turns regulatory hurdles into a competitive advantage, a classic move that would make any Wall Street veteran nod in grim approval—right before they short a competitor.

Why This Changes Everything

This pivot transforms Polygon from a tech layer into a financial services layer. Developers and businesses won't just get faster transactions; they'll get a plug-and-play system to handle real money, with the legal clarity that has long been crypto's Achilles' heel. It brings the promise of decentralized finance crashing into the regulated world of everyday commerce.

The cynical take? It's the ultimate embrace of the system crypto set out to disrupt. But in the real world, you don't beat the giants by ignoring their rules—you beat them by mastering those rules and then rewriting the game. Polygon isn't just playing the game anymore; it's buying the board and setting the stakes.

Why Polygon Acquires Crypto Firms Now?

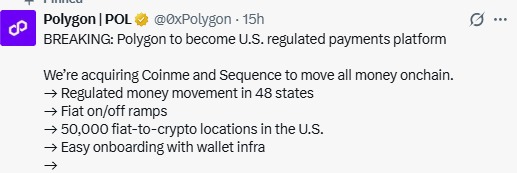

When Polygon acquires crypto firms like Coinme and Sequence, it gains something very powerful: control. Instead of depending on outside companies for wallets, compliance, and on-ramps, it now owns the full pipeline.

Source: X (formerly Twitter)

Coinme gives the firm money-transmitter licenses in 48 U.S. states and access to over 50,000 fiat-to-crypto locations. These include kiosks like Coinstar and retail partners across America. This means users can walk into a store and turn cash into digital currencies legally and easily.

Sequence adds smart wallets and one-click cross-chain transactions. Users no longer need to understand gas fees, bridges, or swaps. Everything happens in the background.

Together, this forms the Open Money Stack.

What Is the Polygon Open Money Stack?

The Polygon Open Money Stack is a complete system for payments. It includes wallets, stablecoins, compliance tools, blockchain rails, and cross-chain movement. When they acquires crypto firms, it fills the missing parts of this system.

Now a business can go from bank account to blockchain settlement using one API. That is huge for banks, fintech companies, remittance platforms, and payout providers.

It is no longer just infrastructure. It is becoming a financial infrastructure.

Polygon Becomes a Regulated Payments Platform

With this move, the organisation acquired crypto firms to become a fully regulated U.S. payments company. It now has:

Money transmitter licenses in 48 states

50,000 retail on-ramp locations

Regulated wallet services

Fiat on/off ramps

Cross-chain payment execution

This is rare for a public blockchain. Usually, only private or permissioned chains take this route. It is doing it while staying open and decentralized.

A Shift From Token Hype to Real Revenue

For years, blockchains depended on token price growth. This step is to build real business revenue. The company plans to earn money from transaction fees and stablecoin movement, targeting over $100 million annually.

This is a big change. They are building income that does not rely on POL price speculation.

With POL already down over 60% from its peak, this strategy helps stabilize the ecosystem.

How This Impacts POL Token Price?

Polygon Price Today shows steady strength. POL ROSE almost 8% in the last 24 hours currently trading around $0.1635.

Source: CoinMarketCap

The reasons are clear:

Regulated payments push

12.5 million POL burned in 2026

Network activity hitting new highs

Technical breakout above $0.164

When the acquisition happens, investors see long-term value, not short-term hype.

If POL stays above $0.16, traders may target $0.185 and then $0.208.

If it falls below $0.155, the price could pull back to $0.131.

The trend remains bullish as long as network usage and burns stay strong.

Final Thoughts

This move is not just buying companies. It is buying the future of regulated blockchain payments. Coinme brings legality. Sequence brings simplicity. The project brings scale.

This is how digital assets becomes real finance.