Dolomite Crypto Explodes: Unpacking the Dolo Token’s Meteoric Rally

Dolomite's DOLO token isn't just climbing—it's rocketing. The surge has traders scrambling and skeptics raising eyebrows. What's fueling this parabolic move in the often-sleepy DeFi corner?

The Protocol Push

Forget vague promises. Dolomite's recent upgrades delivered tangible utility. Enhanced lending mechanics and sharper arbitrage tools are pulling in capital that's hungry for real yield, not just speculative vapor. The platform finally gives sophisticated traders a reason to stick around.

Market Mechanics at Play

Low float, high conviction. A concentrated supply in the hands of long-term believers creates a powder keg—any positive catalyst ignites a fierce short squeeze. Combine that with a wave of fresh listings on key decentralized exchanges, and you've got a classic liquidity crunch driving prices north.

The Narrative is Half the Battle

In crypto, perception often precedes reality. A well-timed marketing push framing Dolomite as the 'sophisticated trader's haven' hit a nerve. It tapped into fatigue with over-simplified DeFi 1.0 products, promising—and initially delivering—a more nuanced set of financial levers.

Caution Beyond the Hype

Let's be real—every rally in this space wears two faces. The same volatility that creates millionaires can wipe out positions in a heartbeat. While the fundamentals show promise, remember that half of Wall Street's 'financial innovation' was just repackaged risk, and crypto isn't immune to that old trick. The true test for DOLO isn't this week's chart; it's whether the protocol can build sustainable value when the hype traders cash out and move to the next shiny thing.

Dolomite Crypto Price Surge Fueled by WLFI Lending Platform

World Liberty Financial announced its first DeFi product called World Liberty Markets launch.This platform is built on Dolomite and allows users to lend and borrow using USD1, ETH, USDC, USDT, and other assets. USD1 is WLFI’s own stablecoin, and it already has more than $3.4 billion in circulation.

Source: X (formerly Twitter)

It means Dolomite is now the backbone of a growing DeFi system. More users on WLFI means more activity on this project. That creates direct demand for DOLO tokens. This is the main reason behind the Dolomite crypto price surge.

Also, because WLFI is linked to the TRUMP family, it has attracted massive attention. That alone brings traders and speculators into the market.

Trading Volume Confirms Strong Market Participation

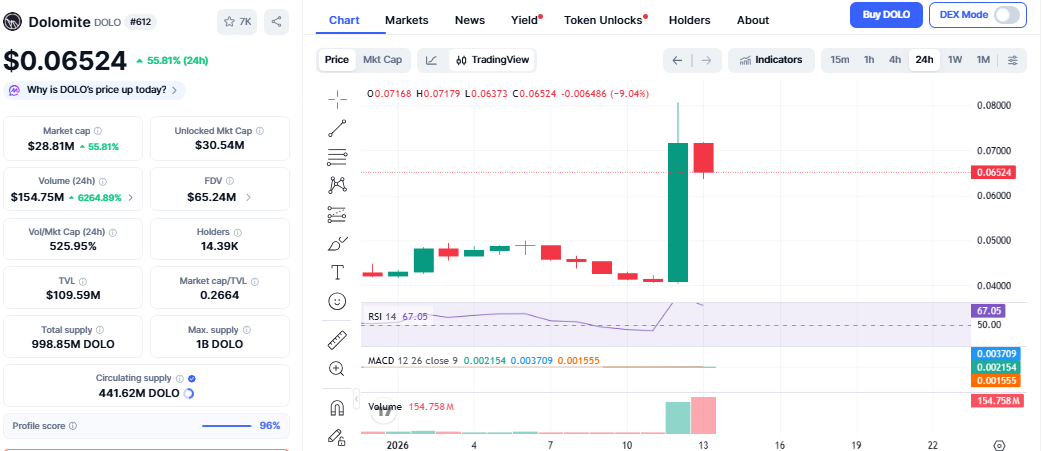

One strong sign that the DOLO crypto price surge is real is trading volume. As per the CoinMarketCap, in just 24 hours, DOLO’s volume jumped by more than 6,000% and crossed $150 million. That means many buyers entered the market, not just a few whales.

Source: CoinMarketCap

RSI has broken through the 80 level, which indicates that the token has become overbought. The prices are changing at a rapid pace and can stabilize soon.

Being overbought can have multiple meanings, and it does not always lead to a crash.

MACD signals are still positive, which suggests buyers are in control for now.

USD1 Stablecoin Gives Long-Term Strength

USD1 is not just another stablecoin. WLFI plans to take it toward a regulated banking model through a U.S. trust charter. If that happens, USD1 could become a bridge between traditional finance and DeFi.

Compared to many DeFi projects, it now has a strong partner with political and regulatory reach.

Key Price Levels That Matter Next?

Looking at the Dolomite price prediction, DOLO must remain above $0.068. If this level becomes support, a possible target could be approximately $0.080.

If it goes below $0.055, there are traders who might begin to book profits. This leads to a slight fall. It only indicates that the rally gets slowed down.

Right now, both outcomes are possible.

Real platform launch

Strong trading volume

Growing USD1 adoption

Long-term regulatory vision

RSI is overbought

USD1 lending yields are still low

Liquidity is thin

Early traders may book profits

So a small pullback WOULD be normal. But as long as WLFI activity grows, the DOLO price rally has a solid base.

Final Thoughts

This is different from normal HYPE pumps. It is backed by product launch, adoption, and big-name involvement. Short-term dips may come, but if USD1 grows and World Liberty Financial expands, it can stay relevant for a long time.

For now, it has moved from a quiet token to a serious market discussion.

This article is for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments are risky, so always do your own research before making any decision.