Strategic Move: Largest Bitcoin Purchase to Date Supercharges Portfolio Holdings

Holdings just got a massive crypto infusion. A major institutional player—or perhaps a whale with diamond hands—has executed its largest Bitcoin acquisition on record. This isn't just dipping a toe in the water; it's a cannonball into the deep end of digital assets.

The Signal in the Noise

Forget the day-traders and the meme-coin chaos. This scale of purchase cuts through the market static. It's a calculated bet, bypassing short-term volatility to anchor a long-term position. When someone moves this decisively, they're not looking at the next resistance level—they're looking at the next paradigm shift.

Portfolio on Steroids

The immediate effect? A dramatic reweighting. Bitcoin's share of the total portfolio just got a serious boost, shifting the risk profile from cautious to convicted. It's the financial equivalent of swapping a sedan's engine for a rocket booster—suddenly, everything moves faster and the destination looks very different.

Why This Matters Now

Timing is everything. This move comes as traditional finance continues its awkward, hesitant dance with crypto—regulating one day, embracing the next. While the old guard debates custody solutions and compliance frameworks, decisive capital is already positioning itself. It's a classic case of 'watch what they do, not what they say.'

The bottom line? A single transaction can speak volumes. This purchase shouts confidence in Bitcoin's foundational thesis, even as Wall Street analysts—the same ones who missed the internet—still debate its 'intrinsic value.' Sometimes, the smartest strategy is simply to buy more of what you believe in, especially when everyone else is still figuring out the spreadsheet. After all, in finance, being early is often mistaken for being wrong—until the checks clear.

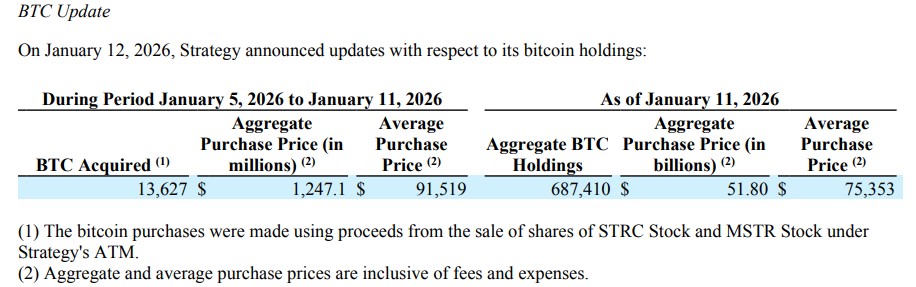

As of today, Strategy holds a total of 687,410 Bitcoins by investing around $51.8 billion at an average price of $75,353 per BTC. The latest MOVE highlights the potential confidence of the big institutional players in the golden asset as a long term treasury even after recent market volatility.

Michael Saylor’s Accumulation Strategy

MicroStratey’s Bitcoin Purchase is supported by an efficient capital markets approach. This company raises capital through various ways, including stock sales, issuance of low-interest convertible notes, as well as preferred stocks like STRC and STRK.

The above technique enables the firm to raise funds when their stocks are performing well. At the end of mid-January 2026, they hold a reserve of approximately 2.25 billion USD that can be used for dividends, interest, as well as day-to-day activities.

After the recent purchase, the market cap of the company is now close to $51.8 billion, with an enterprise value of $65.9 billion. The Bitcoin-reserves of the company are approximately valued at $62.8 billion.

Why Saylor Is Doubling Down Even After Volatility?

Saylor’s Bitcoin strategy shows confidence in the long term approach. The digital asset currently slipped 0.96% to $90,243 in the last 24 hours, extending its weekly decline to 2.72%, even as it remains up 1.19% on the month. There are several factors that affect the price, including the overall crypto market which dropped 0.81% today.

Despite short-term weakness and fear among small traders, MicroStrategy continues to buy the dip, viewing lower prices as an opportunity to expand its BTC holdings.

The company’s strong conviction in Bitcoin’s long-term value allows it to act counter to market panic, steadily accumulating while others hesitate.

Currently, the firm is sitting on around $11 billion in unrealised Bitcoin profit. It is possible due to its ~$75,000 average cost level. Even after buying recent BTCs at higher prices, the firm’s long-term accumulation pattern keeps it in profit, as long as BTC stays above the ~$75k average price meter.

Effect on Stocks Are Clear, But Not On Profits

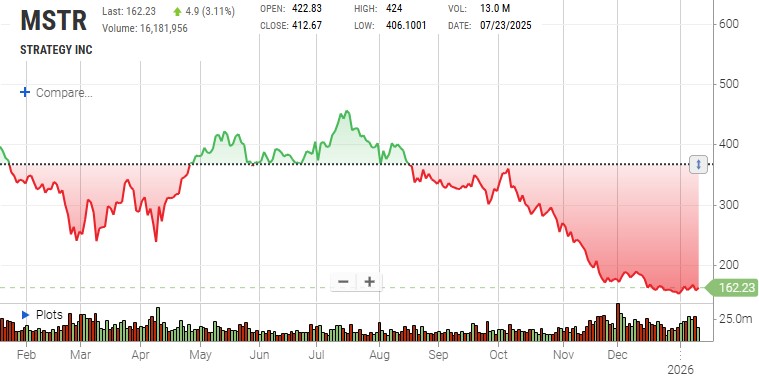

Strategy’s stock, $MSTR, continues to show high volatility, reflecting its close linkage to bitcoin price movements rather than traditional business fundamentals.

MSTR shares currently trade at $162.23 (+3.11%) on the day, with 47% down over three months and 51% year-on-year. Volatility over the past 30 days is around 57%, while one-year volatility stays elevated at 73%, highlighting ongoing instability in the stock.

Despite short-term price swings, MicroStratey keeps low net leverage of about 10%, supported by a well-balanced mix of funding. Its Bitcoins' holdings provide an estimated 74.5 years of dividend coverage, underscoring balance sheet resilience even during market downturns.

How This Matters For Both Strategy And Market

Continued activity in Bitcoin Purchase by Strategy represents an overarching theme in the institution to consider BTC as a Strategic Reserve Asset. Although it has been argued that the model contains risk such as the effects of leverage or volatility, the strategy enhances the long-run value of shareholders because the company’s assets in Bitcoins increase per share.

With the adoption of BTC increasing in 2026, Strategy’s approach not only makes it a software company, but it has actually positioned the entity as a prime corporate proxy for Bitcoins' accumulation, a strategy that continues to shape the traditional as well as the crypto market structures.