Polymarket Trader’s $400K Bet on Maduro Fall: Insider Tips or Crypto Genius?

Did a Polymarket trader have a crystal ball—or a confidential informant—when placing a massive $400,000 bet on Venezuelan President Nicolás Maduro's political downfall?

The High-Stakes Prediction Market

Polymarket, a decentralized prediction platform, allows users to wager cryptocurrency on real-world events. The platform's 'Maduro Exit' market saw a surge in activity, culminating in one trader risking nearly half a million dollars on a 'Yes' outcome. The sheer size of the bet raised immediate red flags across crypto and political circles.

Insider Trading in the Prediction Sphere?

Traditional finance has its SEC; crypto prediction markets have... well, rampant speculation. The timing and conviction behind the $400,000 position sparked theories of privileged information. Could geopolitical intelligence have been monetized on-chain before hitting mainstream news? It's the age-old Wall Street game, just with anonymous wallets and smart contracts.

Where Transparency Meets Opacity

Blockchain ledgers make the bet's size and outcome public, but the trader's identity and motivation remain shrouded. This incident highlights the dual-edged sword of decentralized platforms: unparalleled transparency for actions, complete opacity for actors. Regulators are left staring at a public ledger, wondering if they're witnessing savvy analysis or a federal crime.

The Verdict: A Win for the Trader, a Question for the Market

The trader pocketed significant gains—another crypto fortune built on predicting chaos. Whether this was brilliant geopolitical forecasting or a blatant information asymmetry play remains the million-dollar question. It's a perfect crypto parable: innovate fast enough, and you outrun not just competitors, but the rulebook itself. After all, in the high-stakes casino of prediction markets, the house always wins—until a whale with a potential insider tip walks in.

Polymarket Insider Trade Tales.

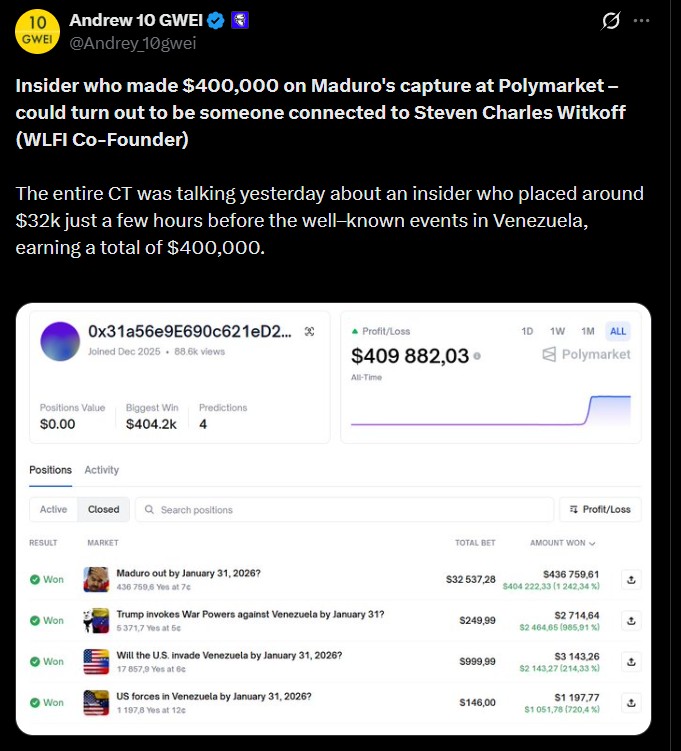

A Polymarket prediction market on-chain investigation by crypto analysts @Andrey_10gwei has caused controversy about a highly lucrative trade. It is said that the trader made approximately $400,000 betting on the political collapse of the Venezuelan President Nicolas Maduro, placing bets just hours before real-world events could be determined.

Source: Official Trader X

The market under consideration, which was solved after the U.S. seized Maduro on January 4, 2026, attracted attention because of the abnormally accurate timing and size of the winning bets. Crypto Twitter was soon theorizing about whether there was insider trading at play.

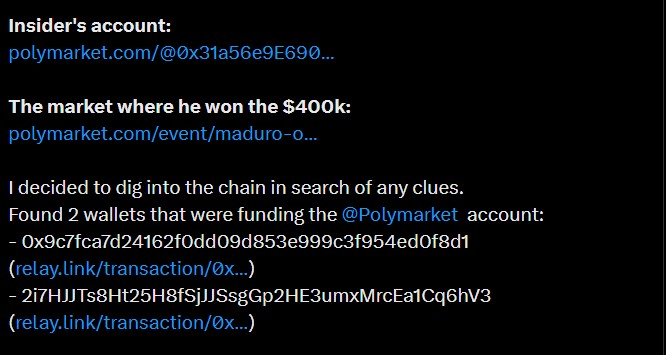

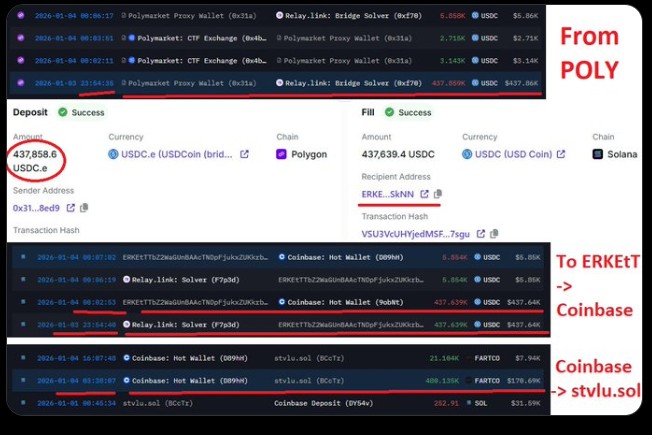

Tracing the Funding Wallets

Based on the analysis, two wallets were found to fund the Polymarket account that won the trade. The two wallets were not very active in terms of any activity other than being fed with money by Coinbase and deposited into Polymarket, a trend commonly linked to burner or intermediary wallets.

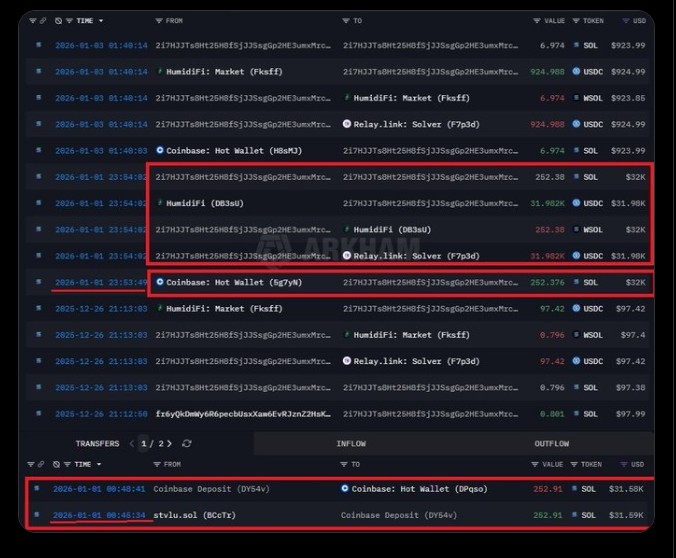

One of these wallets, 2i7HJJ... was filled with 252.39 Solana by Coinbase at 23:53 UTC on January 1. Thereafter, investigators sought similar inbound Coinbase exchange deposits before this transaction.

Source: X

Virtually the same SOL Casts doubt.

A striking match emerged. Approximately 23 hours before, a wallet (BCcTrxcow...) had put in 252.91 solana tokens to Coinbase--nearly the same sum, within a range of error of about 99%. This near numerical and time coincidence sounded off alarms to analysts.

This was further complicated by the fact that the STVLU.SOL wallet had registered several Solana Name Service (SNS) names such as StCharles.SOL.

Source: X

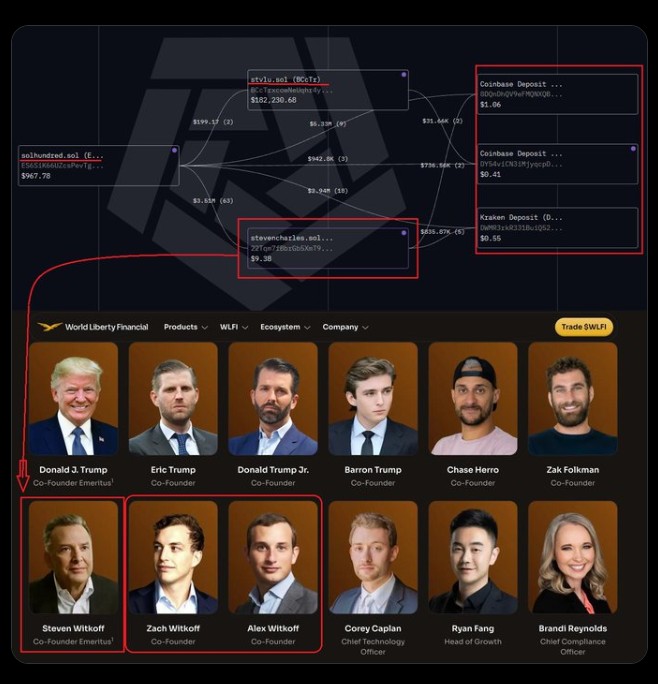

Any Connection with WLFI Co-Founder Steven Charles Witkoff?

Additional on-chain research showed that the original source of funding for STVLU.SOL was Solhundred.sol, a wallet that has made roughly 11 million transactions with another wallet called StevenCharles.sol.

The overlap in ENS/SNS naming, StevenCharles.sol and StCharles.sol, has made analysts suggest the possibility of a relationship to Steven Charles Witkoff, co-founder of World Liberty Finance (WLFI), a venture that has been associated with high-profile political connections.

Interestingly, the three wallets seem to have similar Coinbase deposit trails, which enhances the impression of a connected funding system.

Source: X

Fartcoin Transfer after Withdrawal Raises Additional Query

Further investigation was conducted after the Polymarket winnings were withdrawn. Approximately 3-4 hours following the movement of the insider account profits to Coinbase, some 170,000 worth of Fartcoin were transferred out of Coinbase into the STVLU.SOL wallet.

Although this is not a direct indication of profit recycling, the timing has given rise to speculation that some of the Polymarket proceeds were reinvested in speculative crypto assets.

Source: X

Coincidences or Insider Access?

Although the on-chain movements are very strong, analysts point out that the results are not conclusive but rather deductive. There is no direct evidence that the wallets in question were under the control of Steven Charles Witkoff or any of the affiliates of WLFI. At the time of publication, no response has been made by any of the involved parties.

Also, the crypto project of the TRUMP family, World Liberty Financial (WLFI), has declared that a governance proposal with 77.75% of the votes, allowing the unlocked treasury to be used in incentivizing USD1 adoption, has been passed. The vote indicates the high level of community engagement and the importance of token holders in the development of the WLFI token ecosystem.

Source: Wu Blockchain X

Conclusion

The Polymarket Maduro trade points out the visibility of suspicious trends due to blockchain transparency, but without attribution, the situation is still speculative, which raises still-persisting worries about the insider privileges in crypto prediction markets.

Disclosure: This is not financial advice. Do your own research (DYOR) before investing. CoinGabbar does not incur any financial losses. Cryptocurrencies are extremely volatile, and you will lose all your investment