Zcash Emerges as Top Gainer in 2025 as Privacy Coins Lead Large-Cap Crypto Rally

Privacy just became profitable. While mainstream finance was busy debating regulations, a silent revolution in digital assets was already underway—and it's wearing a cloak.

The Privacy Surge

Forget the old guard. The narrative for 2025 wasn't written by the usual blue-chip suspects. Instead, a cohort of privacy-focused cryptocurrencies, led by Zcash, staged a stunning takeover of the large-cap leaderboard. These aren't niche tokens anymore; they're becoming the core holding for a new breed of investor who values sovereignty as much as returns.

Zcash's Breakout Year

Zcash didn't just climb—it exploded. Its proprietary zk-SNARKs technology, which validates transactions without revealing sender, receiver, or amount, moved from theoretical advantage to practical necessity. As on-chain surveillance by funds and regulators intensified, Zcash's shielded pools became the go-to vault. The market voted with its capital, pushing Zcash to the top of the 2025 performance charts and proving that in a transparent world, opacity has a premium.

The New Market Calculus

The rally signals a fundamental shift. It's a direct challenge to the 'compliance-at-all-costs' model pushed by traditional finance. Investors aren't just seeking alpha; they're seeking autonomy. The demand isn't driven by illicit activity—that's a tired, cynical trope—but by institutions and high-net-worth individuals legally optimizing for financial privacy, something Wall Street has offered for decades through offshore vehicles and complex trusts. The jab? It seems the crypto crowd finally learned the oldest finance trick in the book: if you can't hide the money, hide the transaction.

Privacy is no longer a feature—it's the thesis. And for 2025, that thesis paid off handsomely.

Source: X (formerly Twitter)

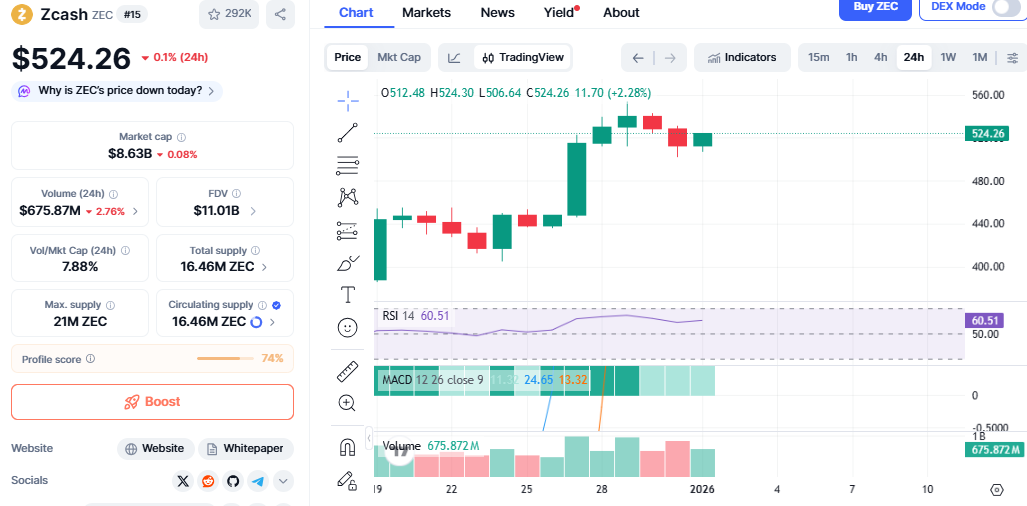

ZEC is trading around the $520–$525 range, even after a small dip in the last 24 hours. On a yearly basis, the token is up more than 800%, making it the top gainer 2025 among all major cryptocurrencies.

Its market value has now crossed $8.6 billion, placing it firmly in the large-cap category.

Why Zcash Top Gainer 2025 Is Getting Attention

The rise of Zcash top gainer 2025 is closely linked to growing interest in privacy. As governments discuss digital currencies and blockchain tracking becomes more common, many users want better control over their financial data.

The privacy feature within this crypto can now be acquired through shielded transactions. Users can opt for privacy when needed while having the ability to remain clear if a situation requires it. Such a feature has enabled this crypto to differ when privacy within the crypto world is eventually becoming a matter of concern.

Institutional Buying Strengthens Zcash’s Rally

It was also one of the biggest gainers in 2025 because of institutional purchases. Cypherpunk Technologies, which is a Nasdaq-listed company and is financed by Winklevoss twins, acquired another 56,418 units at approximately 29 million dollars.

This pushes its total holdings to about 290,000 ZEC, NEAR the value of 1.8% of the total number of circulating coins. The company has clearly outlined its strategy of buying more coins in order to reach the point where it will hold 5% of the total supply of coins.

The company’s executives believe that privacy-based tokens remain undervalued in the current world where everything is constantly monitored.

This kind of long-term buying gives confidence to the market and supports Zcash’s price during pullbacks.

Profit-Taking Causes Short-Term Dip

Even though ZEC is the top gainer of 2025, some price cooling was expected.

Source: CoinMarketCap

After rising more than 800% in a year and over 60% in a month, short-term traders started locking in profits.

It faced resistance near the $550 level and moved lower toward the $500 area.

Still, trading data shows that most long-term holders are not selling. This suggests the pullback is more about healthy consolidation than panic selling.

ETF News Adds Both Hope and Caution

This privacy coin also gained attention after Bitwise included ZEC in a list of altcoin ETF filings. While this created excitement, there is no guarantee of fast approval.

Past examples show that ETF launches do not always lead to long-term price jumps. Because of this, some traders are cautious, even though it’s optional privacy model may help it fit better within regulatory rules.

What to Expect Next?

ZEC Price Prediction

Bullish case: If ZEC stays above the $494 support level, it could continue its strong trend and revisit the $550 level. A further move toward $620 is possible if momentum returns.

Base case: ZEC may trade between $480 and $540 as the market settles.

Bearish case: If selling increases and support breaks, a dip toward $460 could happen, though the long-term outlook would still remain positive.

Final Thoughts

ZEC becoming the top gainer 2025 is not just hype. It reflects rising demand for privacy, steady institutional buying, and limited supply. While short-term price swings are normal, Zcash has clearly secured a strong position as the crypto market moves into 2026.

This article is for informational purposes only, kindly do your own research before investing in crypto market.