Litecoin News: ’Digital Silver’ Narrative Roars Back as Silver Shatters $80 Barrier

Silver just blasted past $80 an ounce—and suddenly, everyone's talking about 'digital silver' again. Litecoin, the crypto that's spent years in Bitcoin's shadow, is getting a fresh look from traders hunting for the next big metallic metaphor.

The Parallel Play

It's not about direct correlation. No serious analyst claims Litecoin's code magically tracks the London silver fix. The connection is purely narrative, a story that sticks. Bitcoin is digital gold: scarce, a store of value. Litecoin, with its faster blocks and different hashing algorithm, positioned itself as the spendable, transactional counterpart—the silver to Bitcoin's gold.

When traditional silver moons, that narrative gets a jolt of adrenaline. Portfolio managers and crypto degens alike start asking: 'If we're betting on precious metals, where's the digital leverage play?' Litecoin, with its established name and simpler tech story, often becomes the answer.

A Cynical Hedge

Let's be real—this is finance. The 'digital silver' tag is as much a marketing hook as it is an investment thesis. It gives traditional media an easy frame and provides crypto bros a seemingly logical reason to pump a coin that, frankly, hasn't had a compelling fundamental update in years. It's the perfect, cynical marriage of old-world commodity hype and new-world speculative fervor.

Will it last? Who knows. But while silver rides high, Litecoin's old nickname is back in vogue—proving that in markets, a good story is sometimes more valuable than a white paper.

A Fixed Supply Makes Litecoin Easy to Understand

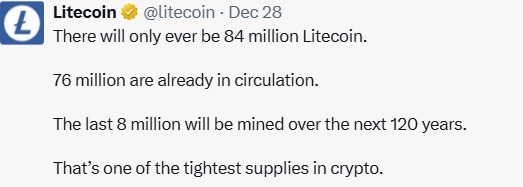

One simple reason people compare LTC to XAGUSD is its limited supply;

There will only ever be 84 million LTCs.

About 76 million are already in circulation

And the rest will be mined slowly over the next 120 years.

This makes it predictable. Everyone knows how many coins are in existence, and how fast new ones will come. Physical asset is different. Its supply depends on mining, exports, and government rules.

Source: X (formerly Twitter)

Recently, China silver exports restrictions were announced. To this news Litecoin’s official account reacted that physical metals can be affected by policies. The digital version, Litecoin, does not have these limits.

Why is Litecoin Called Digital Silver?

The concept is not new. The creator Charlie Lee once referred to this altcoin as “silver to Bitcoin’s gold.”

Bitcoin is often thought of as digital Gold because it is scarce and secure. LTC is similar to it, yet faster and cheaper to use. Just like $SLV compared to gold, is used more in everyday life, LTC was designed for everyday payments.

The chart show both the assets are trading at nearly the same price level, highlighting how closely the crypto is tracking asset's value narrative as “digital silver” rather than just another altcoin.Silver hit all time high, officially opening above a record $81 per ounce, reinforcing strong demand for scarce assets.

In the meantime, the digital currency has been going quietly about its business, carrying out evolutions in its technology.

Smart Contract Plans Are Taking Shape

Another reason LTC has been making news again is its new Layer-2 system called LitVM, which will go live sometime in early 2026. Using BitcoinOS and Polygon technology, LitVM will run smart contracts and apps on the platform.

This means that developers can create DeFi applications and NFTs, among others, without altering it's Core network. As such, the currency remains focused on serving the payment function while LitVM adds flexibility to it.

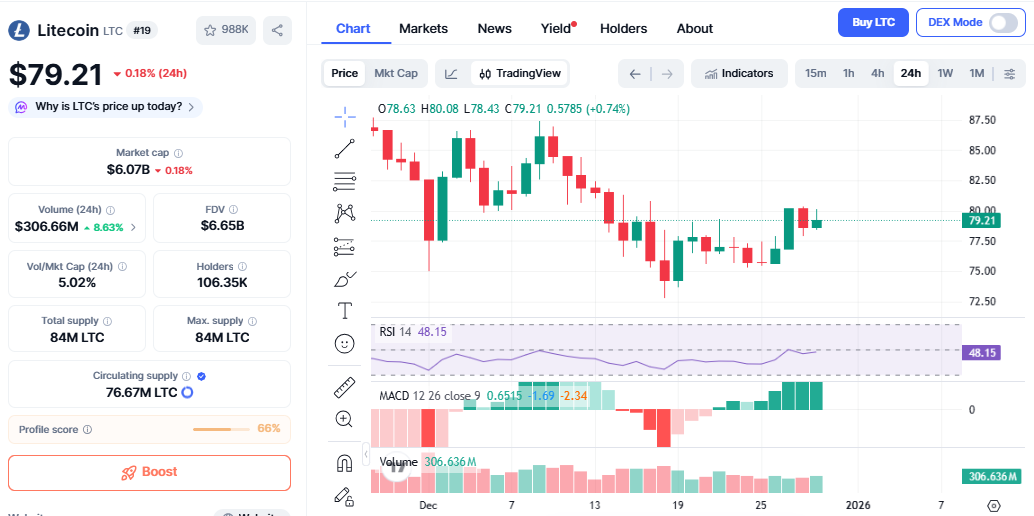

Litecoin Price Today

At the moment, the coin is holding above the $78 support level. Currently, technical signals reflect that the market is calm and neither excited nor fearful. The next area to watch is around $82 to $84, while a bigger challenge remains NEAR $99.

Source: CoinMarketCap Chart

This usually means that such price action occurs when traders are in a wait-and-see mode for clearer direction.

Conclusion

This digital asset is not chasing hype; it is building its case incrementally. In supply, it is capped, has a strong digital silver identity, has proven upgrades like Taproot, and future plans like LitVM. Less about price spikes, this is a phase of Litecoin News that deals with long-term positioning. And that's precisely the reason this coin still matters to many investors.

This article is for informational purposes only, kindly do your own research before investing in the crypto markets.