CZ’s Bitcoin Buying Strategy Revealed: Why Market Fear Creates Your Best Entry Point

When the crypto herd panics, the smart money loads up. That's the brutal, counterintuitive logic from one of the industry's most successful figures.

The Contrarian Playbook

Forget trying to time the perfect bottom. The real opportunity flashes when headlines scream disaster and social media feeds drown in doom. That's the precise moment seasoned players see a signal, not noise. It's about capitalizing on emotional liquidation—buying when others are forced to sell.

Psychology Over Charts

This strategy bypasses complex technical analysis. It targets a simpler, more reliable indicator: widespread fear. When leverage gets flushed out and weak hands fold, asset prices often disconnect from long-term value. It's a fire sale, albeit one that requires nerves of steel to walk into.

The Institutional Edge

Retail traders typically react. Institutions and veterans with dry powder act. They're not buying because they know the dip is over; they're buying because the risk-reward calculus has swung violently in their favor. It's a probabilistic bet on human nature repeating itself—a bet that's paid off repeatedly through every market cycle.

A Cynical Nod to Tradition

It’s the oldest trick in the book, repackaged for a digital age: be greedy when others are fearful. Of course, on Wall Street, they'd just charge you a 2% management fee for the same advice.

So, the next time the market plunges and your portfolio bleeds red, ask yourself one question: are you part of the fearful crowd, or are you preparing to take the other side of the trade?

Source: X (formerly Twitter)

CZ reminded people that early BTC buyers did not buy at the all time high. They bought when the market was full of fear, uncertainty, and doubt. His message was simple, calm, and timely.

Bitcoin Struggles as Fear Remains High

Right now, BTC is having a hard time crossing the $100,000 level. The Fear and Greed Index is sitting at 28, which shows fear in the market. Just a week ago, it was even lower at 22, and earlier this month it dropped to 15, showing extreme fear.

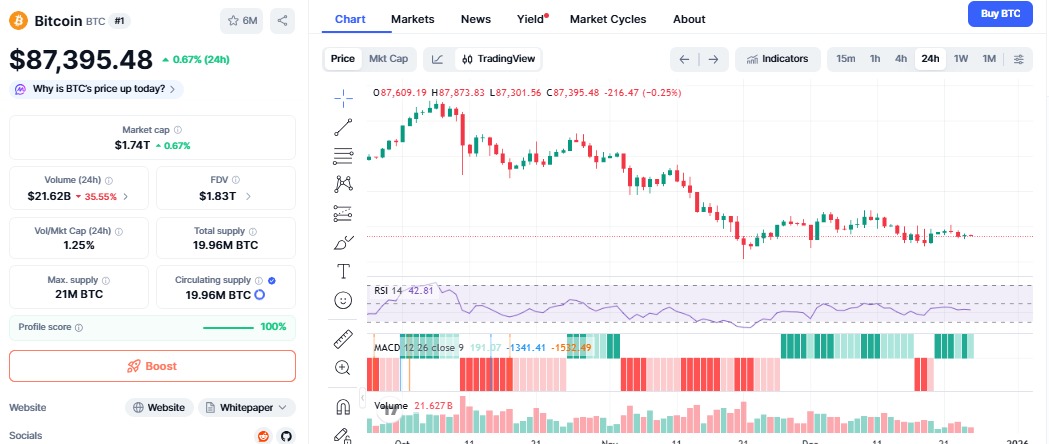

According to coinmarketcap, the coin last reached its all-time high of about $126,198 in October 2025. Since then, the price has fallen by more than 30%. Today, it is trading NEAR $87,390, with a small daily rise of around 0.67%. The market cap is close to $1.7 trillion, but trading volumes are low because of the holiday season.

Source: CMC

This uncertain phase makes CZ Bitcoin Buying Advice stand out even more, as many investors are afraid to act.

Investors Move From Risk to Safety

While BTC is struggling, Gold and Silver are hitting ATH. Gold has reached a new all-time high above $4,500 per ounce. Silver has also surprised the market by becoming one of the top three biggest assets by value worldwide surpassing Apple.

This shows a clear shift in investor behavior. A lot of money is flowing from riskier investments, such as crypto, into gold and silver. Even tokenized gold grew fast; the total market value is now close to $4 billion as per the rwa.xyz data.

This risk-off sentiment explains why crypto feels pressure right now, the long-term conviction still stands.

Long Term Hodlers Still Believe in BTC

Not everyone is fearful, though, as some big figures remain confident in the digital asset. In a list that includes CZ, Michael Saylor and Simon Gerovich continue to show belief in the long term future of the digital asset. Binance’s official account also shared a message saying while gold had a strong year, BTC had a strong decade.

This is in line with the CZ bitcoin Buying Advice, which encourages long-term outlooks over reacting to short-term fear.

Bitcoin Price Outlook

Technically, BTC has somewhat stabilized. Indicators such as the MACD are still positive, and the RSI is neutral, which means further upside is possible. If the currency stays above $87,500 and breaks $88,500 upwards, then it might try to reach up to $90,000 soon.

However, low trading volume still allows the swing of prices to still happen. For now, CZ Bitcoin Buying Advice sends a clear message: markets feel scary before they feel rewarding. Those who stay patient during fear often benefit when confidence returns.

This article is for informational purposes only and not a financial advice, kindly do your own research before investing.