Binance Token Listing Distribution Exposed: Why 84% of Tokens Crash After Launch

Getting listed on Binance used to be a golden ticket—now it looks more like a short-term hall pass. The exchange's token distribution mechanics create a brutal launch environment where most projects can't survive the initial hype cycle.

The Pump-and-Dump Pipeline

Binance's listing process funnels tokens through a concentrated distribution model. Early investors, team members, and venture funds often hold massive allocations that unlock post-launch. This creates immediate sell pressure the moment a token hits the open market. Retail buyers rushing in at the peak frequently become exit liquidity for insiders.

Why 84% Fail

That staggering failure rate stems from structural flaws, not just market sentiment. Projects prioritize exchange listing over sustainable tokenomics, treating the Binance logo as an end goal rather than a starting line. Without real utility or staggered vesting schedules, tokens collapse under their own weight once the initial trading frenzy fades—a classic case of 'build the listing, and the product will come' mentality that rarely works out.

The Survivor's Edge

The 16% that don't implode typically share crucial traits: actual product usage, transparent vesting schedules, and community distribution that extends beyond speculative whales. They treat the listing as a liquidity event, not a liquidation event.

Binance's distribution model isn't breaking any rules—it's just exposing how many projects were never built to last in the first place. Sometimes the market's brutal efficiency looks an awful lot like a casino counting chips before the game even starts.

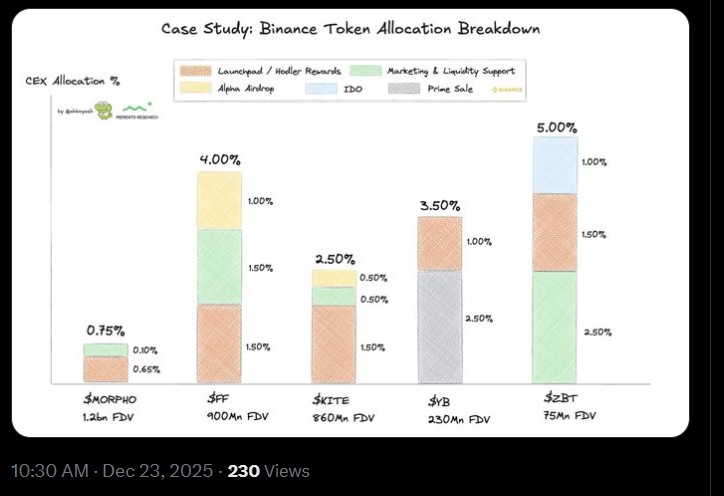

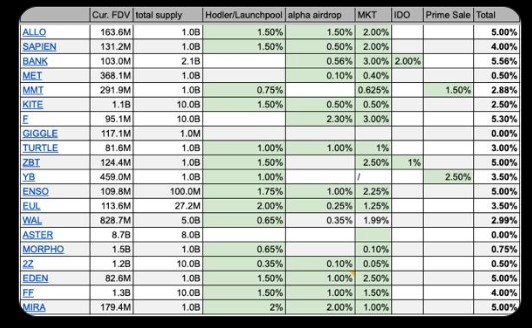

Binance Listing Allocation 2025

Recent research by Ash from Memento Research reveals what really happens during listings, challenging the long-standing myth of opaque “listing fees.”

Public data from multiple listed projects shows that the total tokens allocation for listings usually stays below 5% of the total supply. Large, high-FDV projects often allocate less than 1%, while mid-sized projects allocate slightly more to support early liquidity and user incentives.

Importantly, these tokens do not go to Binance as revenue. Instead, allocations FLOW back into the ecosystem. The main destinations include Launchpool and HODLer rewards, Alpha airdrops, Prime Sale or IDO access for users, and liquidity or market support programs. Every allocation is designed to benefit real users and strengthen early trading conditions.

Source: X

For example, ALLO allocated 5% of its supply: 1.5% for Launchpool rewards, 1.5% for Alpha airdrops, and 2% for market support. ENSO followed a similar structure, also capping its allocation at 5%.

Across 20 recent listings, none show tokens recorded as direct Binance revenue. The listings prioritize community distribution, transparency, and ecosystem growth, not hidden exchange profits.

Overall Binance Market

The trade continues to be robust even though the market is volatile. Bitcoin trading volume is the first to reach an excess of $26 billion, then Ethereum, Solana, XRP, and BNB.

ANIME, ASR, ALPine, and BANK are the top gainers with double-digit gains. In the meantime, ACT, VTHO, OXT, and AAVE are some of the worst losers. BTC and ETH market caps are experiencing low growth, and the majority of key assets are trapped.

Big Reality of Binance Listing Market 2025

The overall picture of token launching is bleak, even though the practices are transparent in 2025. Tracking of 118 events of token generation indicates that 84.7% currently trade at a lower valuation than when they were initially listed.

The median FDV is reduced by 71% and the median market capitalization decreased by 67%. Only an approximate of 15% of tokens are retained at a higher price than when they were launched.

Source: X

These are not local failures but a market-wide trend. Analysts cite a few reasons: the market is too saturated with new launches, TGE valuations are overly high, token utility is weak, and investors are afraid of new cycles due to prior cycles. Macroeconomic pressure has also decreased the desire to have speculative assets.

The concept of early involvement in the token launches as a guarantee of profit has obviously collapsed. The exchange listings can be open, but the success in the long term is still dictated by the fundamentals of the project.

Binance Airdrop Highlights

The Binance-associated ecosystem activity is still rewarding its users with airdrops and incentive programs.

Recent include airdrops by RateX, Aster, vooi, River, Infrared, and Magma Finance.

The fifth airdrop of Aster starts on December 22, where the emission is less, and this is an indication of a more disciplined supply.

Rainbow Wallet has declared its RNBW token TGE in February 2026, whereas the ME sale in Magic Eden is active in MocaPortfolio.

These incidents demonstrate that airdrops are still among the least risky methods of exposure to users.

Source: X

What Investors Should Do Now

Shareholders need to abandon the hyped-up decision-making and conduct serious research. Prioritize good teams, practical utility, sustainable tokenomics, transparent vesting, and actual user traction. Do not think that all new listings are going to be successful.

Final Takeaway

The listings are clearer than they seem, and 2025 shows that only well-founded fundamentals live. Binance Airdrops and Launchpool are less risky than risky launches.

Disclosure: The article is informational in nature and does not represent financial, investment, or trading advice. Investments in cryptocurrencies are market risky and volatile. It is recommended that the readers perform their own research (DYOR) prior to making any investment decisions. CoinGabbar is not liable for any financial loss.