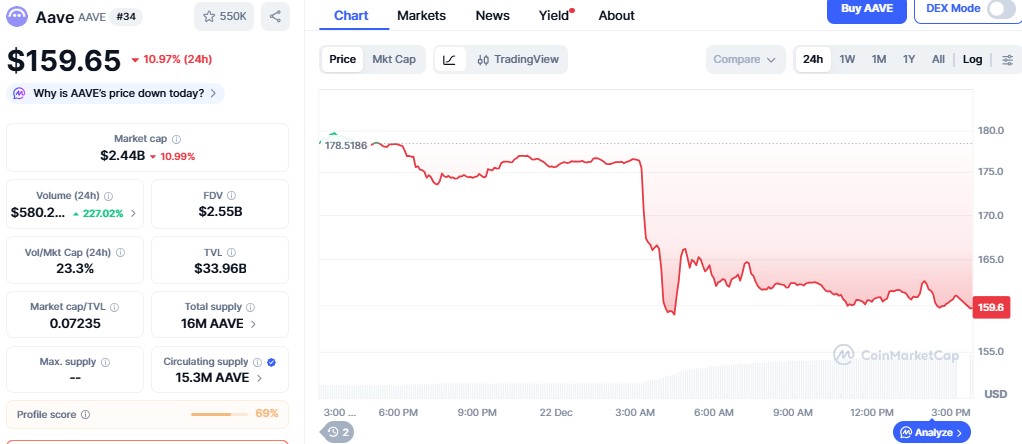

AAVE Plunges 11% in 24 Hours: The Real Reasons Behind the Sudden Crash & What’s Next for DeFi’s Flagship

AAVE just got liquidated. The DeFi blue-chip is reeling from an 11% single-day nosedive—a brutal reminder that even the giants aren't immune to crypto's gravity.

The Sell-Off Trigger: More Than Just Market Jitters

This wasn't a gentle correction; it was a targeted sell-off. While broader market weakness provided the backdrop, the immediate catalyst appears to be concentrated profit-taking and portfolio rebalancing from large holders. The move highlights the lingering sensitivity of even established DeFi tokens to whale movements and shifting liquidity.

Technical Breakdown: Where Support Cracks

Chart technicians are watching key levels shatter. That 11% cut didn't just erase a week's gains—it breached several major support zones that had held firm through previous volatility. The next critical floor is now in sight, and a failure to hold could signal a deeper, more painful recalibration for the entire lending sector.

The DeFi Domino Effect: Is AAVE the Canary?

When a protocol commanding billions in total value locked stumbles, the whole ecosystem feels the tremor. AAVE's sharp drop raises questions about leverage and interconnected risk across DeFi. If the flagship lending market is under pressure, what does that say about the speculative excess built on top of it? It's the classic finance story—everyone's a genius in a bull market, until the tide goes out and you see who's been swimming naked.

What's Next: Recovery Play or Cautionary Tale?

The path forward hinges on two things: protocol fundamentals and trader psychology. AAVE's underlying tech and revenue generation remain robust—this is a liquidity event, not a hack or failure. However, sentiment has been wounded. A swift reclaim of lost ground would signal strong accumulation and long-term conviction. Continued weakness, however, could invite a broader re-rating of DeFi token valuations. For now, the market is voting with its sell orders.

This sudden MOVE has pushed investors to ask a simple question: why is the price falling today, and what comes next?

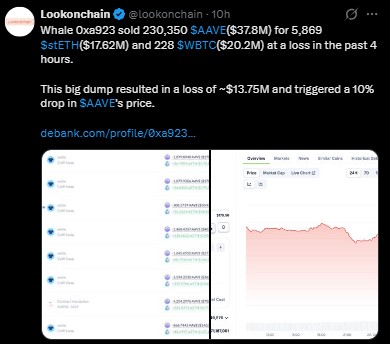

Why Is AAVE Down Today? Whale Activity Triggers Panic

The first clear trigger behind the AAVE price drop is heavy whale selling. According to Lookonchain, wallet 0xa923 sold 230,350 tokens worth $37.8M in just four hours. The assets that were exchanged include 5,869 stETH worth $17.62M and 228 WBTC worth.

This triggered a lock-in of approximately $13.75M of losses for the whale and inundated the market with supply. The consequence of this is the creation of panic selling, resulting in prices plummeting by almost 10% within a short period. Such large seller movements often impact short-term market sentiments.

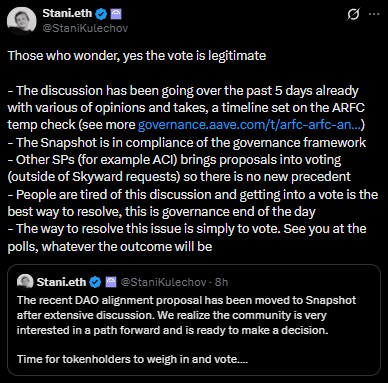

Governance Vote Adds More Pressure to the Market

Another key reason behind why the price is dropping lies in protocol governance. Founder and CEO Stani Kulechov confirmed that the team is voting on a proposal to adjust token ownership between December 23 and 26, 2025.

The discussion has already been active for over five days through an ARFC temp check, with mixed opinions from the community. Any change in ownership structure can impact governance power and future distribution, which naturally raises uncertainty. This risk is generally factored into market prices well in advance, thus adding to the selling pressure.

AAVE Price Prediction: Levels of Support Determine the Next Step

Technically speaking, the warning continues in the AAVE price forecast.

Price is trading in a medium-term downtrend and below its previous range high. Immediate support sits at $155–150. A daily close below $150 could open the door toward $138–140, a prior liquidity zone.

On the upside, resistance stands NEAR $172–175, with stronger supply around $190–200. RSI values are in the mid-40s, indicating weakness in the momentum. A breakout above $175 with strong volume above $650M may give a boost to the bullish trend.

What Should Traders Do Now?

Although the Aave market situation currently looks quite alarming, this price movement can also be seen as the reflection of short-term fear, as it doesn’t signify any kind of failure on the part of the protocol. The market is bound to observe more fluctuations before the governance vote is concluded.

Conclusion

The fall in AAVE price is a result of intense selling by whales associated with short-term uncertainties in governance, rather than a problem in its fundamental structure. Until further information is released, it is important for investors to prepare for the market to be extremely unpredictable while being cautious not to act on their emotions.

This post is for educational purposes only and should not be interpreted as financial advice in any form. cryptocurrency prices are extremely volatile and carry inherent risks. It is always necessary to DYOR and consult a financial advisor for all of your financial needs.