Uniswap’s UNI Burn Proposal: Fee Switch Activation and 100M Token Burn Plan Revealed

Uniswap's governance is about to get spicy. A new proposal has dropped that could fundamentally reshape the economics of the world's largest decentralized exchange. It's a one-two punch: flipping the switch on protocol fees and torching a massive chunk of the UNI supply.

The Fee Mechanism: From Theory to Reality

For years, the 'fee switch' has been a theoretical lever in Uniswap's design—talked about, debated, but never pulled. This proposal aims to change that. It outlines a mechanism to divert a portion of the trading fees generated on the protocol directly to UNI token holders who stake and delegate their voting power. It's a move that finally attempts to attach concrete cashflow to governance participation, transforming UNI from a speculative governance token into a potential yield-bearing asset. Because what's better than voting on emoji proposals? Getting paid for it.

The Great Burn: Scarcity as a Strategy

The second pillar is pure supply shock economics. The plan calls for permanently removing 100 million UNI tokens from circulation. That's not a small number—it's a strategic reduction aimed at increasing the scarcity of each remaining token. In the traditional finance playbook, this is the equivalent of a massive stock buyback, a signal to the market that the protocol believes its own token is undervalued. It's a bold bet on deflationary pressure driving long-term value.

Governance on the Clock

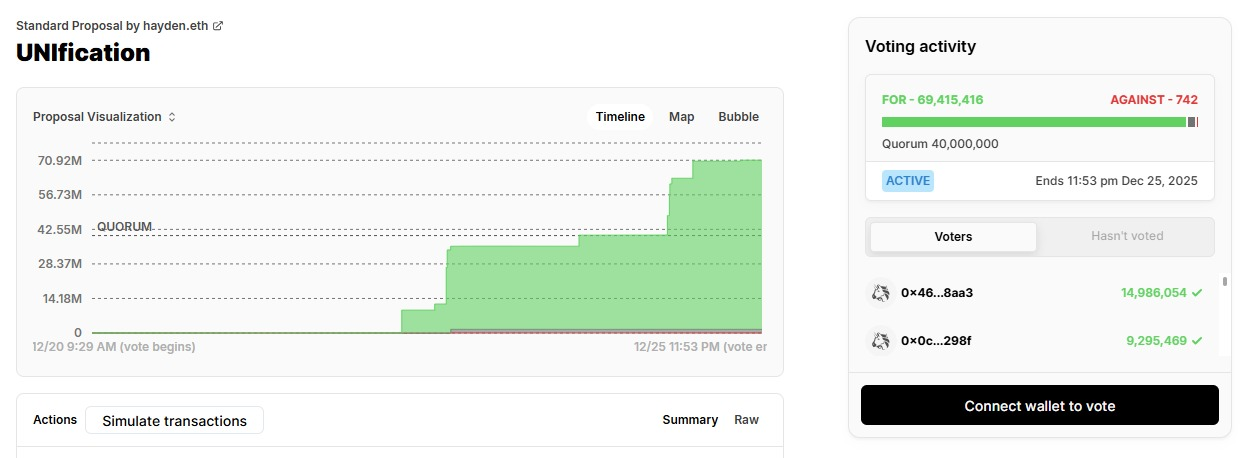

This isn't a done deal. The proposal now enters the arena of Uniswap's decentralized governance. UNI holders will debate, amend, and ultimately vote on its fate. The discussion will likely center on the exact fee percentage, the distribution mechanics, and the long-term impact on protocol growth versus tokenholder rewards. It's a classic tension between reinvesting in the ecosystem and rewarding current stakeholders—a debate Wall Street knows all too well, just with more pseudonymous usernames and fewer suits.

If passed, this could mark a watershed moment for DeFi's flagship protocol, moving it closer to a self-sustaining economic model. If it fails, it's back to the drawing board. Either way, the market is watching. After all, in crypto, a good token burn can sometimes do more for the price than actual user growth—a cynical truth that even the most bullish degens understand in their hearts.

Source: Official Website

Source: Official Website

Voting is still open until December 25th and participation remains strong.

What Is the Uniswap UNI Burn Proposal About?

In essence, the Uniswap UNI burn proposal is all about how the project deals with fees and how it monitors the UNI token supply over time.

The proposal intends, if the vote continues to hold, to burn 100 million tokens from existing treasury funds.

Also, it intends to turn on protocol fee switches for Uniswap v2 and v3; this WOULD see a portion of the trading fees generated on the platform used in the burning of tokens on a regular basis. Fees from Unichain would also be included.

Combined, these changes are supposed to gradually decrease the supply and better LINK the token's value to project's actual usage.

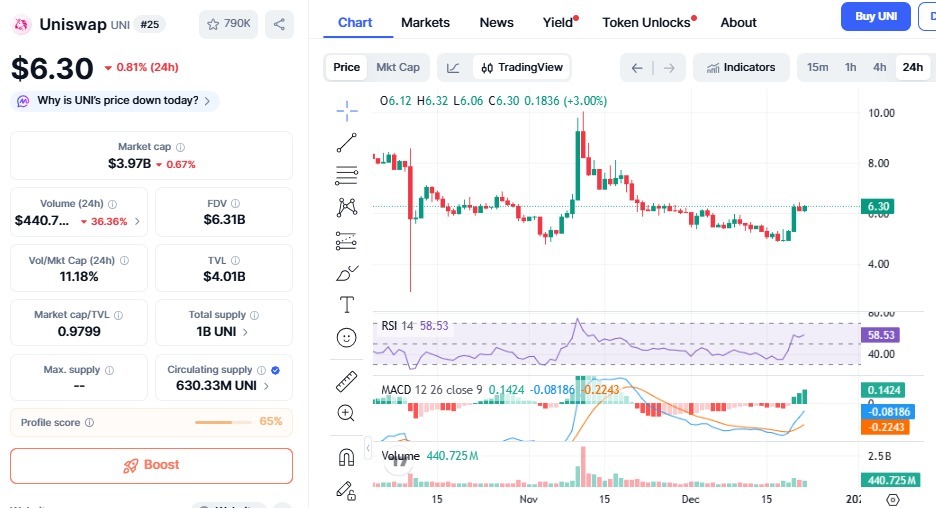

How UNI Price Has Reacted So Far

The news around the Uniswap token burn proposal has already sent ripples through the market. In the last few days, the coin ROSE nearly 25% to briefly reach levels close to $6.50. For now, it is trading at around $6.30, down by about 0.81% in the last 24 hours.

Source: CoinMarketCap

This small pullback resembles normal profit-taking after a strong rally. Many traders locked in gains after the price moved up so quickly, and that did slow momentum in the NEAR term.

Whale Activity Draws Attention

On-chain activity indicates large traders are closely following the update. One prominent whale opened a 10x Leveraged long position near $5.20 ahead of the surge in voting activity. That position is now sitting on more than 150% unrealized gains.

He has set take-profit levels between $6.52 and $10, and not having closed the position means the trader is confident in crypto's direction as the vote continues.

Short-Term Price View

Until the vote wraps up, UNI Token will likely move sideways in the very short term.

Above the range of $5.80-$6.00, the trend remains healthy

A push above $6.50 may bring fresh buying interest if market sentiment improves.

Bigger Picture

Even with strong support of the Uniswap UNI burn proposal, the wider crypto market is cautious. Bitcoin dominance remains high, with most altcoins experiencing slower trade activity. This continues to be the broader market mood that impacts crypto's price action.

What Comes Next?

Attention now shifts to the final days of voting. Among the most consequential governance decisions the protocol has faced in years.

As the vote continues, traders and long-term holders alike watch closely as to how project's next chapter will be built upon.

This article is for informational purposes only and not a financial advice, kindly do your own research before investing.