Zebec Network Price Surge: Can $ZBCN’s Rally Hold Its 2026 Target?

Zebec Network's token is on a tear. The price surge has traders buzzing and analysts scrambling to update their charts. But the real question isn't about today's green candles—it's about the 2026 target looming on the horizon.

The Momentum Behind the Move

Forget slow-and-steady. This is crypto. Zebec's recent price action cuts through market noise, bypassing the usual sideways drift that traps lesser projects. The surge isn't happening in a vacuum; it's fueled by real protocol activity and a community that's all-in on the stream-of-value thesis.

Anatomy of a Rally

What separates a flash pump from a sustainable climb? Infrastructure. Zebec isn't just another DeFi narrative—it's building the pipes for real-time, programmable money flows. That foundation turns speculative interest into legitimate, sticky demand. The charts reflect a market starting to price in utility, not just hype.

The 2026 Question Mark

Targets are easy to set when a token is flatlining. Hitting them during a volatile bull cycle? That's where the rubber meets the road. The 2026 target now acts as both a beacon and a test—a measure of whether this network's fundamentals can outlast the manic-depressive cycles of crypto sentiment. Can the rally hold, or will it become another entry in the graveyard of broken projections that fund managers love to rationalize in their quarterly reports?

One thing's clear: Zebec has the market's attention. Now it needs to prove the surge has staying power.

But why is the token going up today? Is it just a short-term jump, or will the price keep rising through the end of 2025 and into 2026? This article explains it all.

What’s Behind Zebec Network Price Surge 20%: 3 Key Reasons

The Zebec price surge today is happening because of several big updates:

ISO 20022 Integration: As per the Official Zebec Network crypto news, the token has integrated ISO 20022 standards into its payroll system. This is a global "language" for financial messages. It makes the network work much better with traditional banks and cross-border payments

Partnership with Nacha: It has joined the Nacha Payment Innovation Alliance. Nacha is the group that manages the $85 trillion ACH network in the U.S.

Collaboration with Fasset: The asset teamed up with Fasset, a company that helps people send money to other countries. This partnership focuses on Southeast Asia, a huge market. It integrates $ZBCN into Fasset’s digital banking system, which means more people will actually use the token.

These upgrades and partnerships are the reasons why Zebec Network price surge today.

Technical Chart Analysis: Will $ZBCN Price Rally Continue or Crash Soon?

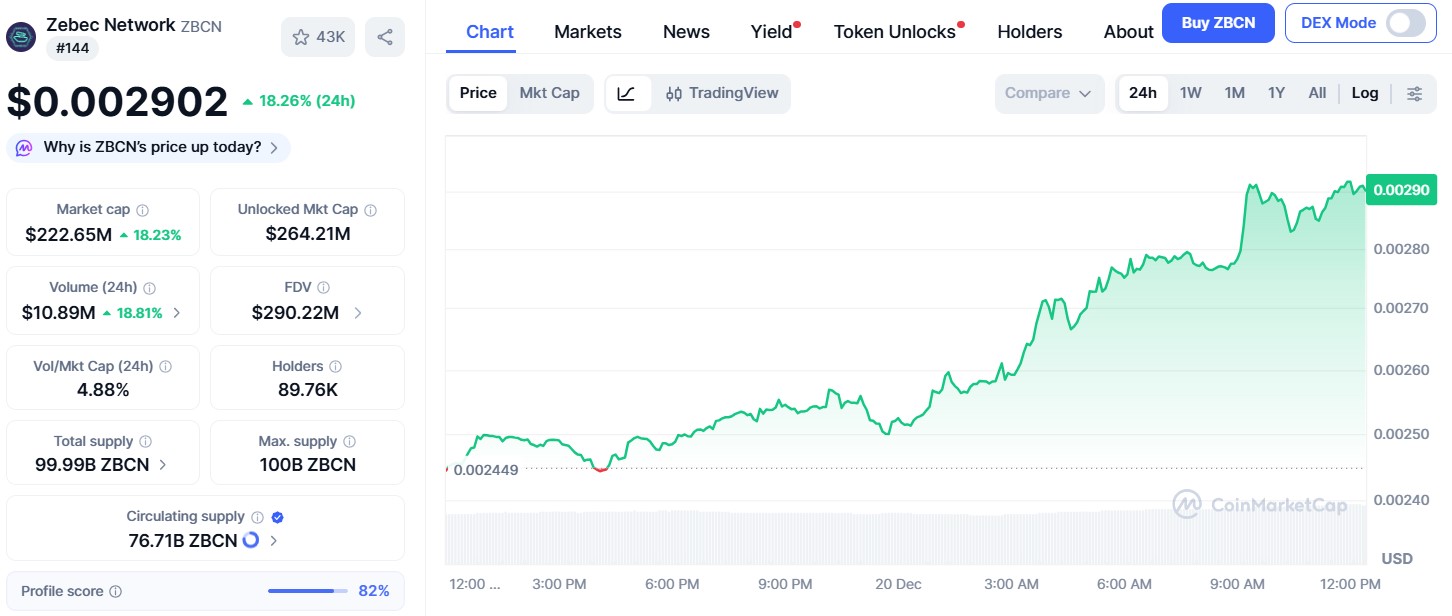

The Official TradingView ZBCN USD chart shows a strong breakout today. The price ROSE from $0.0026 to $0.0029, and the data supports this upward trend:

MACD: The MACD line shows a classic "buy signal" that shows which means the token might achieve more highs.

-

RSI (Relative Strength Index): The RSI is at 73.64 in the "overbought" zone. It means a small "dip" before the next move is possible.

-

Volume: High trading volume proves that many people are interested in buying, which makes the rally look real.

Zebec Network Price Prediction: What's Coming Next?

With the current price momentum, here are the price targets for the short and long term:

The price could reach $0.0032 soon. Because the RSI is high, it might drop back to $0.0026 for a moment before rising up again.

If trading volume keeps increasing, Zebec network price surge could test the $0.0035 range in a couple of weeks. So traders should keep a close eye on its $0.0026 support and $0.0032 resistance levels.

As December 2025 is ending soon, platform’s growth in the real world could drive the price toward $0.0045 or $0.0055 in early Q1 2026. As it hits more milestones, its market position will get even stronger, pushing the price higher.

Will Zebec Mirror Bitlight Price Surge Path? Experts Analysis

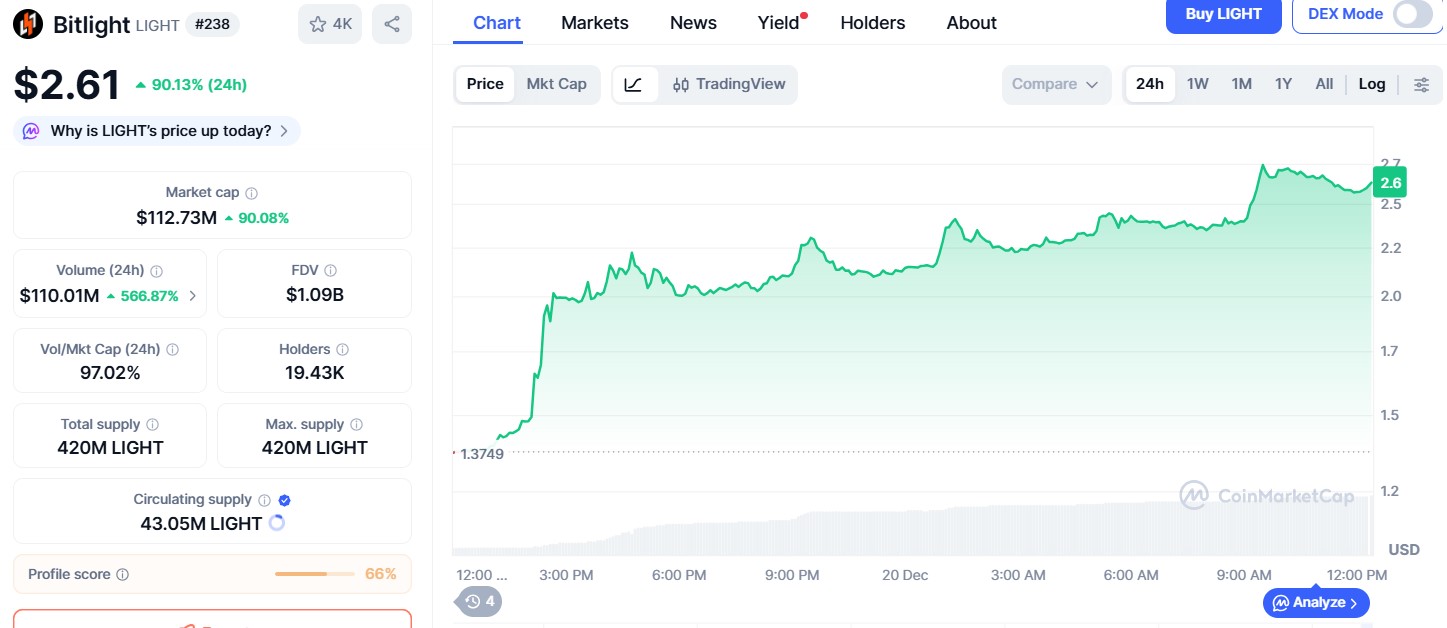

After analyzing the reasons behind the breakout, price prediction, and technical indicator, some analysts at Coingabbar are comparing the asset with Bitlight $LIGHT price surge.

It recently jumped by 90% in just 24 hours as seen in the above official CoinMarketcap Chart.

Similarities in both the asset:

The overall market conditions are still volatile, yet the surge in ZBCN shows strong investor confidence, similar to Bitlight

It has 99.99 billion tokens in total, with 76.71 billion currently in use. This is similar to Bitlight listing structure.

Both are popular DeFi projects.

With more trading volume and the new partnerships, it has a strong foundation to follow that same explosive path and reach $0.006 – $0.008 levels in the long run.

Conclusion: What’s Next?

The 20% Zebec Network price surge is driven by real-world progress like ISO 20022 and partnerships with banking leaders. While the price might be "bumpy" because of volatility, the long-term future for $ZBCN looks very bright. But, like with any crypto rise, investors should be careful about the fear of a market crash and make sure to manage their risks properly.

Disclaimer: The information provided in the article is not financial advice. Always do your own research before making investment decisions.