Metaplanet ADR Trading Launch: Bitcoin-Backed Equity Hits the US Markets

Tokyo-based investment firm Metaplanet just fired a shot across traditional finance's bow—its American Depositary Receipts (ADRs) are now trading stateside, backed by Bitcoin.

Why This Isn't Just Another Crypto Stock

Forget the usual crypto-adjacent plays. This is direct exposure. Metaplanet's strategy is a stark, balance-sheet-level bet on Bitcoin as a primary treasury reserve asset. It's a corporate playbook ripped from MicroStrategy but executed from Asia and now accessible to U.S. investors without the hassle of foreign exchanges.

The ADR Gateway Opens

The launch creates a clean bridge. U.S. investors can now buy a slice of Metaplanet's Bitcoin-backed equity through their regular brokerage accounts. No crypto wallets, no complex international transfers—just ticker symbols and a thesis that digital gold trumps fiat on a corporate balance sheet. It effectively bypasses the traditional ETF route, offering equity ownership with a crypto core.

A New Front in the Institutional Adoption War

This move pressures other institutional models. While fund managers debate spot ETF flows, Metaplanet offers a pure-play equity alternative. It asks a provocative question: why buy a fund that holds Bitcoin when you can buy a company that does? It turns a share certificate into a proxy Satoshi.

The Cynical Take

Let's be real—Wall Street will find a way to fee this up, package it into a structured product, and sell it back to you at a 2% premium. Some hedge fund analyst is already drafting a report on 'synthetic beta dislocation.'

The bottom line? A major Asian firm is betting its treasury on Bitcoin, and you can now ride that bet through the good ol' NYSE. The old world and the new just got a lot more connected—whether traditional finance likes it or not.

Source: X (formerly Twitter)

It is a fantastic opportunity as it is a firm that is supported by BTC. Thus, when you make a MOVE to invest in their stocks, you are actually investing in the cryptocurrency as well.

The Importance of Metaplanet's Bitcoin Treasury

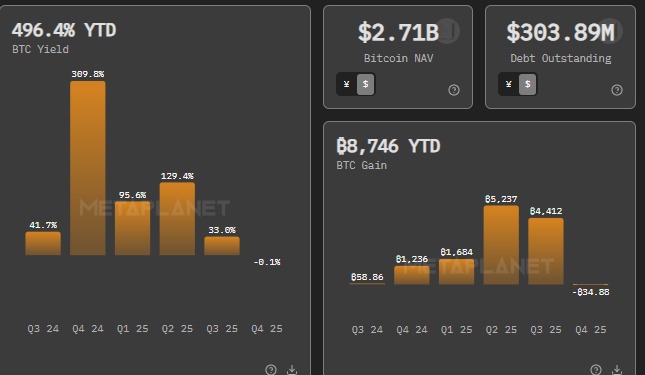

The firm has an enormous Bitcoin holding, with around 30,823 BTC, worth over $2.7 billion at present.

Looking at the long-term growth of Bitcoin, it can be assumed that Metaplanet stock will experience an increase as well. This is one reason why investors have become very attracted to it.

In fact, the firm's holding of BTC has given them phenomenal returns, boasting a YTD return on their bitcoin investment at an impressive 496.4%. In simple words, as it goes up, so does it's Stock price.

Source: Official Website

The Timing of the U.S. ADR Launch

The timing of this launch is crucial. On the same day as Metaplanet ADR was available for U.S. investors, the Bank of Japan raised interest rates to 0.75%, the highest rate in 30 years.

This kind of rate has always left Japan at the level of very low interest rates.

This has encouraged Japanese firms, to seek investments outside Japan. However, by making its ADRs to the United States market, the firm is introducing itself to the American market where investing in a BTC-backed firm is very easy.

How Bitcoin Helps Metaplanet Grow

BTC is the Core of it’s operations.

As the value of Bitcoin price increases, the price Metaplanet shares increases as well.

he Bitcoin-based NAV stands at $2.71 billion. This is one of the major reasons that make it an attractive investment opportunity.

Other companies may base their value on normal assets, but for this organisation, it is cryptocurrency that underlies its value. Therefore, it is the best investment for those who see the future in BTC.

A Global Opportunity for Investors

By being listed on the platform available to U.S. investors, the Japanese firm is unlocking access to a worldwide investment opportunity. This is a significant move because it also gives U.S. investors the opportunity to invest in Bitcoin-backed assets in a more conventional fashion, by way of shares, as opposed to cryptocurrency.

What’s Next?

The future appears to be bright for MTPLF. Not only does it own BTC, but it is also growing and listed on U.S. ADR, and this means that it is going to be a significant force in the marketplace.

Investors who are interested in investing in the digital asset but do not want to have to deal with cryptocurrency are going to find this to be a very attractive alternative. The business model that has put forth is unique to the cryptocurrency world.

This article is for informational purposes only and not a financial advice, kindly do your own research before investing.