Is Crypto Market Dead? Stock and Gold Price Surge Sparks Question

Gold hits new highs. Stocks rally. Meanwhile, crypto markets churn sideways—prompting the inevitable question: is this the end?

The Narrative Shift

Traditional safe havens are having a moment. Investors, spooked by whispers of inflation or geopolitical jitters, are piling into assets their grandparents would recognize. It's a classic flight to safety, leaving digital assets looking like the risky outlier at the party.

Beyond the Headline Noise

Declaring crypto 'dead' based on a short-term divergence is like calling a marathon runner finished at the first water station. The underlying infrastructure—decentralized finance protocols, layer-2 scaling solutions, institutional custody—isn't fading; it's building. Traditional markets surge on central bank promises and corporate earnings. Crypto builds on code.

A Different Kind of Asset

Comparing Bitcoin to gold or tech stocks misses the point. One is a monetary network; the others are commodities or equity shares. Their drivers are fundamentally different. When stocks rise on cheap credit, it doesn't invalidate a blockchain's security model—it just highlights that most investors still think inside the old system's box, chasing the same old signals while a new financial operating system boots up in the background.

The Verdict: Far From Finished

The 'crypto is dead' headline is a perennial favorite, usually a contrarian indicator. Market cycles don't disappear; they rotate. Today's capital flow into stocks and gold isn't a funeral dirge for digital assets—it's a reminder that adoption is a messy, non-linear process. The real story isn't about death; it's about a market maturing, finding its footing while the old guard enjoys one more victory lap, fueled by the very monetary policies that make decentralized alternatives compelling in the first place.

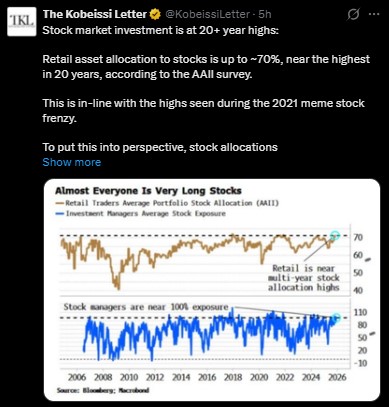

Stock Market Investment Reaches Record Levels

According to “The Kobeissi Letter,” retail investment in stocks is at 70%, which was experienced during the meme stock mania in 2021. On the other hand, investment in stocks among investment managers is at an average of almost 100%, one of the highest levels experienced in two decades. Such high investment in the stock indicates risk appetite that is “through the roof,” despite numerous concerns elsewhere.

A wake-up call in statistics WOULD be that if the worst-performing days are ignored, the S&P 500’s return would be an astonishing 6,400 percent since 1995, whereas the overall return would be 2,600 percent. This would indicate how much those few pivotal days impact overall performance.

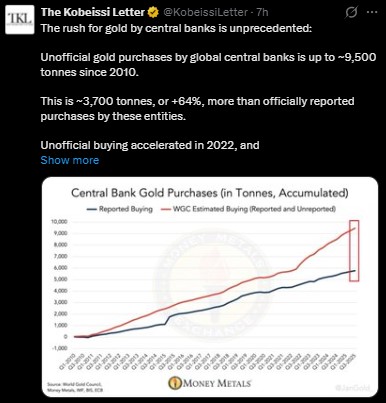

The Gold Price Rush: Central Banks Hoarding Gold

Gold is also witnessing strong demand, especially from central banks. The off-book gold purchase has been approximately 9,500 tonnes since 2010. Central banks have been increasing their acquisitions lately. In Q3 of 2025, Chinese purchases were up 118 tonnes. A whopping rise of 55% was registered on a year-on-year basis. The substantial purchases by central banks reflect a MOVE towards safe assets because of uncertainty in international markets.

Presently, however, Gold is trading at $4,327 per ounce and is still going higher.

Crypto Market Dead: Will It Really Happen?

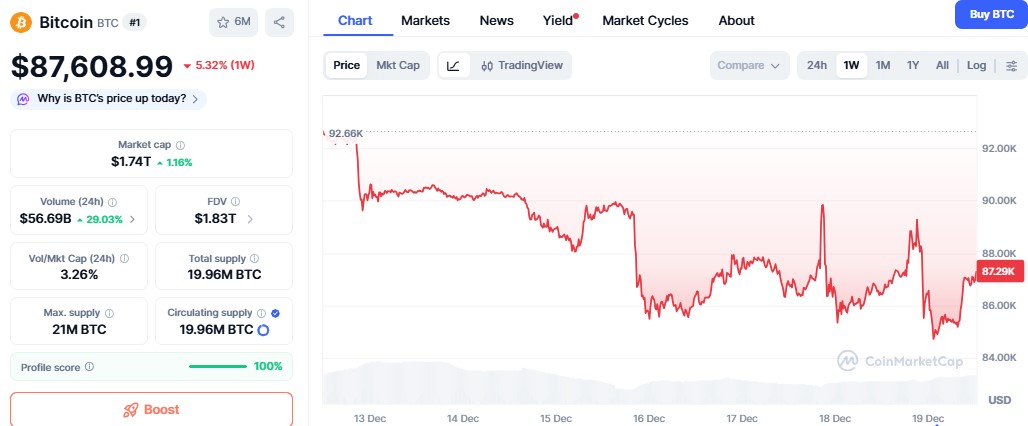

Whereas the stocks and the gold are doing very well, the crypto market has been under immense strain. According to CoinMarketCap, the global cryptomarket cap has declined from $3.21 trillion to a current cap of $2.93 trillion within a span of a week. Bitcoin price, for instance, has declined by more than 5% in a week, from $92.66K to the current market price of $84,724. Ethereum has also fallen by 10% and is now trading at $2,950.

This is attributed to various issues. There have been cases of crypto scams, issues relating to regulation, and geopolitical issues, which are making the investors less confident. There have been reported cases of crypto scams and hacks, such as $1.5B stolen from Bybit and $181M stolen from Beanstalk, which have contributed to this sector. Moreover, there is a lack of regulation and policies in this market. The investors feel that until this is addressed, they will not carry out major trades.

Why is Crypto Going Up Today? Is a Bull Run on the Horizon?

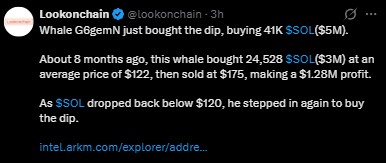

Even with all these challenges, there appear to be glimmers of hope that perhaps the cryptocurrency sector is still not dead yet. Whales and big players are still investing in cryptocurrencies. For instance, Whale G6gemN just purchased 41,000 units of $SOL, worth $5 million, at a price of less than $120.

Secondly, MicroStrategy, a top Bitcoin holder, is still adding to its enormous pool of Bitcoin, with a current total of 671,268 BTC.

Such moves indicate that it has not reached its end. The major players are optimistic about its future, and this may well be the best time for those who are looking to buy the dip.

Conclusion: Is Crypto Market Dead Forever?

The rise of stock and gold investment has definitely brought about questions about the future. But with continued investment by major players in the industry and changes that keep taking place in the crypto environment, there seems to be hope for a possible revival, regardless of whether there will be a clear future associated with it.

This article contains general information and is not to be considered financial advice. Cryptocurrency investments have proven to be highly volatile. You must therefore carry out your own personal research prior to making any investments.