Crypto Alert: Santa Claus Rally Hits Stocks—Will Bitcoin Join the Party?

Santa's sleigh bells are ringing on Wall Street. The traditional year-end surge—the so-called Santa Claus Rally—is kicking into gear, sending stock indices climbing as the holiday spirit (and portfolio optimism) spreads. All eyes now swing to the digital asset arena.

The Crypto Corollary

History doesn't repeat, but it often rhymes. Seasonal stock market momentum has, at times, spilled over into cryptocurrency markets. The logic is simple: bullish sentiment is contagious. When traditional investors feel festive, that risk-on appetite can bypass old-world asset classes and flow directly into digital gold.

BTC's Pivotal Moment

Bitcoin stands at a critical juncture. It's not just following stocks—it's challenging their dominance. A strong move here would signal that crypto isn't just a speculative sideshow but a core component of the modern financial portfolio. Watch for volume; real rallies need fuel, not just holiday cheer.

The Verdict: Watch the Flow

Don't get lost in the tinsel. The real story is capital movement. If this rally is just another sugar rush of year-end window dressing—where fund managers pretty up their books to impress clients—then any crypto follow-through may be fleeting. But if it reflects a genuine, structural shift in asset allocation? That's a gift that keeps on giving.

The next few weeks will test the thesis. Will Bitcoin carve its own path, or simply play reindeer to Santa's sleigh? One thing's certain: in finance, the only free lunch is the cheap champagne at the year-end party.

Santa Claus Rally Stock Market Signal Is Flashing: What’s Coming Next?

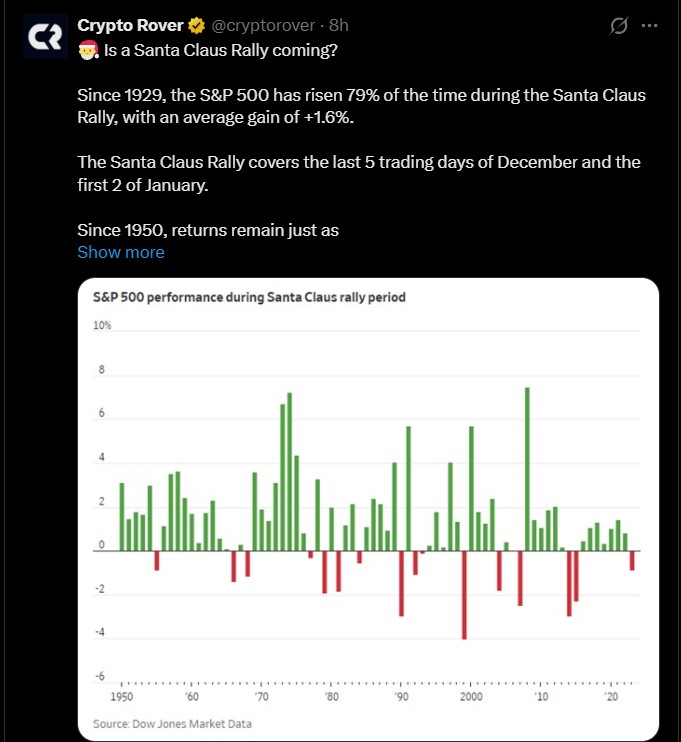

According to Crypto Rover , a well-known analyst, the numbers are clear. Since 1929, the S&P 500 chart history has risen 79% of the time during this window, with an average gain of +1.6%.

Looking only from 1950 onward, results remain strong with a 79% win rate and an average gain of +1.3%. This data clearly shows that this period has a strong historical track record in the Santa Claus Rally Stock Market data.

Even more important for traders, as per S&P 500 December forecast, it has fallen during this period only once in the last eight years, making this window historically very strong for the financial marketplace.

Over the last 75 years, the final two weeks of December have been the strongest two-week period for stocks.

This long-term history keeps the Dec 2025 breakout analysis narrative alive every year. Now the question is: If this financial industry breakout begins, then will the cryptocurrency marketplace also follow?

Santa Claus Rally Crypto vs. S&P 500: What Will December Bring?

Digital assets do not MOVE in isolation. When stocks turn positive, risk appetite usually increases. That is why many traders simply look at how crypto and the S&P 500 move together during the Santa Claus bullish period.

Political headlines are also adding fuel. President Trump recently said he plans to sign a landmark Bitcoin and crypto structure bill this year. This statement is being seen as a major shift.

Clear rules could reduce uncertainty, encourage institutional participation, and improve long-term trust in the industry. For many, this aligns with broader TRUMP crypto bill news and strengthens the case for a crypto Santa rally 2025.

Liquidity Cycles: The Pattern Before Every Altcoin Run

Many analysts point out that big altcoin rallies usually start after pain. The same structure often appears:

-

The Fed stops quantitative tightening (QT)

-

Liquidity slowly returns

-

Altcoins move fast

Before that happens, industry retest support, trigger liquidations, and push weak hands out. This happened in 2020. After the Fed ended QT, altcoin market cap tested support multiple times, liquidations scared investors, and then many altcoins surged over 1,000%.

Supporters of the December breakout believe 2025–2026 is starting to look similar. QT is ending again, altcoin market cap is sitting on multi-year support, and liquidations are already happening.

Crypto Market Update: Fear Fades Slightly, Reversal Soon?

After a DEEP correction yesterday, digital assets prices are showing early recovery:

-

Bitcoin price surged back from $85 yesterday to $87k today, a 2% increase in the past 24 hours.

-

Ethereum price today rose from $2,899 to $2,936.86 reflecting slight strength in the chart.

-

XRP rallied to $1.92, gaining about 3%, adding momentum to the altcoin rally

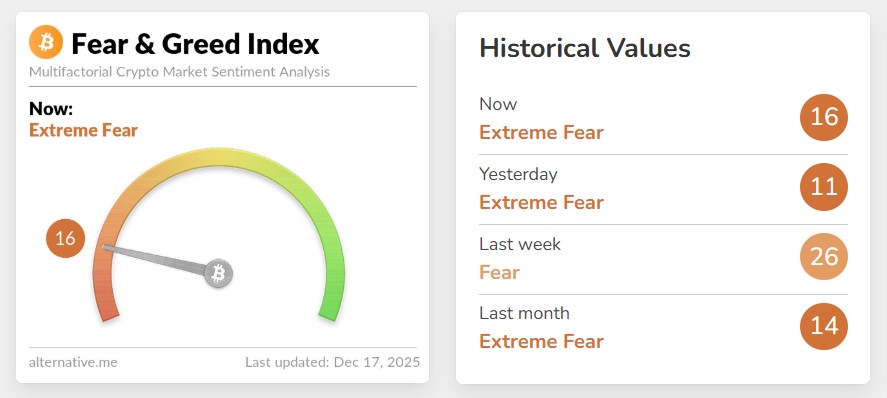

Market sentiment also improved slightly. The fear index ROSE from extreme fear at 11 to 16 today, as seen in the above chart, still in fear but less panicked.

From a market perspective and analysis, this type of price and sentiment setup often appears before short-term rallies ahead of the potential Santa Claus Rally Stock Market window.

Conclusion: The Countdown Starts Now

History shows that the Santa Claus Rally Stock Market is one of the most reliable seasonal trends in finance. With strong historical data, improving liquidity conditions, supportive political signals, and early cryptocurrencies price rebounds, the case for a crypto santa rally is growing stronger.

Still, volatility remains high, and fear has not fully left the industry. Whether this turns into a full BTC santa rally or just a short bounce will become clear as the final trading days of December unfold.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency markets are highly volatile. Always do your own research before investing.