SEC Closes 4-Year Aave Probe - DeFi’s Regulatory Winter Thaws?

The hammer drops—or rather, lifts. After a marathon four-year investigation, the SEC has quietly closed its book on Aave, one of DeFi's foundational lending protocols. No charges. No fines. Just a regulatory sigh that echoes across the entire decentralized finance landscape.

The Long Game Pays Off

Four years is an eternity in crypto time. That's multiple bull runs, countless protocol upgrades, and enough regulatory saber-rattling to make any project founder sweat. Aave's team navigated this gray zone, operating while under the microscope, a testament to both their legal strategy and the protocol's fundamental resilience. The silence from the SEC now speaks volumes.

What 'Safe' Really Means for DeFi

Let's be clear: 'Safe' in regulators' eyes doesn't mean 'unregulated.' It often means 'not a priority today.' This closure suggests the SEC may be drawing a line, potentially viewing certain mature, non-custodial DeFi infrastructure differently from the wild west of token offerings and centralized exchanges that blew up in everyone's faces. It's a nod to legitimacy, albeit a cautious one.

A Blueprint or a One-Off?

The real question isn't about Aave's past, but the industry's future. Does this decision create a precedent? Will other DeFi staples with similar structures breathe easier? Protocols built with genuine decentralization—where code, not a company, manages assets—might finally have a regulatory reference point. Of course, in finance, a precedent is just yesterday's exception until someone decides it's not.

The New Battleground

Don't mistake this for total surrender. The regulatory fight is simply shifting. The focus is moving from 'is this a security?' to 'how is this used?'—think anti-money laundering, tax compliance, and consumer protection at the fiat on-ramps and off-ramps. The war for DeFi's soul isn't over; the front lines have just been redrawn.

So, is DeFi finally safe? For established players like Aave, the immediate threat has receded. A four-year investigation ending with a whimper, not a bang, is arguably the strongest bullish signal traditional finance could ever fail to understand. The irony is rich: the most 'dangerous' part of crypto just got a quiet stamp of 'not worth the hassle' from its biggest critic. Now, the building continues.

SEC Ends Aave Investigation After Four Years

The news became public after founder and CEO Stani Kulechov shared an official letter from the US Securities and Exchange Commission. The letter confirmed that the regulator does not plan to take any enforcement action against AAVE Protocol. With this, the closing of 4 year probe that had been running quietly for nearly four years.

Source: X (formerly Twitter)

Kulechov said the process was tough and required a lot of effort from the team. Still, he added that the protocol is now ready to MOVE forward without the fear of regulatory pressure.

The SEC did not issue a Wells notice, which usually signals upcoming legal action. An SEC spokesperson also said the agency does not comment on active or closed investigations.

Why This Is Important for Crypto

The fact that the SEC Ends Aave Investigation is part of a larger trend. Since US President Donald TRUMP took office in January, the Securities and Exchange Comission has softened its approach toward crypto companies. Several long-running cases involving firms like Ripple, Uniswap, and Gemini have been dropped or paused.

Reports suggest that around 60% of crypto-related cases have been stopped this year. For developers and investors, this shift brings hope that the US is moving toward a more balanced and innovation-friendly approach to crypto regulation.

Big Plan for 2026

Soon after the SEC Ends Investigation, Kulechov shared project's long-term vision for 2026. He said that even after a strong year, It is still at “day zero” compared to what lies ahead.

First is V4, a major upgrade that will use a Hub and Spoke model. This design aims to create one central liquidity pool with many custom markets connected to it.

Second is Horizon, Aave’s real-world asset platform, which already holds about $550 million in deposits and aims to cross $1 billion.

The third pillar is the mobile app. The goal is to make DeFi simple for everyday users and reach one million users in its early phase. Kulechov believes mass adoption is key to it’s long-term success.

$AAVE Token Update and Price Prediction

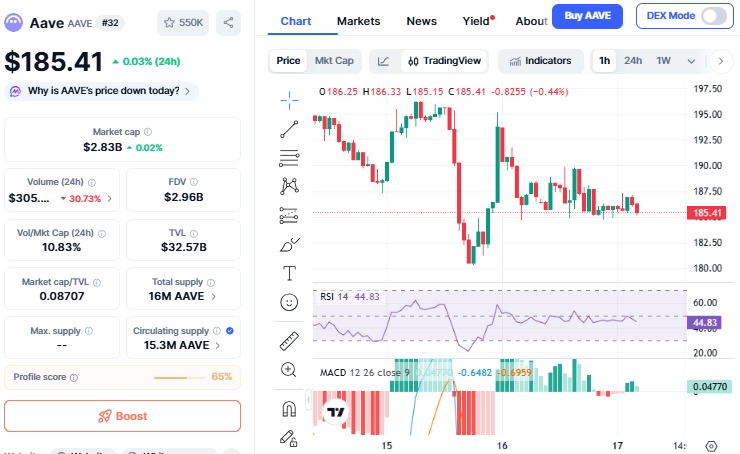

Even though this positive DEFI news, Looking at the AAVE price prediction the token has seen some short-term pressure. The price recently slipped to around $186, falling slightly over the past 24 hours while the broader crypto market moved higher.

The Coinmarketcap charts show that token is struggling NEAR the $193 resistance level. If buyers fail to defend the $171 to $185 support zone, the price could move lower. However, many investors see the end of the SEC probe as a strong long-term positive for the crypto.

Source: CoinMarketCap

Conclusion

The decision that the commission ends Investigation removes a major risk that has followed the project for years. While short-term price moves remain uncertain, the protocol now has the freedom to focus fully on growth, innovation, and adoption. For DeFi supporters, this moment feels like a fresh start.

This article is for informational purposes only, kindly do your own research before investing.