Ethereum Whale Accumulation Surges Following Massive 38,000 ETH Purchase

Whales are circling Ethereum again—and they're not nibbling.

## The Big Money Moves In

A single transaction just shifted 38,000 ETH off the market. That's not a casual trade; it's a statement. While retail investors watch charts, the players with real capital are making moves that reshape the supply landscape overnight. This isn't speculation—it's accumulation.

## What Whale Activity Really Signals

Forget the noise. When wallets this size activate, they're playing a different game. They're not day-trading; they're positioning. This kind of volume doesn't hit the market by accident. It's a calculated bet on scarcity, a direct challenge to the 'weak hands' narrative that often floods social feeds. It’s the old finance playbook—buy when there's blood in the streets—just with a blockchain ledger.

## The Ripple Effect

Every major purchase tightens available supply. It's basic economics, but in crypto, the effects are amplified and visible in real-time. Reduced liquid supply can turn a stagnant price floor into a launchpad, putting upward pressure that retail FOMO eventually chases. The whales aren't just participating in the market; they're actively constructing its next phase.

## A Dose of Cynical Reality

Let's be real—this could also be a sophisticated player shuffling funds between their own cold wallets. In crypto, you sometimes applaud a 'whale accumulation' that's just one billionaire moving money from their left pocket to the right. But the net effect on exchange balances? That part is undeniable.

The message is clear: while the crowd debates the next meme coin, serious capital is building a serious position. Whether it's foresight or just another rich person's game, the ledger doesn't lie. The coins are off the table.

Ethereum Whale Accumulation Seen After Fresh ETH Buy

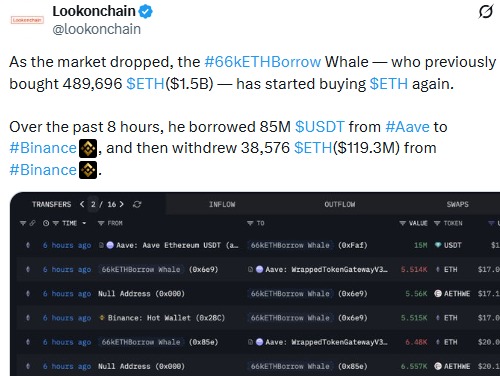

According to Lookonchain data, the wallet known as the “66K ETH Borrowed Whale” borrowed $85 million USDT from Aave. The funds were sent to Binance, and soon after, the address withdrew 38,576 coins, worth about $119 million.

This buy happened when the 2nd best cryptocurrency's price dropped from around $3,300 to near $3,090. Instead of waiting, the big investor used the dip as a buying chance. This move clearly adds to ongoing Ethereum Whale move.

Source: X (formerly Twitter)

This Whale Has a Long History

This is not a new player. Earlier this year, when the cryptocurrency was trading above $4,000, the same investor borrowed heavily using ETH as collateral. As prices fell, the strategy changed. Instead of exiting, the wallet started buying more.

On November 22, the wallet bought 114,684 coins in just two days. Before the latest purchase, it already held 489,696 tokens. Now, total holdings stand at 528,624 tokens, valued NEAR $1.63 billion.

The wallet currently has $647.7 million in debt on Aave, with a liquidation price close to $1,594, which is far below today’s price.

Why Big Whales Buy During Market Drops

To small traders, borrowing during a dip may look risky. However, in the case of big investors, this action can be a strategy. They can borrow stablecoins in order to raise their balance without selling their tokens.

Such an Ethereum Whale Accumulation can normally depict a level of confidence in a particular goal, such as an increased value in the future. The above does not have a direct impact on ensuring a gain in price but can affect a stable market environment.

Ethereum Price Update

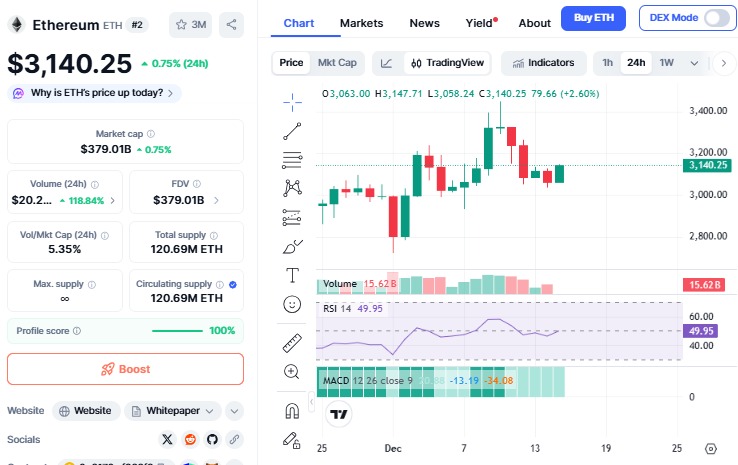

The current price of the currency is $3,140. It is up 0.77% in a day. This is a slightly better performance than the whole crypto market. The net outflows in daily ETH ETF are $19.41 million as per Sosovalue.

Source: CMC

It is trading above the 30-day average at $3,036.

RSI at 46.28 depicts neutral momentum with no overbought pressure.

The MACD is at +23.39 signals early bullish strength.

Momentum indicators are mixed, featuring neither strong buyers nor strong sellers.

Ethereum Price Prediction

Below is the short-term ETH price prediction:

If support at $3,100 is maintained, it may attempt to increase towards $3,250.

If selling pressure rises, a re-test of support at $3,030 might happen.

Conclusion

This accumulation is emerging as an important market indicator with big investors continuing to accumulate during a quiet market.

Although no less risk remains, such huge investment trends imply confidence in crypto’s strength in the future.