Metaplanet’s $150M Bitcoin Gamble: Will Shareholders Back the Bold Crypto Move?

Tokyo-listed Metaplanet is pushing shareholders to approve a staggering $150 million fund dedicated to Bitcoin acquisition. The move signals a radical corporate pivot into digital assets.

The Corporate Crypto Pivot

This isn't a tentative toe-dip. The proposed fund represents a major strategic bet, positioning Bitcoin as a core treasury asset. The company aims to bypass traditional finance's inflationary pitfalls and tap directly into crypto's growth narrative.

Shareholder Showdown

The vote puts institutional sentiment to the test. Approval would greenlight one of the most aggressive corporate Bitcoin strategies in Asia, while rejection could stall the plan entirely. It's a high-stakes referendum on Bitcoin's legitimacy as a balance sheet asset.

Why It Matters

Metaplanet's plan cuts through the usual corporate hedging. It's a direct, sizable allocation that treats Bitcoin not as a speculative side bet, but as a foundational financial strategy. The move pressures other firms to clarify their own digital asset stance.

Finance's predictable skepticism—calling it a 'volatile distraction'—misses the point entirely. This is about structural adaptation, not short-term trading. The vote outcome will reveal whether shareholders are ready to embrace that shift or cling to depreciating legacy models.

Source: Metaplanet X

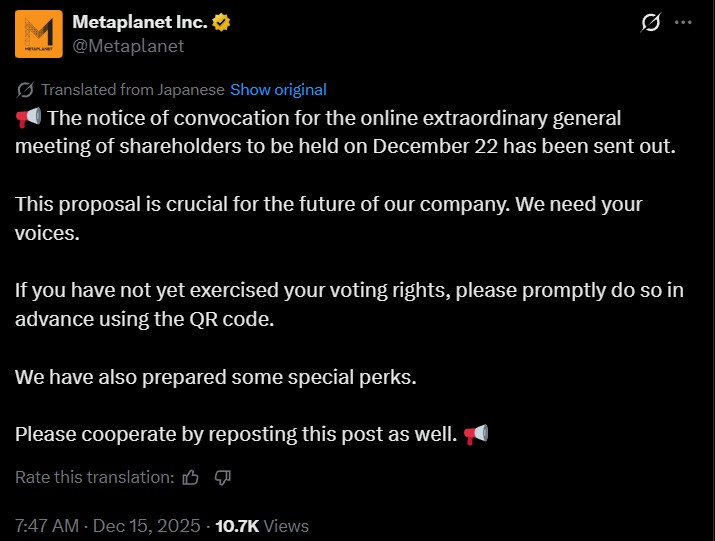

Metaplanet’s Extraordinary Shareholder Meeting on December 22

Metaplanet Inc. declared that its online extraordinary general meeting of shareholders has been sent out notices and that investors should exercise their voting rights beforehand through the use of a QR code or electronic means.

Some of the key proposals that will be discussed during the meeting are the changes in the articles of incorporation of the company and the reorganization of capital reserves.

The changes will aim at providing flexibility in the future fundraising efforts aimed at buying Bitcoins.

One of the suggestions includes the issue of perpetual preferred shares to raise about $150 million.

The management has insisted that shareholder involvement is paramount and the agenda is fundamental to the mid- to long-term strategy of the company.

To promote participation, the organization is providing shareholders with lottery-based incentives who vote early and has sought reposts to increase visibility and quorum.

Bitcoin Treasury Strategy and Yield-Based Funding

Under the proposed preferred shares, MERCURY Class B perpetual preferred stock will be introduced with a fixed dividend of 4.9%. This structure enables the company to tap capital without the instant dilution to common stockholders.

The model of funding is based on the effective approaches to treasuries that are observed in other parts of the world, where yield-bearing instruments are utilized to purchase BTC in turbulent market situations. Metaplanet has already exceeded its 2025 target of holding BTC, with a holding of over 30,823 BTC.

Market-wise, this WOULD be an indication of confidence in the long-term value and would balance capital costs by means of predictable dividend payments, which could stabilize investor sentiment.

Preferred Shares, MARS, and Corporate Bitcoin Accumulation

Previous strategies involved the issuance of MARS Class A senior preferred shares, which are analogous to the Strategy STRC instrument, to accumulate BTC non-dilutively. These buildings attracted the attention of the market greatly after they were announced in November.

The announcement of MARS and MERCURY equity instruments by Metaplanet in the past had triggered an increase of 17.6% in the stock price, indicating that investors were keen on Bitcoin-aligned corporate strategies in Asia.

The trend indicates an increased institutionalization of bitcoin as a balance sheet asset, especially by companies that are looking to find alternatives due to currency weakness and economic uncertainty in Japan.

Japan’s Macro Backdrop and Bitcoin Adoption

The low-yield environment and currency pressures have been long-term factors that have prompted corporations to consider Bitcoin as a strategic reserve asset in Japan. Metaplanet has one of the most aggressive roadmaps in the world, aiming to reach 210,000 BTC by 2027, which makes it one of the most ambitious companies holding a Bitcoin treasury in the world.

Assuming it is accepted, the preferred share issue would hasten the accumulation when the crypto market is down. Nonetheless, the risks of execution and the overall volatility of the crypto market are also important variables that define investor sentiment.

Conclusion

The vote of December 22 is a decisive MOVE in its BTC treasury growth, and shareholder consent would provide a substantial amount of capital to solidify its long-term belief in BTC.

Disclaimer: This is not financial advice. Please DYOR before investing. CoinGabbar is not responsible for any financial losses. crypto assets are highly volatile, and you can lose your entire investment.