Russia’s Crypto Paradox: 83% Awareness Clashes With Mere 5% Wallet Adoption

Russia's digital asset landscape reveals a stark divide between knowledge and action.

Massive Awareness, Minimal Action

A recent survey paints a clear picture: crypto isn't a foreign concept in Russia. The vast majority of the population knows it exists. But that awareness hits a wall when it comes to practical use. The jump from knowing about Bitcoin to actually holding it in a self-custody wallet remains a giant leap for most.

The Wallet Gap

This chasm—where familiarity far outpaces hands-on participation—highlights a critical friction point in global adoption. It's the difference between window-shopping and buying. For the crypto ecosystem, bridging this gap is the real challenge, far more complex than just spreading brand recognition.

Potential on Ice

The numbers suggest a market simmering with latent potential, waiting for the right catalyst to turn curiosity into ownership. It's a reminder that in finance, widespread talk rarely matches actual walk—especially when it involves taking personal custody of assets away from traditional, state-sanctioned rails.

Russia Crypto Survey Report By SberBank

According to a new national poll by Sber Analytics, the disparity between the awareness of cryptocurrencies and their real use in Russia is quite large.

Although the majority of the respondents are aware of digital assets and almost half of them wish to have a regulated Russian crypto wallet, the proportion of people who actively use cryptocurrency nowadays is very low.

The results indicate an increasing interest under the restraint of regulatory uncertainty, financial constraints, and apprehensive mood.

Source: Wublockchain X

Growing Awareness but Limited Usage in Russia

The results were announced by the Sberbank Deputy Chairman, Anatoly Popov, at the "FI Day. AI & Blockchain" conference, where the idea of crypto is widely exposed.

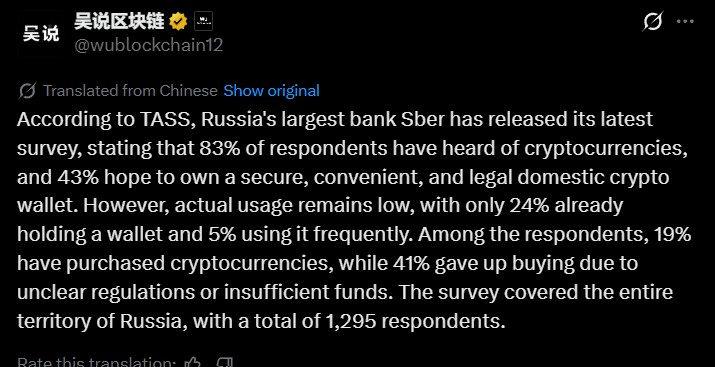

Russia in Cryptocurrencies are is well known at the national level, with 83% of the respondents having heard about them.

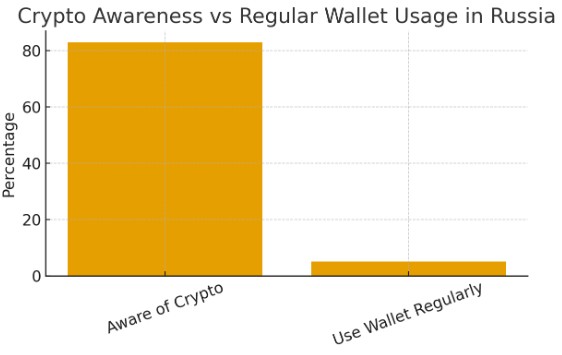

There is a need to have regulated tools for digital assets, as 43% desire a secure, convenient, and legal crypto wallet.

33% plan to create a wallet, while 24% already have one, but only 5% use it frequently.

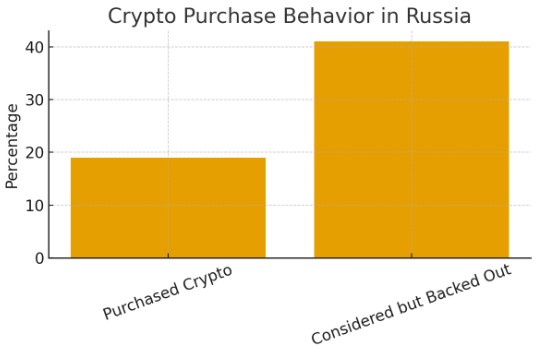

The study also shows that 19% have purchased cryptocurrencies so far, whereas 41% considered purchasing but stepped back due to unclear Crypto regulations in Russia or insufficient funds.

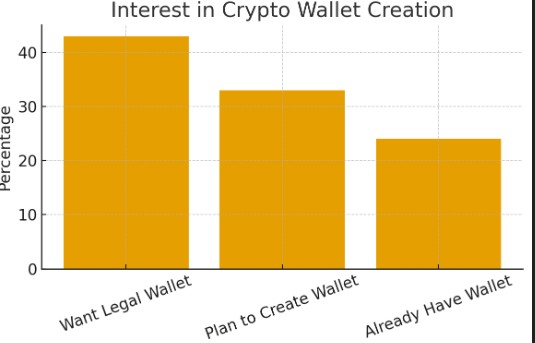

The level of trust is ambivalent: 52% of people distrust crypto, and 42% partially trust it.

There is an increased willingness to experiment by younger Russians between 25-34 who focus on being independent of the banks, potential income, and anonymity.

Source: Sber Report

Interest–Usage Gap Highlights Regulatory Challenges

The metrics underline a key disconnect between curiosity and actual adoption.

A high awareness level (83%) has a drastic comparison with a low level of active use (5%).

Source: Official

The demand for regulated tools seems to be high, with almost half of them hoping that they will have a legal wallet, yet the uncertainty regarding laws is pushing away participation.

In case Russia comes up with more transparent frameworks, adoption might increase rapidly, particularly among younger adults and technologically-conscious groups.

Source: Official

Sber’s Growing Role in Russia’s Digital Asset Landscape

Sber, the largest state-supported bank in the country, is gaining influence on cryptocurrency discourse.

The fact that Sber conducts and publishes this survey indicates an increased interest in the activities of the institutions in digital assets.

Although the survey does not specify the on-chain activity of Sber, the bank is experimenting with blockchain integrations and is a member of CBDC pilots.

Since the 2022 sanctions, Russian institutions have explored tokenization, cross-border settlements, and blockchain adoption despite domestic restrictions on consumer cryptocurrency payments.

Source: Official

Regulation, Sanctions, and Shifting Public Sentiment

Russia’s crypto environment continues to evolve in response to geopolitical and economic pressures.

Post-2022 rules allow international Bitcoin mining and cross-border payments but restrict domestic usage, creating a confusing regulatory environment.

In case Russia introduces a controlled wallet or demystifies the rules, it is possible that adoption will skyrocket among the 43% of interested people.

Although the attitudes are cautious, the level of familiarity and high interest is an indication of a potentially growing user base in the medium term.

Conclusion

According to the survey conducted by Sber, the Russians are well-informed about Bitcoin and reluctant to engage in it because of uncertainty regarding the regulations.

As 43% of Russians are willing to adopt a legal wallet, the future of digital assets in Russia could be determined by the clarity of the rules and institutional support. With Sber and other market leaders still investigating the blockchain projects, formal adoption structures might develop.

Disclaimer: This article is for informational purposes only and should not be taken as financial advice. Always conduct your own research before making investment decisions.